Stock Market & Economy Recap - Sunday, June 6

S&P 500 Earnings Update

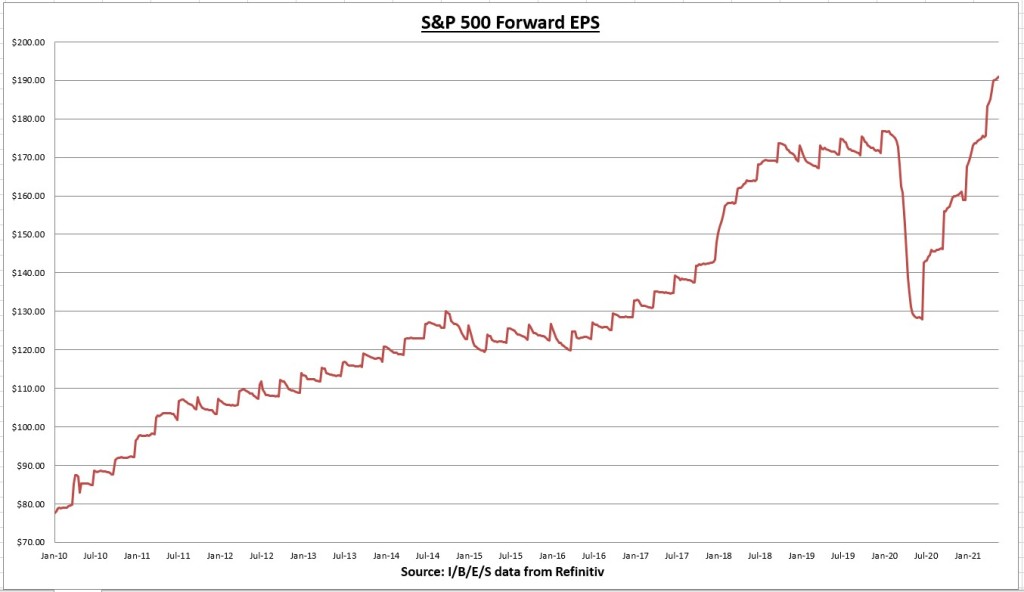

The S&P 500 earnings per share (EPS) increased to $191.52 this week. This is the tenth straight week the EPS has increased. Q1 earnings have largely wrapped up, with 99% of the index having reported. 87% of companies have beaten estimates, and combined earnings have come in 22% above expectations.

The S&P 500 increased 0.61% this week, closing just shy from another record.

The S&P 500 price to earnings (PE) ratio is now 22.1.

The S&P 500 earnings yield is now 4.53%, which is still reasonably priced in relation to fixed income alternatives, as the 10-year treasury bond rate fell to 1.56%.

Economic Data Review (Previous Two Weeks – In the Order in Which They Were Reported)

Consumer Confidence came in at 117.2 for May, -0.3% below last month (which was revised down from 121.7 to 117.5), and +36.4% higher than a year ago. February and March results were both revised higher by +5.3% and +5.4%, respectively. According to the report:

“Consumers’ assessment of present-day conditions improved, suggesting economic growth remains robust in Q2. However, consumers’ short-term optimism retreated, prompted by expectations of decelerating growth and softening labor market conditions in the months ahead.

"Consumers were also less upbeat this month about their income prospects—a reflection, perhaps, of both rising inflation expectations and a waning of further government support until expanded Child Tax Credit payments begin reaching parents in July.

"Overall, consumers remain optimistic, and confidence should remain resilient in the short-term, as vaccination rates climb, COVID-19 cases decline further, and the economy fully reopens.”

Consumers' expectations index declined 8.2% for the month. The percentage of consumers expecting business conditions to improve over the next six months declined 8.5%, while the percentage of consumers expecting business conditions to worsen over the next six months increased 22.3%.

New Home Sales for April came in at 863 thousand, which is 5.9% below the prior month (which was revised down from 1021 thousand to 917 thousand), and 48.3% higher than a year ago.

We got our second estimate of 1st quarter real Gross Domestic Product (GDP), which was relatively unchanged from the first estimate at +6.4% annualized. The economy has recovered 91.5% of the COVID-19 recession in inflation-adjusted dollars, and is likely to make a new all-time high as early as Q2.

Also worth noting is that the economy has already surpassed the pre-COVID-19 high point in nominal terms (unadjusted for inflation).

Personal Consumption Expenditures excluding volatile food & energy prices (Core PCE) increased 0.7% in April and +3.1% annualized (up from +1.9% annualized last month). You have to go back to February 1992 to find a higher annualized PCE inflation reading. Core PCE is the Fed’s preferred method of inflation monitoring.

