Stocks Near Pre-COVID Highs

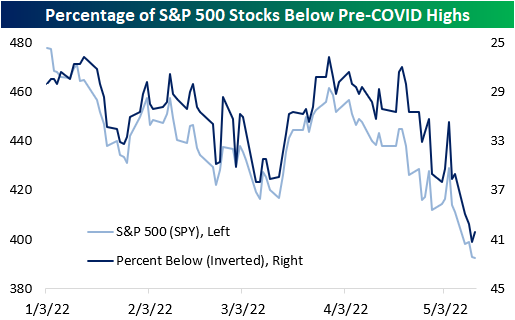

Two days ago, we outlined the percentage of stocks in each S&P 500 sector that were below their pre-COVID highs to show that many of the stocks that surged due to pandemic effects have significantly fallen off, netting long-term holders a negative return since the onslaught of the pandemic. Over the course of the next few weeks, we will be outlining the S&P 500 stocks that are breaking below/above their pre-COVID highs, as we did yesterday. Yesterday, the S&P 500 fell by 10 basis points to close at a new 52-week low, but the index is still up over 15% relative to pre-COVID highs. As of yesterday’s close, 40.4% of S&P 500 stocks were below this critical level, an 80 basis point improvement relative to the close on 5/11. 71.4% of utilities and 66.7% of communication services stocks were below their respective pre-COVID highs as of yesterday’s close. On the other hand, only 18.5% and 23.8% of S&P 500 stocks in the materials and energy sectors were below their respective highs between the start of 2019 and the end of February 2020. Additionally, 11.2% of S&P 500 stocks were between 0-5% above their pre-COVID highs (56 members).

Only one stock crossed below its pre-COVID highs for the first time since breaking above that level: MGM Resorts (MGM). However, the stock gapped higher by over 3% today, thus returning above this level. The weak performance as of late is due to a variety of factors including China’s zero-Covid policy, the broader market drawdown, and a weak reaction to the latest earnings report, even though the company beat on the top and bottom line.

One stock traded lower to enter a +2% channel relative to pre-COVID highs for the first time in a couple of months: Jack Henry (JKHY). JKHY is a payment processing and lending firm and competes with the likes of Block (SQ) and Toast (TOST).

To gain access to our chart scanner tool, click here to become a Bespoke premium member ...

more