Stocks Near Pre-COVID Highs - Thursday, May 19

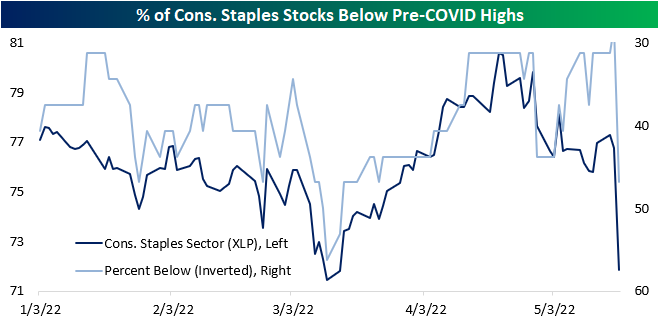

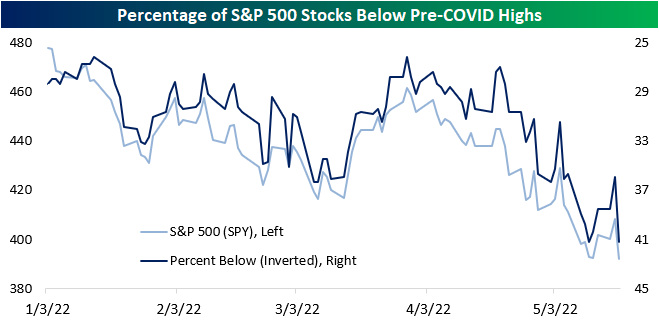

Last week, we outlined the percentage of stocks in each S&P 500 sector that had fallen below their pre-COVID highs to show that many of the stocks that surged due to pandemic effects have significantly fallen off, netting long-term holders a negative return since the onslaught of the pandemic. (Read it here.) Over the course of the next few weeks, we will be outlining the S&P 500 stocks that are breaking below/above their pre-COVID highs. Yesterday, the S&P 500 fell by over four percent to set a new 52-week low, breaking the 4,000 level. The index is still up over 15% relative to its pre-COVID high, but as of yesterday’s close, 41.2% of S&P 500 members were below their respective pre-COVID highs, as 26 members crossed below this critical level yesterday. Notably, six of the 32 S&P 500 consumer staples stocks crossed below, moving the percentage from 28.1% to 46.9% on the back of weak earnings reports from Walmart (WMT) and Target (TGT). 66.7% of Communication Services stocks and 60.0% of Real Estate stocks in the S&P 500 are below their pre-COVID highs, but only 18.5% and 23.8% of Materials and Energy stocks are below this level, respectively. Additionally, 8.2% of S&P 500 members were within 5% of their pre-COVID highs, and 15.1% are within 10%.

(Click on image to enlarge)

(Click on image to enlarge)

Four S&P 500 stocks crossed below this critical level for the first time in a while yesterday: Cognizant Technology (CTSH), MGM Resorts (MGM), Tyler Tech (TYL), and Verisk Analytics (VRSK). This comes amidst weakness in the Technology sector (XLK) versus the broader S&P 500, as the sector is down close to 25% on a YTD basis versus the S&P 500’s drawdown of about 18%. However, XLK is still up close to 30% relative to pre-COVID highs.

(Click on image to enlarge)

Additionally, there are three stocks that entered a 2% channel above their pre-COVID highs for the first time in a while. Dexcom (DXCM) entered the channel amidst weakness in the broader energy space, and Pentair (PNR) extended the downtrend that is yet to break. Walmart (WMT) sold off significantly in two consecutive days after a weak earnings report and is now less than 1% from its pre-COVID high. A month ago WMT was 30% above this level.

(Click on image to enlarge)

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more