Stock Market & Economy Recap - Saturday, Dec. 4

S&P 500 Earnings

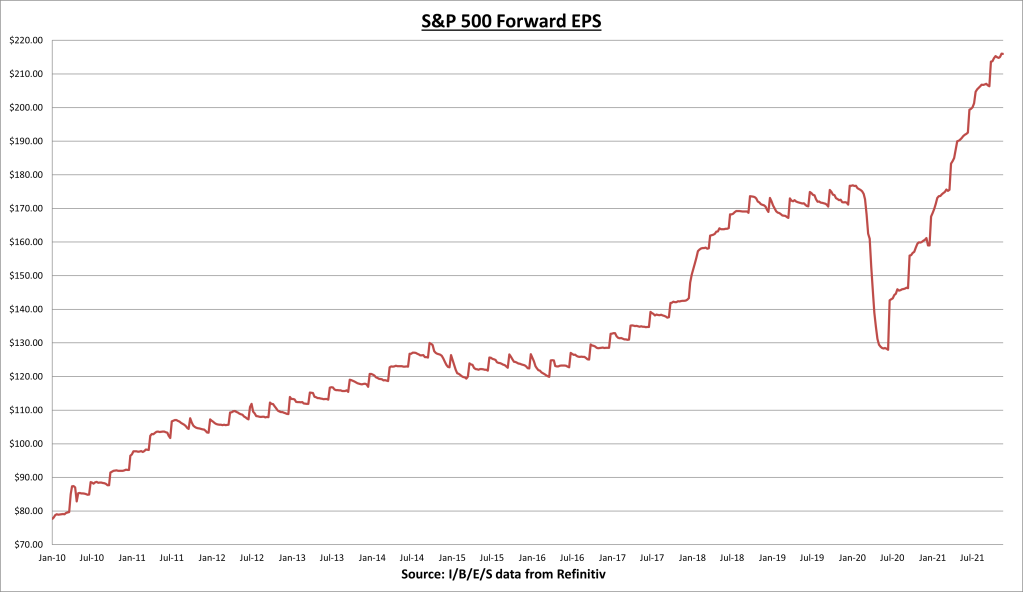

S&P 500 earnings per share (EPS) declined modestly this week, from $216.03 to $215.97. 99% of S&P 500 companies have now reported Q3 results. 81% have beat expectations and earnings have come in a combined 10.3% above estimates. Q3 earnings growth currently stands at +42.6%.

The S&P 500 price to earnings (PE) ratio fell to 21x, as the index declined -1.22% for the week.

The S&P 500 earnings yield is now 4.76%, compared to the 10-year Treasury bond rate which declined to 1.34%.

Economic Data Review

Consumer confidence declined in November, falling to 109.5 while October was also revised lower.

The consumers expectations index – based on expectations for business conditions, labor markets, and financial prospects six months out – also declined. The Labor market outlook and financial prospects expectations fell, and the business conditions outlook improved slightly. Despite the disappointing monthly results, the consumer confidence index is still higher than it was at this point last year.

The ISM Manufacturing Purchasing Managers Index (PMI) for November came in at 61.1, a slight increase over last month (60.8), and remains well in expansion territory (any reading above 50 indicates expansion). New Orders improved from 59.8 to 61.5, employment improved from 52 to 53.3, and prices (input costs) declined from 85.7 to 82.4.

The BLS employment report for November came in well below expectations at 210 thousand net jobs gained, the lowest since December 2020. Total private payrolls increased +235 thousand, while government jobs decreased -25 thousand. As well, September & October results were revised higher by a combined +82 thousand jobs.

Average hourly earnings grew +0.3% for the month, and are now +4.8% higher over the last 12 months.

We’ve now recovered 82.5% of the net jobs lost to the COVID-19 recession, but we are still 3.912 million net jobs below the prior peak.

The ISM Services Purchasing Managers Index (PMI) came in at a record high 69.1 for November. New orders came in the same as last month (69.7), in strong growth territory, and input prices dropped slightly from 82.9 to 82.3.

