Stocks With Aggressive Valuations Getting Crushed

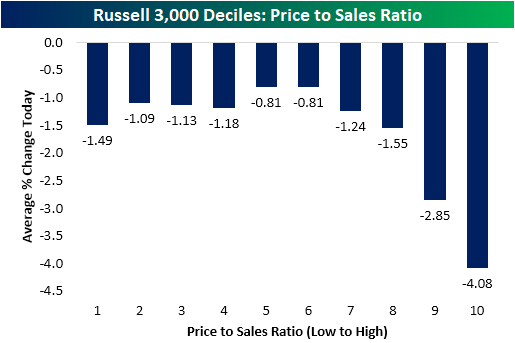

One theme popping in and out of recent price action has been the underperformance of stocks with higher valuations. That was once again apparent today. In the chart below, we break down the Russell 3,000 into equal-sized deciles (10 groups) based on their price to sales ratios (sorted from those with the lowest ratio to the highest). As shown, the stocks with the highest P/S ratios significantly underperformed today with the decile of the most elevated ratios falling over 4% on average. The ninth decile similarly experienced outsized declines of 2.85% compared to the average stock in the index which fell 1.6% today.

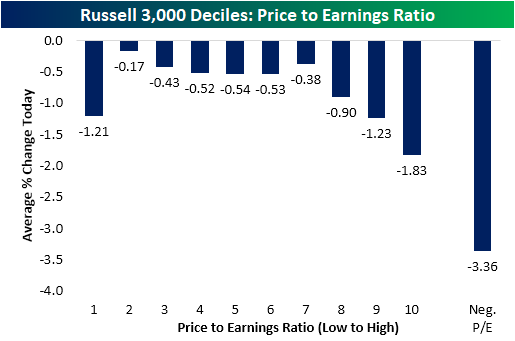

Turning to another common valuation metric, the P/E ratio, the dynamic is just as evident. In the chart below we again broke the Russell 3,000 into equal-sized deciles except we separated out all stocks with negative earnings as well. As shown, the stocks with negative earnings (no P/E ratio) got absolutely crushed today with an average drop of 3.36%.

Disclaimer: For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our ...

more