Starbucks: Significant Discounted Considering International Growth

Starbucks (Nasdaq: SBUX) shares have recently declined from a high of $61.70 to $54.50, an 11.5% drop, due to a couple of factors: The first one is the decline in comparable same-store sales, creating fear that the world's biggest coffee chain is facing stagnant growth in its biggest market -- the U.S & second, failure to retain occasional customers especially during the afternoon which translated into flat average transaction per store, a factor of surprise to the investors since it occurred during the holiday season. Does Starbucks have more room for growth or did it become an only dividend play? Let me discuss the reasons why we believe there is more room to grow:

Source: Google.

Top & bottom line

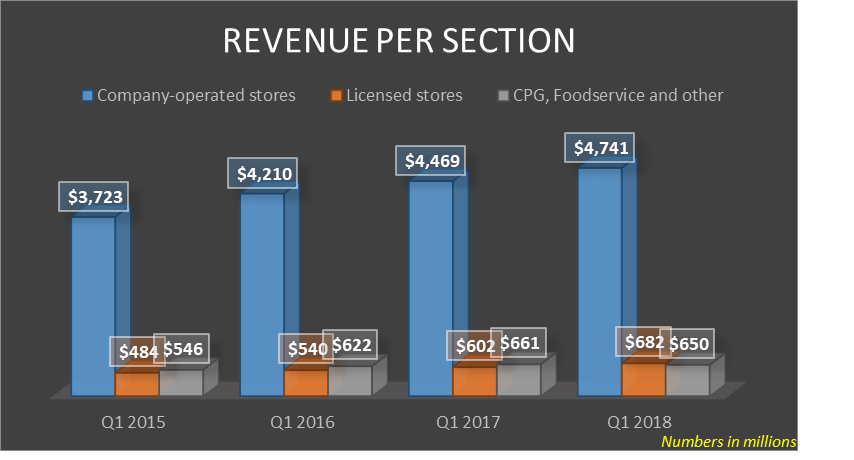

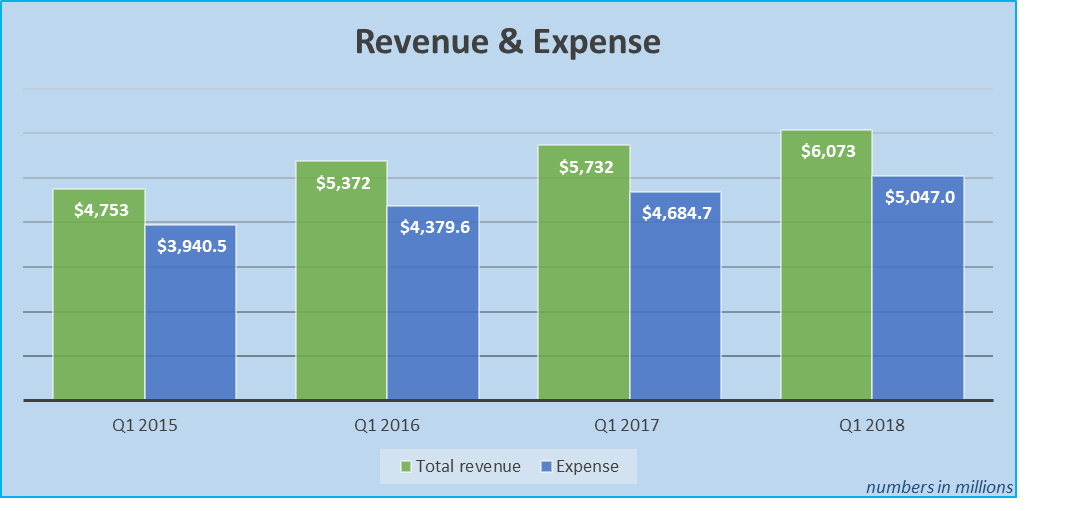

Total revenue Y-o-Y (Fiscal year ends in October) for Q1 2018 was $6.073 billion up from $5.733 billion, a 5.9% increase. Revenue per section came in as follows: company-operated stores revenue rose from $4.469 billion to $4.741. billion, a 6.1% increase while licensed stores revenue increased from $6.020 billion to $6.820 billion, a 13.3% increase. The only decrease came from CPG, foodservice and other, which declined from $6.61 billion to $6.49 billion, a 1.8% decrease.

Source: SEC filing, Chart created using Excel by author.

Expenses, on the other hand, increased by 8%, from $4.684 billion to $5.047 billion, and as a percentage of net revenue, it increased from 81.7% a year ago to 83.1%. This increase is due to a food-related mix shift in the Americas segment and restructuring costs related to the closing oTeavanna retail stores. Store operating expenses as a percentage of company-operated stores revenue decreased from 36.7% to 36.6%.

(Click on image to enlarge)

Source: SEC filing, chart created using Excel by author.

