Stock Market & Economy Recap - Saturday, Aug. 14

S&P 500 Earnings Update

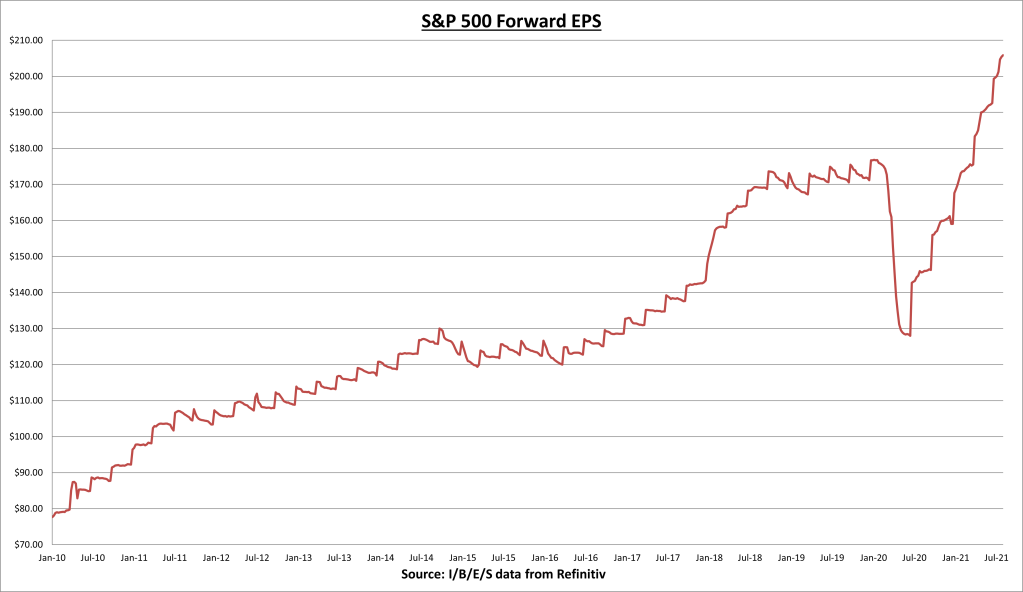

S&P 500 earnings per share (EPS) increased to $205.89 this week. The forward EPS is now +29.5% year-to-date. 91.4% of S&P 500 companies have now reported Q2 results. 87% have beaten estimates, and results have come in a combined +16.4% above expectations. Q2 EPS growth is now +93.8%.

The S&P 500 increased +0.71% for the week, for yet another record.

The S&P 500 price to earnings (PE) ratio is now at 21.7.

The S&P 500 earnings yield is now 4.61%, with a dividend yield of 1.30%, compared to the 10-year Treasury bond rate of 1.297%. The equity risk premium remains a healthy 3.31%.

Economic Data Review

The NFIB small business optimism index decreased to 99.7 in July, down -2.7% for the month and +0.9% over the last 12 months. 6 of the 10 index components declined for the month. The index remains above its historical average of 98.4.

The same dynamics remain in place, half of all small businesses are now reporting at least one unfilled position, while plans to fill open positions also remain near a record high. I suspect some relief is in sight with unemployment benefits set to expire next month.

Compensation remains near a record high and 27% plan to raise compensation in the next three months (near a 48-year high). Price increases and plans to increase prices remain near a 40-year high. Small business owners report their biggest problems remain quality of labor, taxes, regulations, & inflation. Overall, it was a slight disappointment, but I think a lot of these issues have already been accepted and discounted.

The Consumer Price Index (CPI) increased +0.5% in July, for an annualized rate of +5.3% (unchanged from +5.3% last month). The biggest contributors coming from fuel & gasoline (+2.4% for the month, +41% for the last 12 months), energy services (+8% for the month, +7.2% over the last 12 months), and food (+0.7% for the month, +3.4% over the last 12 months).

