Still Time To Buy Spotify Stock After Q1 Earnings?

Image Source: Unsplash

Despite missing its first quarter expectations on Tuesday, Spotify (SPOT - Free Report) stock has risen +3% since its Q1 report to over $600 a share.

That said, investors may be wondering if the rally in the music streaming giant’s stock can continue with SPOT up more than +35% year to date, to largely outperform the declines among the broader indexes and even top Netflix’s (NFLX - Free Report) +27%.

Image Source: Zacks Investment Research

Spotify’s Q1 Results

Missing analysts' lofty forecast, Spotify reported Q1 EPS of $1.13 compared to expectations of $2.29 per share. Still, this was a 7% increase from earnings of $1.05 a share in Q1 2024. Spotify’s Q1 sales rose 11% year over year to $4.4 billion, although this missed estimates of $4.59 billion.

Like video streaming king Netflix, Spotify’s subscription growth among its music platform has led to much hype in recent years, with it noteworthy that the company’s net subscribers spiked 12% during Q1 to 268 million. Adding 5 million new net subscribers, Spotify’s monthly active users (MAU) grew by 3 million to 678 million.

Spotify’s Guidance & Outlook

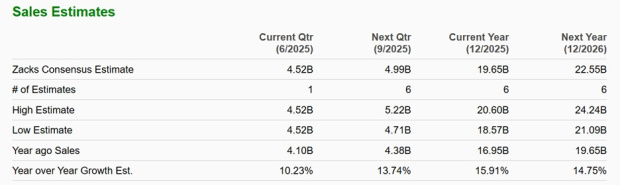

Providing guidance for the second quarter, Spotify expects to add 11 million MAU and 5 million subscribers. Furthermore, Spotify forecasts Q2 revenue at $4.52 billion or 10% growth, which fell in line with Zacks estimates (Current Qtr Below). Based on Zacks projections, Spotify’s total sales are expected to increase 16% in fiscal 2025 and are projected to spike another 15% in FY26 to $22.55 billion. Notably, the Sweden-based technology firm expects Q2 operating income at 539 million euros and forecasts a 31.5% gross margin.

Regarding full-year margins, Spotify continues to expect improvement in 2025 at what it called a more measured pace than last year's exceptional gains as the company strategically invests to accelerate its long-term growth ambitions.

Image Source: Zacks Investment Research

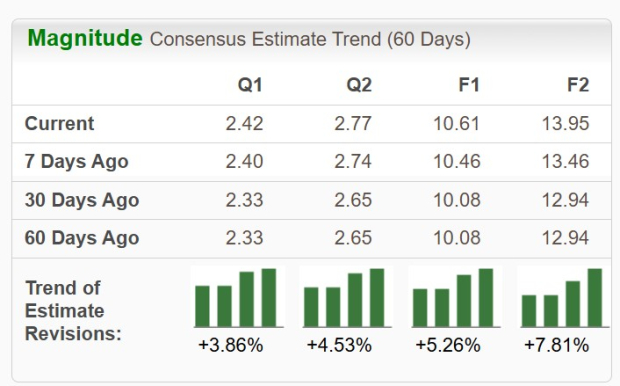

SPOT EPS Revisions

Suggesting more upside in Spotify stock is that earnings estimate revisions have continued to trend higher over the last week. Plus, FY25 and FY26 EPS estimates are now up 5% and 8% in the last 60 days, respectively.

Spotify’s annual earnings are currently expected to soar 78% this year to $10.61 per share, from EPS of $5.95 in 2024. Plus, FY26 EPS is projected to spike another 31% to $13.95.

Image Source: Zacks Investment Research

Bottom Line

Spotify’s rapid expansion is still hard to overlook, with its stock sporting a Zacks Rank #1 (Strong Buy) at the moment. This is largely predicated on the trend of positive earnings estimate revisions even amid its Q1 earnings miss. Correlating with such, it wouldn’t be surprising if the stellar price performance of SPOT continued.

More By This Author:

Meta Platforms Q1 Earnings and Revenues Top Estimates

Buy Pfizer Stock For A Rebound After Crushing Q1 EPS Expectations?

Buy The Dip In Amazon Or Apple Stock As Earnings Approach?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more