Stock Market & Economy Recap - Sunday, May 23

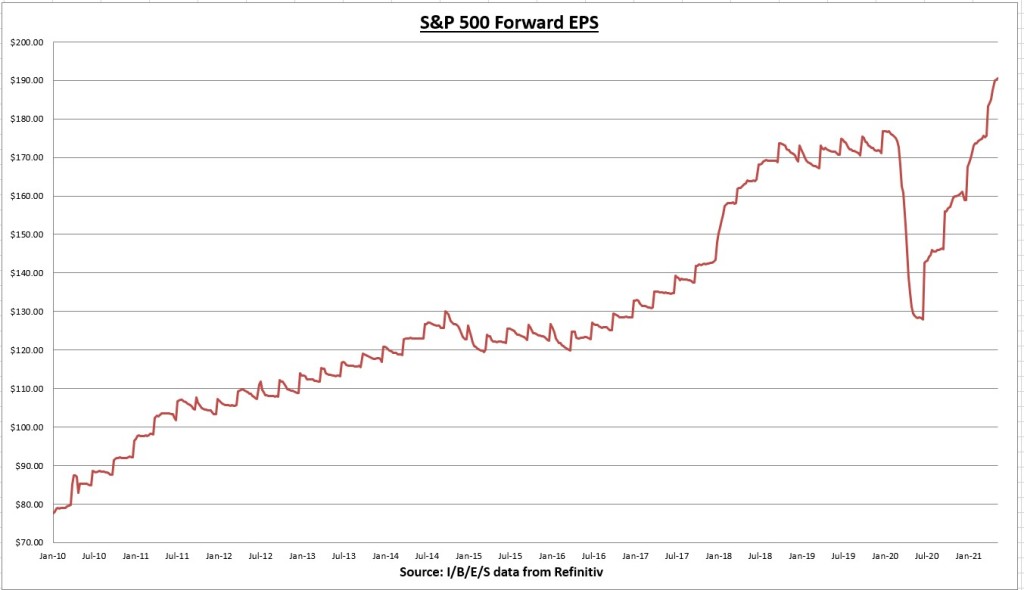

The earnings per share (EPS) for all S&P 500 companies combined increased to $190.50 this week. This is a gain of +0.20% for the week, and +19.8% year-to-date. 95% of S&P 500 companies have now reported Q1 results. 87% of companies have beaten earnings estimates, and earnings have come in at a combined +22.8% above expectations.

The S&P 500 index declined -0.43% for the week.

Due to the increase in EPS along with the decrease in price, valuation got a little more attractive. The price to earnings (PE) ratio decreased to 21.8.

The S&P 500 earnings yield is now at 4.58%, compared to the 10-year treasury rate of 1.63%.

Economic Data Review

The Conference Board’s Leading Economic Index (LEI) increased a better-than-expected +1.6% in April. The LEI has now made a new all-time high, fully recovering from the COVID-19 recession. According to the report:

“While employment and production have not recovered to their pre-pandemic levels yet, the U.S. LEI suggests the economy’s upward trend should continue and growth may even accelerate in the near-term.”

2021 real GDP estimates now stand at +6.4%. 8 of the 10 index components increased in April, led by the decline in weekly unemployment claims, S&P 500 prices, and the ISM new orders index.

The LEI has now increased +14.7% over the last 12 months, which is the highest annualized growth rate since my data set began in 1999.

Notable Earnings

Home Depot (HD) reported Q1 adjusted EPS which came in +25% above expectations, and growth of +86% over Q1 2020 results.

Quarterly revenue came in +8% above expectations, a growth rate of +32.7% over Q1 2020 results. There is no doubt the home improvement giant has benefited from the stay-at-home orders, and the trend seems to be picking up steam as the company continues to report record revenue growth rates.

Over the last four quarters, quarter revenue growth rates have come in at +23.4%, +23.2%, +25.1%, respectively, and now +32.7%. Prior to this, the average revenue growth rate was around 6%.

Gross margins improved to 33.98%, operating margins improved to 15.42% (as operating income grew +76%), and the company reiterated its forward guidance while announcing a $20 billion stock buyback program. The company has now reported $141 billion in revenue and $20.7 billion in operating income over the last 12 months, both record highs for the company.

There is a lot of good news already priced into the stock at current prices. Looking forward, these results will make for tough comparisons to come. Look for sales growth to revert back to the long-term average. Currently, the stock is pulling back to the 50-day moving average. I’m looking at potential support around $285-$293, which should provide support at the 50-day fail.

Chart of the Week

It was all about retail earnings this week. Earnings were stellar across the board, with all five major retailers reporting earnings well above expectations. Here is the breakdown in the order in which they reported this week:

- Home Depot: +25.3% above expectations, +86% year-over-year growth.

- Walmart (WMT): +39.7% above expectations, +43% year-over-year growth.

- Target (TGT): +67% above expectations, +525% year-over-year growth.

- Lowe’s (LOW): +23% above expectations, +81% year-over-year growth.

- Macy’s (M): (expectations were for EPS of -$0.39, but they actually reported positive EPS of $0.39 – 119% year-over-year growth rate).

Revenues also surpassed expectations across the board.

- Home Depot: +7.7% above expectations, +33% year-over-year growth.

- Walmart: +4.7% above expectations, +3% year-over-year growth.

- Target: +11.2% above expectations, +23% year-over-year growth.

- Lowe’s: +2.6% above expectations, +24% year-over-year growth.

- Macy’s: +7.9% above expectations, +56% year-over-year growth.

All companies reiterated their confidence in the economic recovery by improving their forward guidance. This shouldn’t come as much of a surprise after April’s retail sales annualized growth rate came in at an all-time high.

Summary

It was a slow week for economic data. Retail earnings took center stage. Earnings continue to be stellar, as 2021 earnings growth estimates are now +35%, and 2022 and 2023 earnings growth projections are +12% and +9%, respectively. Against the backdrop of low interest rates, there remains no alternative to stocks. The fundamentals remain supportive of risk assets overall, but I wouldn’t be surprised to see a correction to the vicinity of the 50-week moving average.

But looming in the background is the potential that we are witnessing a major policy mistake. In 2018, the Federal Reserve believed inflation was a threat. They raised interest rates and completely ignored the inversion of the yield curve. In hindsight, it was a clear mistake.

Today, the Fed has pledged to allow inflation to run high for some time before they make a policy change. Perhaps not wanting to repeat the same mistake they made in 2018. They continue to believe inflation will be transitory, and hopefully it will be. But by waiting, they run the risk they will need to tighten monetary policy by more than what the market can handle.

Not long ago, the Fed projected rates would stay at 0% through 2023. Regular readers know I was very doubtful that they would ever be able to pull that off. After this last CPI report some of the Fed speak has already started to shift. We’ll see how this evolves in the next few months, depending on where the CPI comes in.

Watch for them to stop the monthly buying of $120 billion of treasuries and mortgage back securities (possibly as early as September if the CPI keeps running hot and the job market improves). There will be no recap next week.

Note: I/B/E/S data from Refinitiv.

Disclaimer: None.