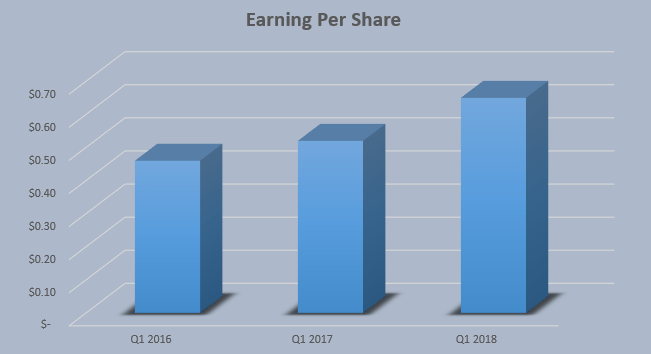

Finally, non-GAAP EPS grew 25% to $0.65 and included a $0.07 benefit from changes in the U.S. tax law. Another reason for this increase is the implementation of the buyback program by the company, purchasing 28.5 million shares equivalent to $1.6 billion the in 1st quarter 2018.

Source: SEC filings, chart created using Excel by author.

Growth prospects

The most commonly discussed issue between investors is the slowing momentum of comps sales in the U.S. and the saturation in terms of number of stores opened, as mentioned lately in a CNBC article:

“ Seventy-five percent of Starbucks locations in California (Starbucks' largest U.S. market representing approximately 20 percent of its U.S. footprint) now have a store within a one-mile radius," Strelzik said. "There are now 3.6 Starbucks locations within a one-mile radius of the typical Starbucks in the U.S. relative to 3.3 and 3.2 stores in 2014 and 2012 respectively.

Strong new store performance appears to be coming – at least in part – at the expense of existing store traffic. “

The implications of stores saturation are a real problem, with US comps sales coming at 2%, below the 3% analyst’s target and the 3%-5% projection made by the management along a slowdown in transaction comps.

Another issue discussed is less frequent visit from occasional visitors especially during the afternoon.

But investors are clearly focusing only on the retail US market and ignoring all the other divisions starting with the improvement made in the digital program like the Starbucks reward program and the Chinese market growth opportunity (Starbuck’s fastest growing market) that I will discuss in further details:

Starting with the digital improvements, Starbucks added over 1.4 million active Starbucks Rewards members in the U.S., up 11% year-over-year, making a total of 14.2 million active members. Mobile payment in the U.S. has grown to over 30% of total tender. Also, the company is working on partnerships with VISA, Alibaba and other company to launch new products and attract customers, as mentioned in the earning call transcript:

“In partnership with Chase and Visa, we are launching a co-branded credit card in February. These customers will earn stars at an accelerated rate at Starbucks as well as earn stars everywhere else they shop.

In April, also with Chase and Visa, we are launching a co-branded stored-value card targeted to customers who don't want or can't qualify for credit cards. This card will also let customers earn stars wherever Visa is accepted. In March, we are launching a significant marketing initiative to sign up customers for special offers outside of Starbucks Rewards. With only 14 million of the 75 million or so unique customers who visit us each month signed up for rewards, we have a tremendous opportunity to leverage our new digital technologies to initiate and advance additional direct digital relationships.

By the end of the fiscal year, we expect to establish millions of incremental digital customer relationships outside of Starbucks Rewards, giving us an entirely new direct marketing capability to a vast customer audience. “

China

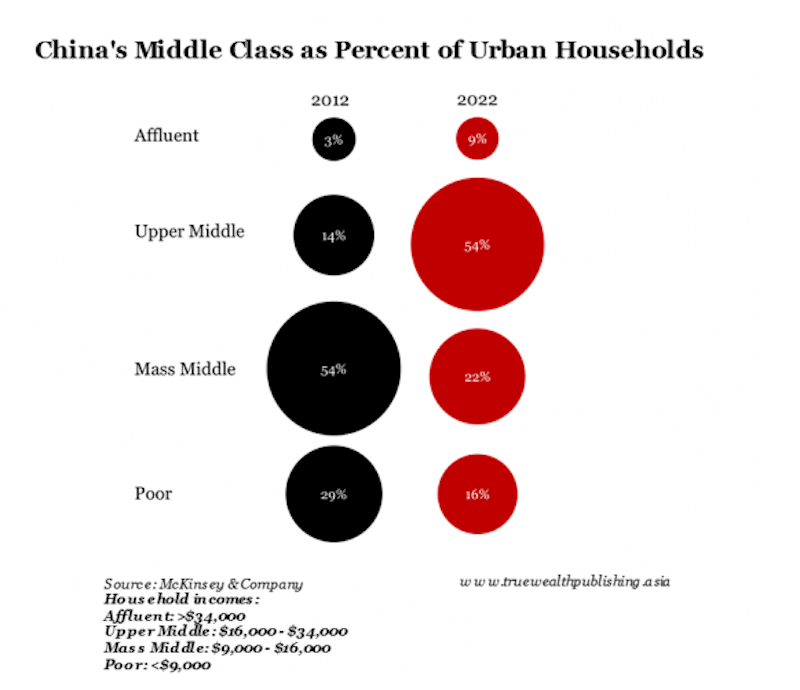

The other growth opportunity that is being overlooked by the investors is China. Starting with some macro statistics, according to business insider :

