Buy Pfizer Stock For A Rebound After Crushing Q1 EPS Expectations?

Image Source: Pixabay

Pfizer (PFE - Free Report) shares spiked +3% in Tuesday’s trading session as the pharmaceutical giant was able to crush its Q1 earnings expectations this morning.

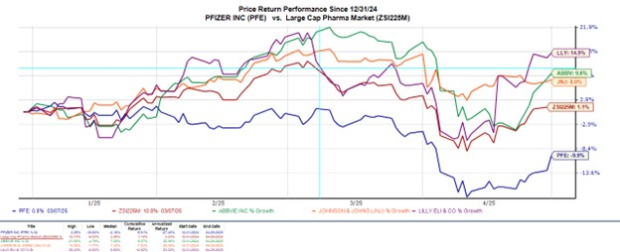

Still, Pfizer stock has fallen 10% year to date and hasn’t provided the defensive hedge that many of its Zacks Large Cap Pharmaceutical peers have been able to provide, such as AbbVie (ABBV - Free Report), Eli Lilly (LLY - Free Report), and Johnson & Johnson (JNJ - Free Report).

That said, investors may be eyeing Pfizer stock for a continued rebound with PFE still trading near multi-year lows of $20 a share.

Image Source: Zacks Investment Research

Pfizer’s Q1 Results

Navigating what it called a dynamic operating environment, Pfizer posted Q1 earnings of $0.92 per share, crushing EPS expectations of $0.64 by 43% and rising from $0.82 a share in the prior year quarter. Pfizer also highlighted that it’s on track to exceed its net cost savings targets. This comes as Pfizer has experienced declining revenue from COVID-related products along with discouraging clinical results for its weight loss drug, which would help the company compete with Eli Lilly and Novo Nordisk (NVO - Free Report).

Posting mixed results, Pfizer’s Q1 sales of $13.71 billion missed estimates of $13.83 billion and were down from $14.87 billion a year ago. However, it's noteworthy that Pfizer has exceeded the Zacks EPS Consensus for 11 consecutive quarters with a very impressive average earnings surprise of 43.48% in its last four quarterly reports.

Image Source: Zacks Investment Research

Pfizer Reaffirms Its Full-Year Guidance

Reassuringly, Pfizer reaffirmed its full-year fiscal 2025 guidance, including revenues in the range of $61 billion-$64 billion, with Zacks projections currently at $63.48 billion. Pfizer still expects adjusted FY25 EPS at $2.80-$3.00, with the Zacks Consensus at $2.99.

Pfizer’s “Cheap” P/E Valuation

Most appealing to long-term investors is that Pfizer stock is trading near its decade-long low in terms of price to forward earnings at 7.7X and well below the high of 20.1X during this period. PFE also trades at a noticeable discount to the benchmark S&P 500’s 21.3X forward earnings multiple and its Zacks industry average of 16.4X.

Image Source: Zacks Investment Research

Pfizer’s Enticing Dividend

At current levels, Pfizer’s annual dividend also stands out with a 7.46% yield that towers over its industry’s 2.51% average and the benchmark’s 1.33%. Although Pfizer lost its status as a dividend aristocrat during the 2008 financial crisis, the company has now increased its dividend for 16 consecutive years.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Following its Q1 report, Pfizer stock sports a Zacks Rank #2 (Buy). Corresponding with such, earnings estimate revisions for FY25 and FY26 are up over the last 30 days, and this trend could continue with Pfizer blowing away EPS expectations while highlighting its cost-saving initiatives.

This would certainly bolster Pfizer’s “cheap” P/E valuation and may lead to an extended rally as PFE does appear to offer long-term value to shareholders, considering its enticing dividend.

More By This Author:

Buy The Dip In Amazon Or Apple Stock As Earnings Approach?Time To Buy Microsoft Or Meta Stock As Earnings Approach?

4 Retail Discount Stocks To Watch As Industry Juggles Tariff Woes

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more