The Consumer Price Index minus food & energy (Core CPI) rose +0.3% in July, +4.2% annualized (down from +4.45% last month). New vehicles rose +1.7% for the month, +6.4% over the last 12 months. Used cars and trucks rose +0.2% for the month (down from +10.5% last month), but still up a whopping +41.7% over the last 12 months.

CPI and Core CPI remain well above the historical averages, and I don’t think that will change significantly anytime soon. But at least we had a pause in the annualized growth rate, and that may be taken as minor victory in comparison to what we’ve seen over the last six months or so.

The Producer Price Index (PPI) increased +1.0% in July, +7.8% over the last 12 months (up from +7.3% last month). The data set only goes back to November 2010, so we can’t put this into a historical context. But its clear we’ve never seen anything quite like this in the last 10 years. Expect producers to pass on those extra costs to consumers, which will spill over into the CPI. No significant relief on inflation is in sight.

Notable Earnings

The Trade Desk (TTD) reported adjusted EPS of $0.18, which is +96% growth and +38.5% above street expectations. Gross margins and operating margins improved dramatically, with gross margins coming in at 82% and operating margins coming in at 22%.

Sales grew 101% (+7% above street expectations) year-over-year and 27% sequentially. Customer retention rate remains over 95% for seven years now. Which means 95% of customers that use the service end up staying.

The company broke the $1 billion mark in sales reported over the last four quarters (trailing twelve months). TTM revenue growth is now +52% and +16 sequentially.

The Trade Desk has now reported $282 million in earnings before interest/taxes/depreciation/amortization (EBITDA) over the last four quarters.

Gross profit margins are near a company record at 81%. Operating margins continue to improve, now above 21%.

I love the company, but I hate the current valuation. The stock trades 127x forward earnings and 39x sales. It was a $10 stock a few years ago, and now it trades at around $80. Needless to say, a lot of good news is already priced in. I maintain a half position in the company. Due to its operational excellence, I want some skin in the game.

If the stock were to fall to the $40-$50 range, I would go to a full position. That’s around 50% lower than current prices, which reflects how overvalued this stock could potentially be. But valuation isn’t a timing tool. Stocks can remain overvalued for a long time, until they eventually grow into those earnings or fail.

Chart of the Week

France’s stock index (CAC 40) is up +39% year-to-date, more than double the S&P 500. The index finally broke out above its year 2000 high. There are many benefits to global diversification. The laggards eventually turn into the leaders, and vice versa. You’ll never time the transition with any consistency. Just go along for the ride.

France makes up about 5-8% of the total international stock index funds, and 10-15% of the developed international stock index funds.

Summary

The market continues to overlook the COVID-19-related disruptions. There are now 10 million job openings nationwide, a record, with half of all small businesses reporting at least one unfilled position. This means there is more room for improvement.

With an earnings yield more than triple the treasury bond rate, it doesn’t take much for stocks to continue their upward path. I would still like to see a pullback in the vicinity of the 50-week moving average. It would be healthy, but impossible to time.

With Q2 earnings mostly behind us, all eyes will be on the Jackson Hole Symposium in two weeks, where the Fed could lay the framework for reducing its bond buying program. There is no need for the Fed to maintain crisis level stimulus. And the more they wait, they risk falling behind. With the cost of capital effectively 0%, investors are willing to bet on companies that may not turn profitable for five or more years (if ever).

Needless to say, there is a lot of speculative money in the markets. And those areas could be most at risk when the Fed eventually reverses course. The market is always forward-looking, so it's better to prepare ahead of time. If you are invested heavily in those high growth names with no earnings, it may be a good time to diversify. There are a lot of stocks that are going up for the wrong reasons.

Next Week

There will be 18 S&P 500 companies reporting earnings. I’ll be paying attention to Home Depot (HD) on Tuesday, Nvidia (NVDA) on Wednesday, and Applied Materials (AMAT) on Thursday. For economic data, we have retail sales and industrial production on Tuesday, and the Conference Board’s leading economic index (LEI) on Thursday.

I/B/E/S data is from Refinitiv.

Disclaimer: None.