Stock Market & Economy Recap - Saturday, Nov. 27

S&P 500 Earnings Update

S&P 500 earnings per share (EPS) increased to $216.03 this week. The forward EPS is now +36% year-to-date. 97% of S&P 500 companies have now reported Q3 earnings. 81% have beaten estimates, and results have come in a combined 10.2% above expectations. The Q3 earnings growth rate is now +42.4%.

The S&P 500 price to earnings (PE) ratio dropped to 21.3 this week as a result of the increase in EPS and the drop in the price of the index.

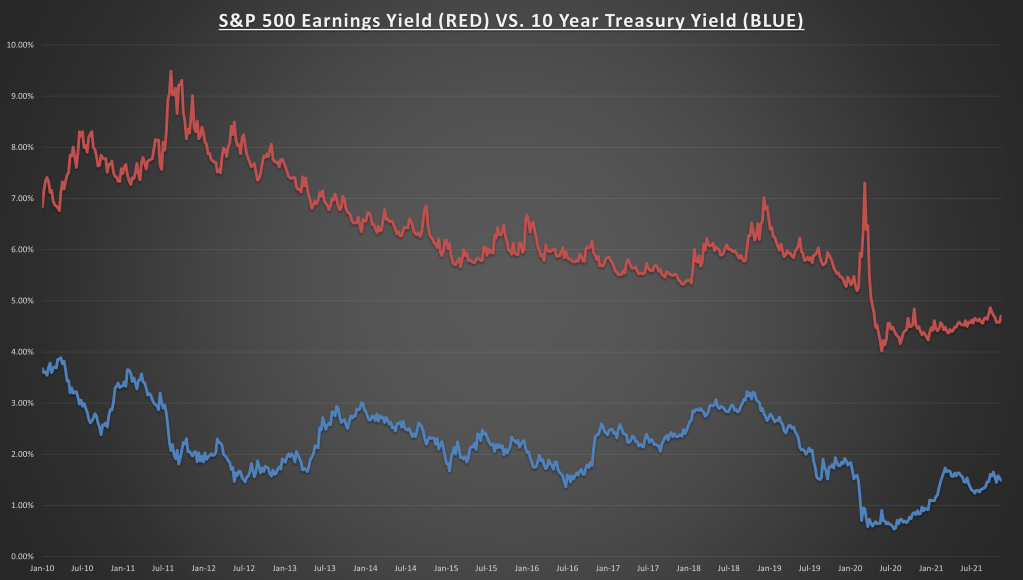

The S&P 500 earnings yield is now 4.7%, remaining well above the 10-year Treasury bond rate, which declined to 1.49% this week.

Economic Data Review

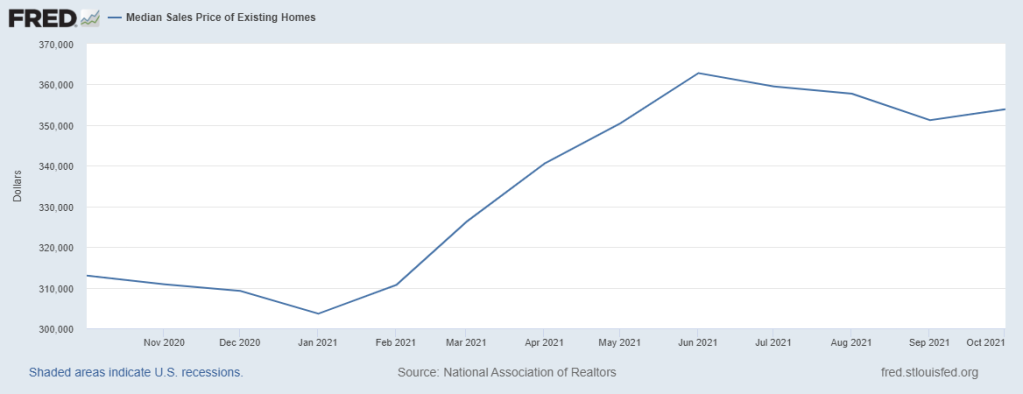

Existing homes sales for October came in above expectations at 6.34 million units, which was an increase of +0.8% over last month but down -5.8% from this time last year, as supply constraints fail to keep up with demand. The monthly gains were led by the Midwest (+4.2%) while the Northeast actually experienced a decline of 2.6%, the South was up 0.4%, and the West was unchanged.