The ISM Manufacturing PMI came in at 61.2 for May, an increase of 0.5% for the month and the twelfth straight month of expansion (readings above 43.1 indicate expansion). The new orders index increased 2.7% for the month, while the prices index (input costs) declined 1.6%. 16 of the 18 manufacturing industries reported growth for the month.

The ISM Services PMI reached another new all-time high in May, coming in at 64. A gain of +1.3% over the prior month.

My weighted ISM (which takes into account how much the services and manufacturing sectors comprise in today’s economy) came in at 63.3 for May. At 63.3, if annualized, corresponds to an approximate GDP growth rate of 5.2%.

The BLS Non-farm employment report showed a net jobs gain of +559,000 in May. March and April results were both revised higher, March went from +770 thousand to +785 thousand, and April went from +266 thousand to +278 thousand, a net jobs gain of +27 thousand higher than previously reported.

Approximately 87% of the job gains came from the private service providers, with leisure and hospitality reporting a net gain of +292 thousand jobs. Average weekly hours remained the same as the last month, at 34.9, and average hourly earnings increased +0.5% for the month.

13 months into the jobs recovery, and we’ve now recovered about 66% of the net job losses. Still 7.6 million below pre-COVID-19 highs.

Notable Earnings

Nvidia (NVDA) reported quarterly earnings the week prior, with EPS coming in +20% above expectations for a growth rate of +106% over Q1 2020 results.

A new record high for quarterly net income was set for the company as operating margins improved.

A new record high for quarterly revenues was set, as well. Q1 revenues came in +5% above expectations, for a growth rate of 84% over Q1 2020 results.

A record high revenue growth rate was illustrated as sales surged on increased demand for both gaming and data center products. The company also raised forward guidance.

Here is another great company whose stock price is already priced near perfection at 21x sales and 45x forward earnings. The surge in demand due to data mining cryptocurrency could lead to volatility if the crypto trend were to reverse, like it did in 2018. The company is executing very well in all segments, and if the ARM deal goes through (roughly a 50/50 chance right now), it would only strengthen its competitive advantages.

Cyber security company CrowdStrike (CRWD) reported another strong quarter, with adjusted EPS coming in 100% above expectations.

Revenues grew 70% year-over-year and came in about 4% above street expectations. Sequential revenue growth came in at 14%, slightly below the company’s average since IPO of 17%. The company guided for approximately 63% revenue growth (14.3% sequential growth) in the next quarter (orange bar in chart above).

Customer count grew 82%, now in the 11,420 range, with 64% of customers buying at least 4 of the company’s cloud security products.

Thus, another strong quarter for a great company whose stock price isn’t cheap. The stock has been consolidating recent gains and declined post earnings due to concerns about the slowing growth rate and rising operating costs.

CrowdStrike, Zscaler (ZS), and Fortinet (FTNT) are at top of their class in a very important industry. This doesn’t mean they will turn out to be tremendous stock performers, but I like what they are doing and I believe they have their place in a well diversified portfolio.

Charts of the Week

This week's charts illustrate the cumulative advance-decline lines for the New York Stock Exchange and the S&P 500 index. It takes the number of stocks that close higher and subtract the stocks that close lower on a daily cumulative basis. These are my favorite technical indicators that show the level of participation under the surface.

Both charts continue to soar higher, showing a broad level of participation in these rallies. There are no signs of exhaustion here. And next time someone tries to tell you this rally is being led by only a handful of tech stocks, feel free to show them these charts.

Summary

The economic recovery appears to remain firmly in place. There are some signs the growth rate may be peaking, but that is to be expected. I’m watching for the shift in consumer spending from goods to services now that the economy is really starting to reopen. There is a lot of pent up demand for those services that were most affected by the restrictions. This month's jobs report reflected that, as the biggest category for job gains came from the leisure and hospitality sector.

As for the jobs report, I thought it was decent overall even though the net jobs gained came in lower than expected for the second straight month. Actually, I think it was a “goldilocks” report in that it was strong enough to show the expansion is still in place, but not too strong as to have any effect on the Federal Reserve's current policy. If net jobs gained came in at 1 million, the market might have interpreted that as a precursor for tighter monetary policy. Unfortunately, this is the environment we are in.

Earnings are still great, interest rates are still very low, the economic expansion is still in place, and there remains broad participation in the stock market advance. All this remains supportive of risk assets.

This doesn’t mean we can’t have a correction, and 2020 showed us that something can always come out of nowhere and change everything. The inflation concern is real, but there is no reason to get ahead of ourselves at the moment. Next week's CPI report will be interesting.

Next week there are two S&P 500 companies reporting earnings. For economic data, we have the NFIB small business optimism index on Tuesday and the increasingly important gauge of inflation via the Consumer Price Index (CPI) on Thursday.

Disclosure: I own shares of CrowdStrike, Zscale, and Fortinet. I/B/E/S data is from Refinitiv.

Disclaimer: None.