Stock Profile: LVMH Moët Hennessy – Louis Vuitton

Photo by Wance Paleri on Unsplash

LVMH Moët Hennessy – Louis Vuitton (LVMUY), the world’s leading luxury goods group, owns 75 brands, or Maisons. Its sprawling luxury goods portfolio includes some of the world’s most respected brands including Louis Vuitton, Dior, Dom Pérignon, Hennessy, Tiffany, Sephora, Bvlgari, and hotel groups Cheval Blanc and Belmond. During 2022, LVMH generated a record €79.2 billion in revenues from 81 countries and ended the year with 196,000 employees and 5,654 stores. At year-end, the founder, Bernard Arnault, and his family owed 48% of LVMH's outstanding shares and 64% of the voting rights.

Global Leader

The concept for creating a global conglomerate of luxury brands came to French founder Bernard Arnault during a trip to New York City in the mid-1980s when he noted that his cab driver had never heard of Charles de Gaulle but knew Christian Dior. Shortly thereafter, Arnault acquired a failing textile and retail conglomerate that owned the Dior brand and embarked on a turnaround, cutting costs and selling nearly all the assets so he could focus on reinvigorating the Dior brand. Soon after, Arnault bought fashion house Celine and then set his sights on LVMH Moët Hennessy – Louis Vuitton, accumulating a controlling block of LVMH shares and becoming chairman and CEO in 1989.

Through his pursuit of acquiring artisanal companies deeply rooted in European culture, professionalizing operations and then building the brands from a preserved heritage, Arnault built the world’s largest luxury products conglomerate. Today, LVMH holds 75 brands, or Maisons, spanning wines & spirits, fashion & leather, perfumes & cosmetics, watches & jewelry, selective retailing, and hospitality. Brands include Moët & Chandon, Hennessy, Dom Pérignon, Louis Vuitton, Christian Dior Couture, Celine, Givenchy, Fendi, Pucci, Marc Jacobs, Guerlain, Make Up For Ever, Fenty Beauty by Rihanna, Bvlgari, Tag Heuer, Tiffany, the Paris department store Le Bon Marché, Sephora, travel retailers DFS and hotel groups Cheval Blanc and Belmond.

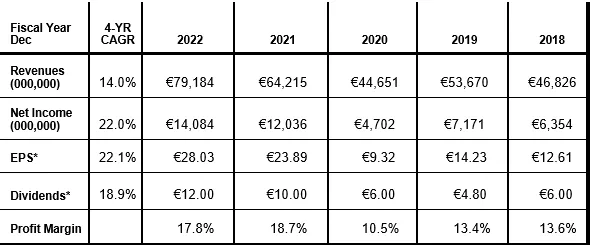

Despite global economic and geopolitical challenges, LVMH Moët Hennessy – Louis Vuitton rang up record results in 2022 with revenues increasing 23%, or 17% organically, to €79 billion and earnings and EPS both up 17% to €14 billion and €28.03, respectively.

Results included double-digit organic revenue growth for all business groups and market share gains worldwide. During 2022, LVMH rang up 37% of group sales from Asia, 27% from the U.S., 24% from Europe, and 12% from other markets.

By business group, Wines & Spirits sales (9% of total group sales) bubbled up 11% organically and Fashion & Leather Goods sales (49% of group sales) jumped a fashionable 20% organically with Louis Vuitton hitting the €20 billion revenue milestone during the year. Perfumes & Cosmetics sales (10% of group sales) rose a fragrant 10% while Watches & Jewelry sales (13% of total sales) gained an elegant 12% organically with Tiffany profits exceeding €1 billion for the first time and up two-fold since LVMH acquired it in 2020. Selective Retailing (19% of group sales) rang up a 17% organic sales increase with Sephora achieving record profits.

Profitable Growth

During the past five years, LVMH has generated stunning, profitable growth with sales compounding 14% annually and EPS growing at a 22% annual clip. During the past five years, LVMH generated an alluring 20% average return on shareholders’ equity with after-tax profit margins averaging nearly 15%.

Strong Balance Sheet

LVMH Moët Hennessy – Louis Vuitton maintains a classy balance sheet with €7.3 billion in cash, €10.4 billion in long-term debt, and €55.1 billion in shareholders’ equity. During 2022, LVMH generated €17.8 billion in operating cash flow and €12.9 billion in free cash flow, representing a stylish 91% of reported earnings. The company paid €6.8 billion in dividends, or €12.00 per share, up 20% from last year.

LVMH’s strong cash flow has enabled the company to invest in its brands, and make accretive acquisitions while also returning cash to shareholders. Indeed, in 2022, the company invested nearly €5 billion mainly dedicated to the expansion of its store network, the development of production facilities, and employment. In addition, the company acquired Joseph Phelps, a California vintner, for €587 million which will help alleviate supply chain issues encountered during the past several years. Inves- tors shopping for attractive long-term returns should consider LVMH Moët Hennessy– Louis Vuitton, a high-quality global leader, with profitable growth, a strong balance sheet, and opulent cash flows. Buy.

More By This Author:

Portfolio Highlights: Quarterly Movers & Shakers, March 2023Smartly Investing In Artificial Intelligence

Portfolio Review: Maximus Maximized Valuation

Disclaimer: Copying, reproduction or quotation is strictly prohibited without written permission. Information presented here was obtained from sources believed to be reliable but accuracy and ...

more