Notable Earnings

Salesforce (CRM) reported quarterly earnings that were 38% above street expectations, while sales came in 1% above street expectations and with a growth rate of 27%. This was the first full quarter since the Slack acquisition and the company reported 51% sales growth in the platform/other segment (which includes Slack), along with 17% sales cloud growth, 21% service cloud growth, 20% data segment growth, and 25% marketing cloud growth.

The stock fell about 6% after earnings as the company gave its forward guidance of sales that came in better than expected, but earnings guidance fell short. Yet, a light earnings forecast doesn’t have much of a material impact in my opinion. I would look to add to positions on any follow through on the sell off.

CrowdStrike (CRWD) reported adjusted EPS that was 70% above street expectations (+113% growth), on revenues that were 5% above expectations and with 63% growth. Cash flow from operations grew 80%, and free cash flow grew 62%.

1,607 net new subscription customers were added for the quarter, bringing the running total up to 14,687 (+75% growth), and the company is expanding its relationship with the US government to provide endpoint protection and response.

68% of customers are using 4 or more modules (up from 61% last year), and 32% of customers are using at least 6 modules (up from 22% last year), showing that the company is building a competitive advantage through the power of customer switching costs.

The stock is not cheap by any means (250x forward EPS & 40x sales), but it has declined about 30% over the last few weeks. I would look to add to positions if there is follow through.

Veeva Systems (VEEV) reported EPS that was 10% above expectations (24% growth), on revenues that were 2% above expectations (26% growth). The company continued to cite some short-term issues facing commercial cloud software, anticipating a 10% reduction in the number of pharma sales reps across the industry.

Q4 projections on sales ($478 to $480 million) came in slightly below street expectations, while Q4 EPS came in slightly above expectations ($0.88 actual vs. $0.87 estimate). Despite the near-term headwinds, the $3 billion annual sales target by 2025 still looks well in tact.

DocuSign (DOCU) reported EPS that was 26% above street expectations (+164% growth) on sales that were 2.4% above expectations (+42% growth). But it was all about the billings & forward guidance, which was a big and unexpected miss. The company now expects $560 million in Q4 sales (street was expecting around $574 million), for a growth rate of approximately 32%, which would be the slowest quarterly sales growth rate since IPO.

The weakness in billings suggests the soft sales forecast will last for awhile. As a result, the stock is getting hammered (down about 30%-40% as I type this). The company focused on meeting the sharp spike in demand, while lead generation fell short, and now they are paying the price for it.

Summary

The week began with some positive news regarding Black Friday sales, with total sales coming in +29.8% above last year, as store traffic increased 42.9% (still down 28% compared to 2019). Still the COVID-19 variant loomed in the background. We saw the effect that the Delta variant had on Q3 GDP, so it seems inevitable now that Q4 and Q1 2022 economic growth estimates will need to be revised lower. But by how much?

By Tuesday it appeared the market was ready to move on but then Fed Chairman Powell thought it was a good time to finally admit the Fed was wrong all along to call inflation “transitory” (about a year too late, Jay), and that a faster pace of tapering was warranted (which means rate increases likely coming even sooner).

We still don’t have any idea what the economic effects of the new variant will be (because of restrictions and mandates), yet he thought this was a good time to surprise the market.

Then on Wednesday Treasury Secretary Yellen maintained her stance that stimulus was “at most a small contributor to inflation.” So we are supposed to believe that a 30%+ increase in the money supply doesn’t have an inflationary effect.

We have a real epidemic in regards to the lack of accountability from our elected officials. No one wants to take responsibility, they just want to pass the blame onto someone or something else. Not our finest week for the Fed Chair & Treasury Secretary. The odds of a policy mistake seem to increase.

The data continues to support the recovery, but we may be starting to see inflation finally having a negative impact on demand. This week, Apple (AAPL) warned suppliers that iPhone 13 demand may be softening. Up to now consumers accepted higher prices because of stimulus offsets. We can’t count on that going forward.

It was an eventful week with some volatile market moves. We may be in the middle of a perfectly normal and healthy market correction, with growth stocks especially taking it on the chin, but the fundamentals continue to be supportive for risk assets.

Next Week

6 S&P 500 companies will be reporting earnings. For economic data, we have the Consumer Price Index (CPI) on Friday.

I/B/E/S data comes from Refinitiv.

Disclaimer: None.