The median sales price for existing homes is now $353,900, which is +13.1% over the last 12 months. Price increases over the last 12 months were led by the South (+16.1%), Midwest (+7.8%), West (+7.7%), and Northeast (+6.4%). Unsold inventory is now at a 2.4-month supply, still well below the six-month supply level typically associated with a balanced market.

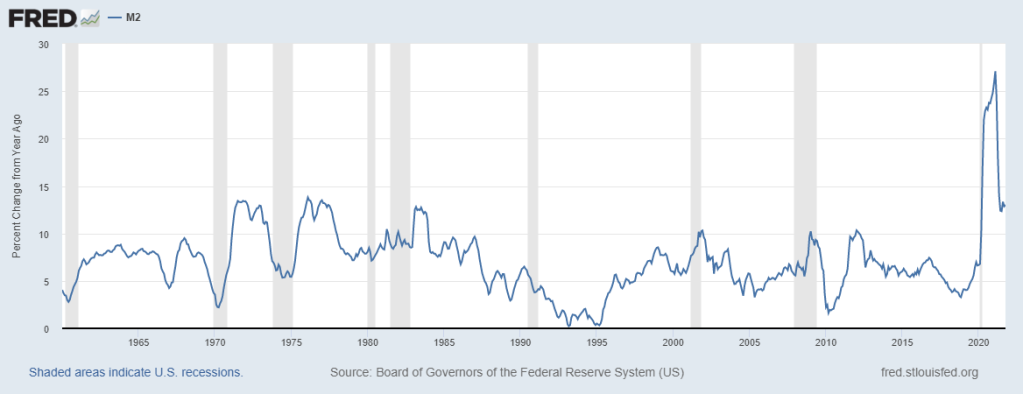

M2 money supply increased at an annualized rate of 13% in October, up from 12.9% last month and still well above the long-term average of 6-7%. There is little hope of reigning in the inflation threat until this number reverts back below the historical average without raising the short-term Fed Funds rate, which probably isn’t going to happen until summer 2022 at the earliest.

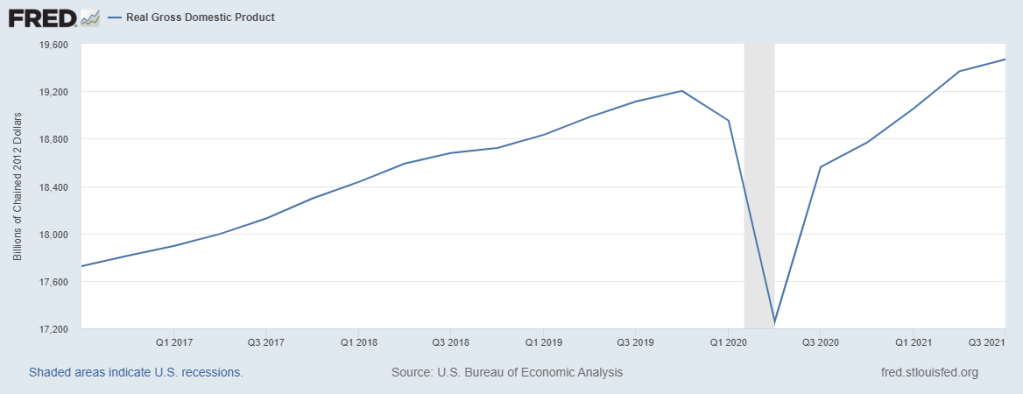

The second estimate of Q3 real Gross Domestic Product (GDP) came in at +2.1%, slightly better than the first estimate (+2.0%). Real GDP is now +1.4% above the pre-COVID-19 peak.

Q3 remains the slowest quarter of economic growth since the COVID-19 recession, but all signs point to much stronger growth in Q4, with the latest Atlanta Fed GDP Now estimate coming in at +8.2%.

Weekly unemployment claims fell to 199 thousand, back below pre-COVID-19 levels. You actually have to go back to 1969 to find a better result. Another good sign for the labor market.

