Stock Market & Economy Recap - Saturday, Nov. 20

S&P 500 Earnings Update

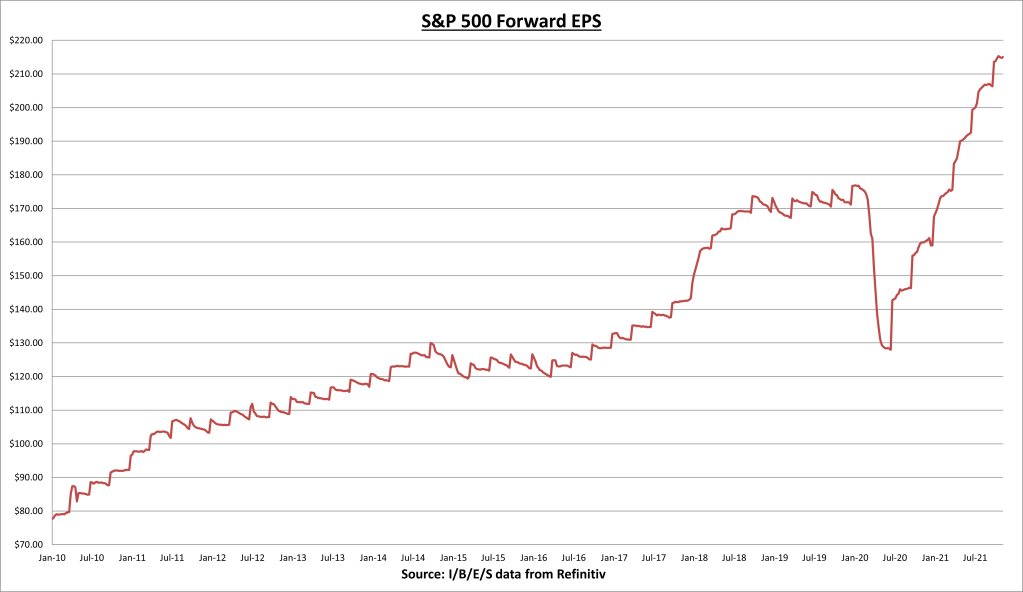

S&P 500 earnings per share (EPS) increased to $215.03 this week. The forward EPS remains +35% year-to-date. 95% of S&P 500 companies have now reported Q3 results. 81% have beaten estimates and results have come in at a combined 10.3% above expectations. Q3 EPS growth is now +42.3%.

The S&P 500 price to earnings (PE) ratio remains at 21.8.

The S&P 500 earnings yield is 4.58%, which still compares favorably to fixed income alternatives, with the 10-year Treasury bond rate at 1.53%.

Economic Data Review

Total retail sales increased to a record $638.2 billion in October. An increase of 1.7% from last month (which was revised higher), and an increase of 16.3% over the last 12 months. Total retail sales are now +21.4% above the pre-COVID-19 peak.

The monthly gains were led by non-store retailers (e-commerce) (+4%), gasoline stations (+3.9%), and electronics/appliance store (+3.8%).

Industrial production increased 1.6% in October, and +5.1% over the last 12 months. The index has now completely recovered from the COVID-19 decline and has been at its highest levels since December 2019.

Capacity utilization increased to 76.4% in October, but it is still below the long-term average of 79.6%. Manufacturing increased +1.2% for the month, led by a surge in motor vehicle assemblies (+18.8% for the month, 9.1 million units).

The Conference Board’s Leading Economic Index (LEI) hit another record in October, increasing +0.9% for the month and +9.3% over the last 12 months.

Notable Earnings

Nvidia Corp. (NVDA) posted another record quarter, with earnings coming in +8% above Wall Street expectations and with +83% growth over last year.

Sales came in at $7.1 billion (+4% above expectations and with a 50% growth rate), led by strong gains in the company’s gaming and data center divisions. Gross margins also improved from 62.6% to 65.2%. NVDA now expects Q4 revenue to come in around $7.4 billion, which would be a growth rate of 48%.

Intuit (INTU) reported EPS that was 58% above expectations, and with 63% year-over-year growth. Sales came in 11% above expectations and 52% higher than last year. The company also raised full year 2022 sales guidance to 26%-28% growth. The growth was led by the small business and self employed segments, along with Credit Karma.

Intuit expects the Credit Karma segment to grow approximately 80% in fiscal 2022. And the recent acquisition of Mailchimp should significantly effect top line sales results in 2022 as well.

I am a long-term shareholder in both companies, they both remain some of my favorite non-FAANG stocks. They are both crushing it in their own ways, but the stock prices have gone parabolic, with Nvidia up +146% and Intuit up +93% over the last year, compared to the S&P 500 at +31%. The stocks would have to pull back quite a bit before I’d even consider adding to positions.

Summary

Upbeat news from retail giants Walmart (WMT) and Home Depot kicked off the week (HD). Both companies reported earnings that beat expectations and both raised forward guidance. The total retail sales confirmed with a nice beat, coming in well above the inflation rate (+1.7% retail sales vs. +0.9% inflation).

We also got some upbeat news within the industrial production report that showed signs auto production is picking up. Hopefully the worst of the supply chain issues in the auto manufacturing sector are behind us.

We also got a ton of Fed speak as we get closer to finding out who the next Fed chair will be. What is being overlooked is the composition of the Fed’s voting members is likely to become even more “dovish” next year, as a few of the more hawkish voting members are set to be replaced.

Bad policy mistakes plus onerous restrictions/mandates are the largest contributors to the current problems. They are trying to fix problems they themselves created and their projections are losing credibility by the day.

Let’s not forget that at this time last year, the Fed was projecting inflation to be around 1.8%. What a miss that was. Their most recent estimates for 2022 inflation is around 2.2%, which will likely be wrong as well.

It amazes me that we have a real Fed Funds rate of -6% and a real 10-year Treasury yield of -4.5%, yet at the same time the Fed is still expanding its balance sheet, albeit at a slower pace. Frankly, given this backdrop I’m kind of surprised stocks aren’t even higher than they are.

Regular readers know the mantra of this blog is earnings and interest rates are what ultimately drive stock prices, not scary headlines or doomsday predictions. The biggest near-term threat would be a spike in interest rates.

I still see this as a lower probability event right now, but the odds increase for every month inflation remains overheated. The good news is that with an earnings yield of 4.6%, there is a decent size cushion for interest rates to rise before it threatens stock valuations, in my opinion.

Next Week

12 S&P 500 companies will report Q3 results. I’ll be paying attention to Zoom (ZM) on Monday. For economic data, we have existing home sales on Monday, and on Wednesday we’ll get the second estimate for Q3 GDP, Core PCE inflation, new home sales, & personal incomes.

I/B/E/S data is from Refinitiv.

Disclaimer: None.