Stock Price Of Microsoft: Projections For The Next Few Years

Image Source: Unsplash

Microsoft’s focus on cloud services has paid off for investors in a big way. The tech giant’s stock price (MSFT) reached over $300 per share in late 2023, doubling from pre-pandemic levels, as its Azure cloud platform continued to gain ground.

Azure is now the second largest cloud infrastructure business behind Amazon Web Services, but it is growing faster. In its latest fiscal year, ending in June 2022, Azure revenue grew by 35% to surpass $25 billion. Thanks to Azure and other cloud-related offerings like Office 365, server products and cloud services accounted for over 50% of Microsoft’s quarterly sales for the first time in Q4 2022.

This cloud computing momentum has transformed Microsoft from a legacy software provider into a cloud juggernaut. It is now one of only two U.S. companies worth over $2 trillion by market cap, alongside Apple (AAPL). In December 2022, MSFT reached over $325 per share intraday – an all-time high propelled by another quarter that beat Wall Street expectations.

Looking ahead, analysts see even more potential for growth as businesses and consumers continue migrating workloads and data to the cloud. Microsoft remains well-positioned with a diverse portfolio that includes cloud infrastructure, security, data analytics, and business applications.

As long as it continues innovating and gaining Azure market share over rivals like Amazon (AMZN) and Google (GOOGL), the stock price of MSFT has room to climb higher in 2023 and beyond.

To reiterate, Microsoft’s focus on cloud computing has transformed the company from a software provider into a leading force in this dominant sector. Microsoft is well-positioned for further growth in 2023 and beyond through intelligent investments and strategic acquisitions.

The Power of Azure

Azure is Microsoft’s flagship cloud platform, which continues gaining ground on market leader AWS. In Q1 2023, Azure revenue grew 35% year-over-year as more businesses utilize its infrastructure, database, analytics, and artificial intelligence services. Azure is growing faster than the overall cloud market, demonstrating its strength.

Beyond Infrastructure

Microsoft offers a unique portfolio that combines cloud infrastructure via Azure with business productivity tools. Popular apps like Office 365 and Dynamics 365 provide recurring revenue streams, while the GitHub acquisition boosts developer productivity in the cloud era.

New Horizons

AI and mixed reality technologies represent significant growth opportunities. Microsoft is well underway developing solutions leveraging Azure AI, as well as hardware like HoloLens. As hybrid work/learning trends take hold, these tools promise new avenues of enterprise spending.

Investing in the Future

With a massive cash pile and ongoing profits, Microsoft continues acquiring complementary products. Recent buys like Activision Blizzard (ATVI) position it at the forefront of the gaming industry’s pivot to interactive media and streaming.

All evidence suggests Microsoft’s determined focus on cloud services and next-gen technologies has revitalized the business. As digital transformation accelerates globally, Microsoft's stock stands poised to keep gaining well into 2023.

MSFT EPS Earnings Projections

(Click on image to enlarge)

Image Source: Zacks

Microsoft’s EPS is in a strong uptrend. Hence, logic dictates that the astute investor will view sharp pullbacks and or crashes through a bullish lens. In other words, look at the long-term trend: the stock is trending upwards, EPS is rising, and insiders are not dumping the stock.

All in all, this indicates that Microsoft's stock will go on to put a series of new highs much faster than many of its peers. On a relative strength basis, it is far more potent than Amazon, Alphabet, or Intel (INTC), all of which make great long-term investments.

