Stock Market & Economy Recap - Saturday, July 24

S&P 500 Earnings Update

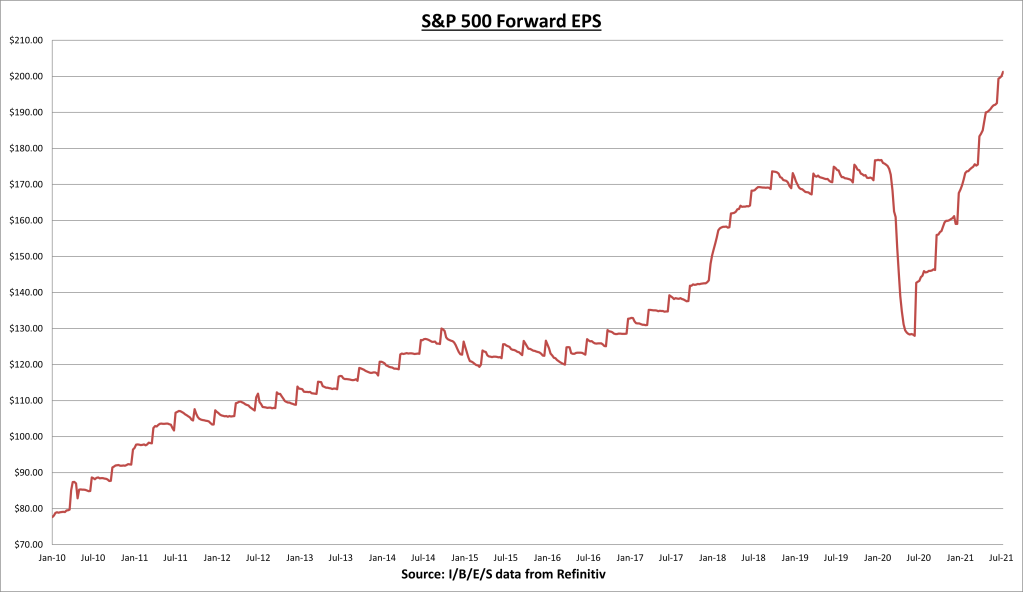

S&P 500 earnings per share (EPS) increased to $201.27 this week. The forward EPS is now at +26.5% year-to-date. Approximately 25% of the S&P 500 has reported Q2 earnings so far. 88% have beaten earnings estimates, and results have come in a combined +17.3% above expectations. Q2 2021 earnings growth is now +78.1%.

The S&P 500 increased +1.96% this week, for another record.

The S&P 500 price to earnings (PE) ratio is now at 21.9.

The S&P 500 earnings yield is now 4.56%, compared to the 10-year Treasury bond rate – which declined to 1.28% this week. Despite the record highs in the stock market, valuations (when adjusted for interest rates – equity risk premium) are more attractive than they were back in 2010 and 2018, when the S&P 500 was trading between 1300 and 3000.

Economic Data Review

The Conference Board’s Leading Economic Index (LEI) came in at 115.1 for June, a gain of +0.7% for the month, while May was revised slightly lower (from 114.5 to 114.3).

The LEI is now +12.8% higher than it was at this time last year. Although the growth is down slightly from last month, it is still well above average. Recession odds typically don’t increase until the LEI turns negative year-over-year. No danger of that, it seems.

Notable Earnings

Semiconductor manufacturer ASML Holdings (ASML) reported Q2-adjusted EPS of $2.97 -- which was in line with street expectations -- and a growth rate of +45%. Gross margins improved to 51% and operating margins improved to 31%. Operating income grew +50%, to $1.492 billion.

Q2 revenue reported to be about 3% below street expectations, and down 8% sequentially, but with a growth rate of +21% over Q2 2020 results.

Trailing twelve-month (TTM) revenues made another company record, for the ninth straight quarter.

ASML trailing twelve-month (TTM) net income continues to soar. Profit margins have climbed to a company record 29%.

ASML is a company on my shopping list for the next correction. It’s been on my radar for awhile, but it never really gave a good entry point. It is a company with competitive advantages, strong returns on invested capital, record revenues, and it is highly profitable with little debt.

Chart of the Week

This week the National Bureau of Economic Research (NBER) officially defined the COVID-19 recession period as beginning in March 2020 and ending in April 2020, thus making it officially the shortest economic recession in post World War II history. None of this is a surprise to anyone, but the question is: does this have any predictive value?

The short answer is no, unfortunately. Economic expansions don’t have a set clock. If we go back and look at each recession and expansion since WWII, there is little we can deduct about the future. There is some correlation between the length of recession and length of expansion. More specifically, longer recessions tend to lead to longer-lasting economic expansions.

The average expansion has been 64 months. And economic expansions have been getting longer over the last 30 years. The average of the last 4 economic expansions has been 103 months. Each recession and expansion is unique, but if history is any guide, this expansion could still have more years to go.

Summary

It was a quiet week for economic data, so earnings took center stage. I expect to see a tug of war between fundamentals (earnings & interest rates) and near-term concerns (peak growth, inflation, delta variants, etc.).

There is some potential seasonal weakness ahead as well, as post election years have typically seen some market weakness in August & September, before the Q4 rally. But these are just averages, and we know nothing about the last two years has been average. So, who knows. I expect the fundamentals to win out at the end of the day. With a current 88% beat rate for Q2, earnings continue to be underestimated.

Next Week

For economic data, we have new homes sales & consumer confidence on Monday, a Fed statement and press conference on Wednesday, our first look at Q2 GDP on Thursday, and PCE inflation & personal incomes on Friday. For earnings, close to 1/3rd of the S&P 500 will be reporting Q2 results. The list of names I’ll be watching is too long. It will be one of the busiest weeks of the quarter.

I/B/E/S data is from Refinitiv.

Disclaimer: None.