Stocks And Sectors With The Biggest Declines

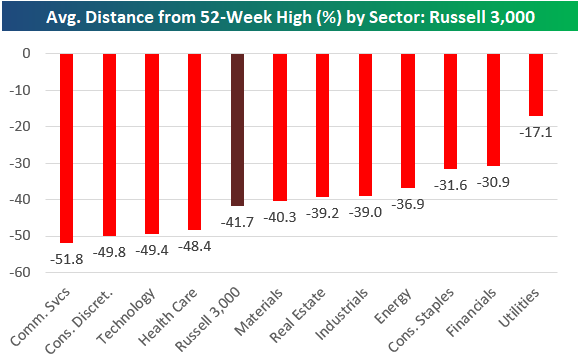

The average stock in the Russell 3,000 was down 41.7% from its 52-week high as of the close yesterday. That means the average stock would need to rally 71.5% from here to get back to its high. It’s much worse in some sectors, though. As shown below, four sectors have average prices roughly 50% below their 52-week highs.Communication Services is at -51.8%, Consumer Discretionary is at -49.8%, Tech is at -49.4%, and Health Care is at -48.4%.Even Energy stocks are 36.9% below their 52-week highs.

Below is a look at the stocks that have seen the biggest drops in market cap since the end of 2021. Across the entire Russell 3,000, we’ve seen more than $13 trillion in market cap erased, and there have been five individual stocks that have seen their market caps fall by more than $500 billion — Microsoft (MSFT), Alphabet (GOOGL), Meta (META), Amazon (AMZN), and Apple (AAPL). There have been 18 stocks that have seen market cap fall by more than $100 billion, including names like Tesla (TSLA), JP Morgan (JPM), Home Depot (HD), Nike (NKE), Intel (INTC), and Cisco (CSCO). Five of the names on this list are down 60% from 52-week highs: META, NVDA, NFLX, ADBE, and PYPL. This is just true carnage in equities, unlike anything we’ve seen since the Financial Crisis or the Dot Com bust.

If you want to see even more pain, below is a list of Russell 3,000 stocks with market caps still above $2 billion that are down more than 75% from their 52-week highs. These stocks collectively add up to just $300 billion in market cap at this point, and their market caps are down about $680 billion since the end of 2021.

Carvana (CVNA) and Peloton (PTON) are the only members of the “down 90%+” club, while stocks like Affirm (AFRM), Wayfair (W), RingCentral (RNG), Unity Software (U), Roku (ROKU), and Teladoc (TDOC) are down more than 80%. The list below is basically a “who’s who” of widely-traded growth stocks that saw huge gains post-COVID only to give it all back over the last year.

More By This Author:

One Way Bonds

Gold to Silver Ratio Plummeting

Claims Staying Low

Click here to learn more about Bespoke’s premium stock market research service.

See Disclaimer ...

more