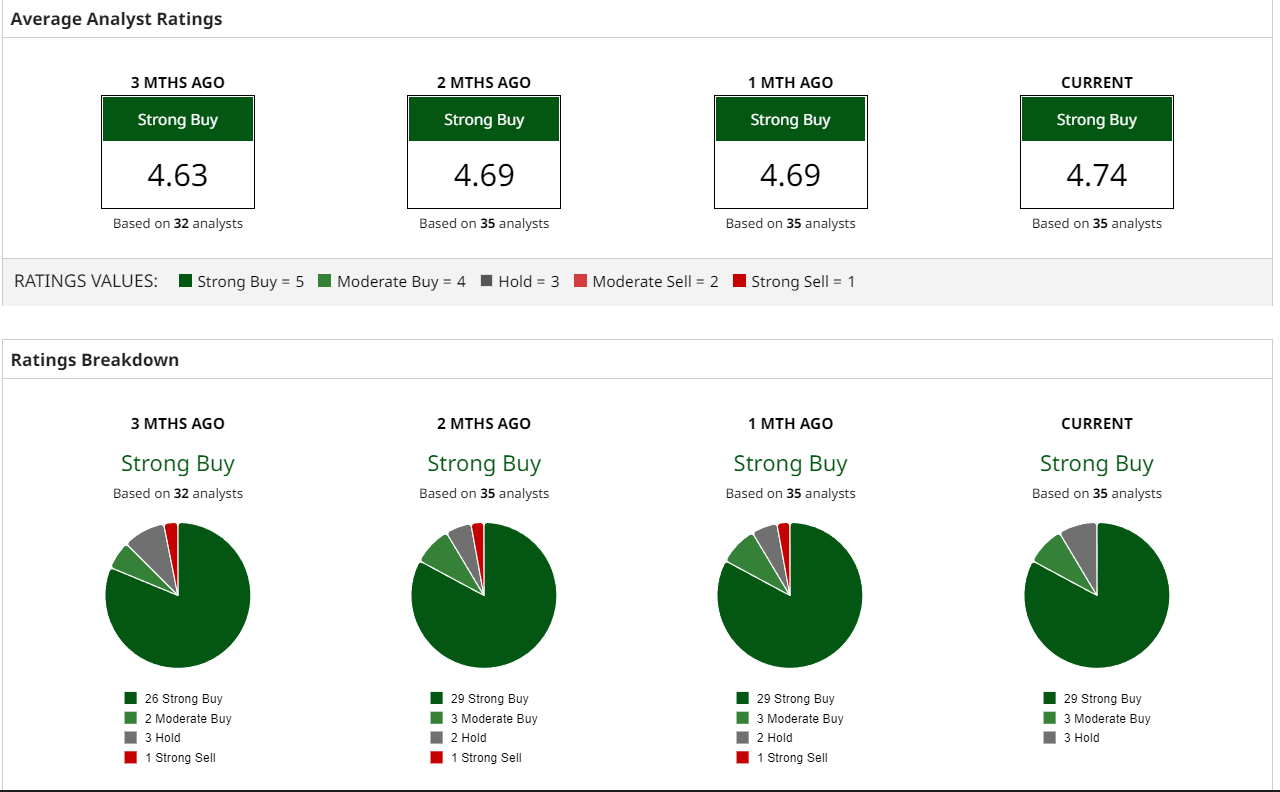

Market Insights on MSFT: Analyst Perspectives

(Click on image to enlarge)

Image Source: Barchart

Analysts generally hold a favorable view of the stock, although one must remain cautious. Typically, analysts strongly recommend a stock after it has experienced significant gains, which seems to be the case with Microsoft. On weekly charts, the stock has been trading in an overbought zone. However, the long-term outlook for the company appears promising, so savvy investors may consider utilizing pullbacks to enhance their positions.

Analysts often lag in issuing sell warnings and consistently make buy recommendations late. Therefore, focusing on the overall trend would be advisable, which currently suggests that all substantial price pullbacks should be viewed as opportunities.

Microsoft Stock Price: Current Analysis

(Click on image to enlarge)

Image Source: Finviz

Microsoft stock has recently been seen trading in the oversold range on the monthly charts, suggesting a substantial pullback may be imminent. While it’s not as highly oversold as it was in January 2023, there is still room for it to reach new highs before experiencing a downturn. A pullback from $290 to $300 presents an attractive opportunity to add to one’s position. An even more favorable entry point would be around $270.

Taking a longer-term perspective, if the stock can achieve a monthly close at or above $366, it could potentially test the range of $405 to $420, with the possibility of surpassing $445.00

Microsoft: Riding High in a Turbulent Market

The stock price has proven resilient in these uncertain times, recently seen trading at around $327.26 per share as of early October 2023. While many watched their portfolios shrink during the 2022 bear market, Microsoft shareholders experienced smoother sailing, thanks to the company’s robust fundamentals and diversified business model, and they are now reaping substantial gains.

As previously discussed, Microsoft maintains its dominance in enterprise software with popular solutions like Microsoft 365, Azure cloud services, and the Windows operating system. The pandemic accelerated the digital transformation of work and daily life, increasing demand for Microsoft’s productivity and collaboration tools as more activities shifted online. The latest quarterly earnings report showed an impressive 20% year-over-year growth for Azure, driven by increased cloud adoption.

Beyond software, Microsoft has enjoyed steady revenues from its Xbox gaming segment. The launch of the latest Xbox Series consoles in late 2020 coincided with more consumers seeking at-home entertainment during lockdowns and social distancing restrictions. Game pass subscriptions gained widespread popularity and the service now boast tens of millions of users.

Through constant innovation and expansion into adjacent industries, Microsoft provides multiple avenues for consistent earnings. The stability of its stock price reflects investor confidence that Microsoft can navigate economic challenges, thanks to diverse revenue streams and a massive customer base committed to the platform.

For those seeking a reliable tech investment during market turbulence, shares of the company may be a prudent choice.

More By This Author:

The China USA War: Unraveling The Trade War Of The CenturyBiotech Sector: On The Verge Of Triumph Or Turmoil?

Unleashing The Future: The Epic Evolution Of AI Into A Personal AI Powerhouse

Disclosure: This content was originally published on April 20, 2017, but it has been continuously updated over the years, with the latest update conducted in October 2023.