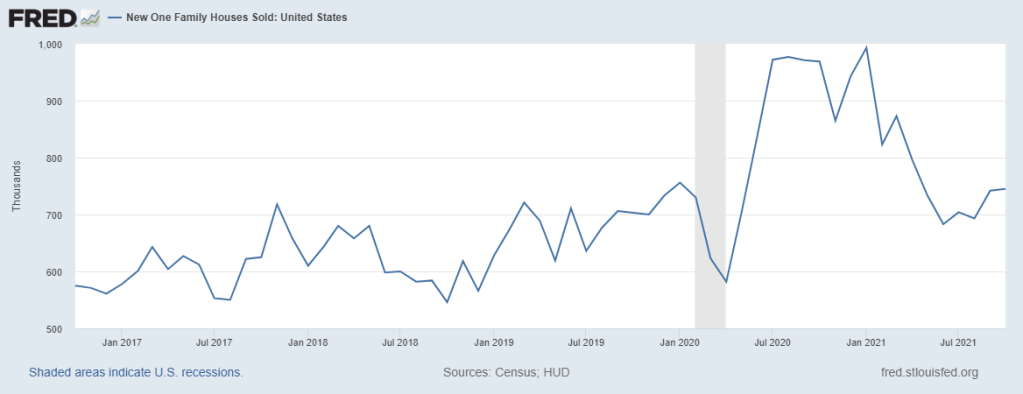

New home sales for October increased +0.4%, to 745 thousand. Sales are still down -23.1% over the last 12 months, as supply constraints and labor shortages limit the production of new homes.

The median sales price for new homes increased +0.7% in October, to $407,700. Median sales price for new homes has risen +17.5% over the last 12 months. Strong demand and a lack of supply keep prices high.

Personal Consumption Expenditures minus food & energy (Core PCE) increased +0.4% for the month, in line with expectations. Core PCE is now +4.1% over the last 12 months, up from the 3.7% annualized rate last month. Much like the CPI, annualized PCE inflation is at its highest level since November 1990.

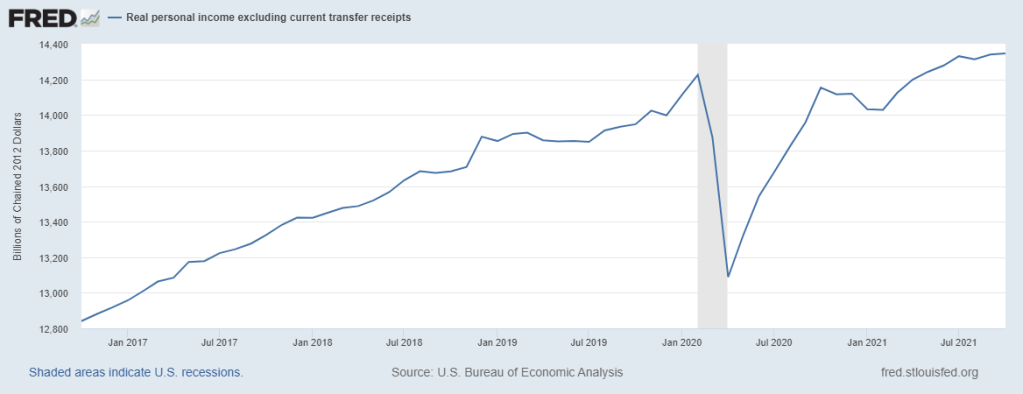

Real personal incomes excluding transfer payments increased +.04% in October, for another all-time high, and +1.4% over the last 12 months. Despite the increases, it still doesn’t compete with the rise in consumer prices of between 4-6%, proving to be a hidden tax on consumers.

Notable Earnings

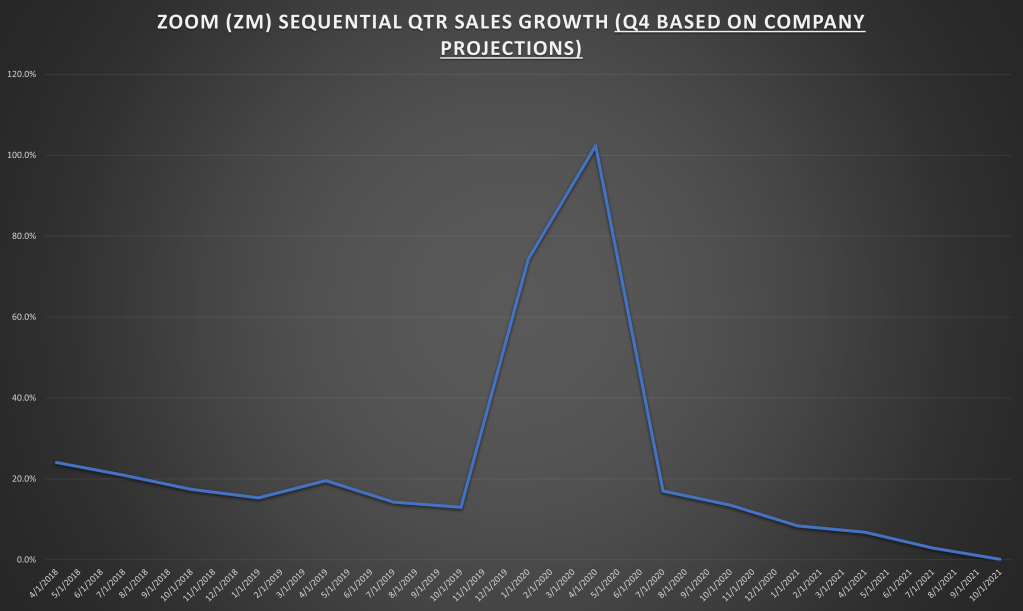

Zoom (ZM) reported quarterly earnings that were only +2% above expectations, at a +12% growth rate. This was the smallest quarterly beat since the company went public. Sales came in +3% above expectations and at a +35% growth rate.

Though the pace of sales growth has slowed, the company’s profitability has improved marginally. Customers contributing over $100 thousand in revenue over the last 12 months grew 94%, and Q4 projections came in a little above street expectations.

Despite record sales and earnings, the stock price has hit a new 52-week low. The stock went from $60 to $600 last year, so some consolidation was to be expected. The above chart shows the pace of sequential quarterly sales growth since IPO.

After spiking during the pandemic, its growth rate has slowed to a standstill. Q3 sequential sales growth was a new company low at +2.9%, and according to the company’s projections, Q4 sequential sales growth will be 0%.

I think the market is overreacting, but I don’t have high conviction on this. Strong competition from Microsoft (MSFT) and Cisco (CSCO), slowing sales, and an eventual return to normalcy could have an effect for awhile.

Summary

The week began with current Fed chair Powell getting renominated by the President for another four-year term. I’m scoring this as a positive only because it alleviates some uncertainty that would have come with a new Fed chair.

The slew of economic data this week largely reinforced that the expansion is still well in tact, as well as the inflation threat. Personal incomes are rising, but not at the pace of cost increases (inflation) when we subtract government transfer payments. With overall transfer payments slowing down (or stopping altogether), price increases could be especially painful for consumers going forward.

FOMC meeting minutes from the November meeting were released this week. It appears more Fed voting members are open to speeding up the reduction of its bond buying program, which could push forward the time frame for the first increase in short-term interest rates.

“Various participants noted that the (policy-setting) Committee should be prepared to adjust the pace of asset purchases and raise the target range for the federal funds rate sooner than participants currently anticipated if inflation continued to run higher than levels consistent with the Committee’s objectives.” We can only hope.

By the end of the holiday-shortened week, all the focus returned to the ongoing COVID-19 saga. Markets fell at the thought of more restrictions. Here are a couple points to remember:

- It is too soon to draw any conclusions.

- Volumes on Friday were very low due to the holiday and the half day (markets closed at 1 p.m. EST), which likely exacerbated the market moves.

We’ve all been left guessing since few, if any, market participants are experts on infectious diseases. It’s best to focus on what is tangible at the moment. Earnings are great, valuations are reasonable, rates remain low, and barring anymore lockdowns, there is a low risk of recession in the next six to 12 months.

Next Week

9 S&P 500 companies will be reporting earnings next week. I’ll be paying attention to Salesforce (CRM) on Tuesday, Crowdstrike (CRWD) and Veeva systems (VEEV) on Wednesday, and Docusign (DOCU) on Thursday. For economic data we have consumer confidence on Tuesday, ISM Manufacturing on Wednesday, and ISM Services & the BLS employment report on Friday.

I/B/E/S data is from Refinitiv.

Disclaimer: None.