“ China had an urban population of 730 million people in 2015. So even if that figure doesn’t change (and it will only grow), by 2022 over 550 million people in China will be considered middle class. That would make China’s middle class alone big enough to be the third-most populous country in the world. “

Source: Business insider

550 million middle-class people in China is double the US population and for that exact reason, Starbucks has acquired the remaining 50% share of its East China business from long-term joint venture partners, Uni-President ("UPEC") and President Chain Store Corporation ("PCSC"). As a result of this acquisition, Starbucks has assumed 100% ownership of over 1,400 Starbucks stores in Shanghai and in the Jiangsu and Zhejiang Provinces, bringing the total number of company-owned stores in China to over 3,100 at the time of closing.

Also, Starbucks is growing its digital presence in China by introducing new payment methods with WeChat and AliPay and as a result, generating encouraging positive growth, as stated in their Earning call transcript:

“Leveraging our digital flywheel continues to represent a huge opportunity and unlock for us in China. Since launching WeChat Pay one year ago and adding Alipay in September, digital payments have increased to over 60% of total tender. 90-day active Starbucks Rewards members now total over 6 million, and our e-commerce and social gifting in China represented nearly 20 million in Q1, up threefold from a year ago.

This digital success was accompanied by success in retail stores, generating revenue growth of 30% in Q1 2018. Not only that but also Shanghai Roastery is generating tremendous revenue for the company as stated by the Q1 earning call transcript:

“Customers, in some cases, are lined up for hours to enter the roastery and be taken on an immersive, multisensory coffee, food and tea journey. On its very first day of operation, the Shanghai Roastery became the highest grossing Starbucks store in the world, averaging more than double the number of transactions of our highly-successful Seattle Roastery, and with an average ticket of $29. The unparalleled retail experience delivered by the Shanghai Roastery will enable us to serve well over 1 million customers every year. At the same time, amplifies and elevates the Starbucks brand across China and CAP overall”

Add to it the comments made by Howard Schultz (Starbucks CFO):

“I'm going to give you some numbers that we have not yet released, because I think it's very important as we look at the difference between 3% and 2% comps for the quarter. I think, again, here's a number that I think you'll be very interested in. Our U.S. Starbucks stores, on average, do about $32,000 a week. The roastery in Shanghai, after eight weeks of operations, is doing on average twice that, not each week but each day.”

With all this tremendous success, both in the retail and online division, Starbucks still have substantial opportunities to expand in China. The company is currently operating only half the number of stores (Company-operated stores) in the US, 9,525 compared to 4,682 in China.

All these reasons prove that Starbucks still have a lot of room to grow outside the US, and China acting as its biggest market to expand its operations.

Valuation

For this part, we will be using three methods of valuation: Discounted Cash Flow, Price to Earnings and Price to Revenue, then taking the average of the three prices:

First, for the DCF valuation, we will be using WAAC equal to 7.8% and running multiple scenarios for growth ranging between a bearish scenario of 1%, a just right scenario of 2% and a bullish case of 3%. The average of the answers obtained is $81.27

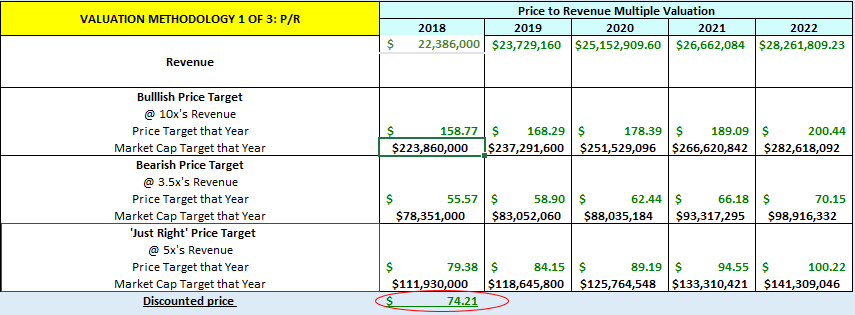

Calculating the target price using P/R as follow gives us a price target of $74.21:

(Click on image to enlarge)

Source: Author’s own projections, chart created using Excel.

And finally using the P/E ratio, the company currently has a P/E of 18 which is considered fair seeing as there was increase in EPS by 25%. By using projections for next 5 years and running different scenarios ranging between a bearish P/E of 10, a just right scenario of 18 and a bullish scenario of 25 then discounting the price to today’s value using WAAC of 7.8%, we get an answer of 58.63$.

The average of the 3 prices gives us a target of $71.37, a 31% increase from its current price of $54.50.

Take home

In conclusion, investors are only focusing on the US markets, and are overlooking the opportunities offered in foreign countries, especially China, where the company has clearly succeeded to implement and expand its retail stores along its digital division, producing astonishing sales numbers and growth.

The company still might face some headwinds from its Teavanna stores closing along the low the US comp sales but that’s only in the short term (couple quarters ahead), to resume its growth in the future thus offering a buy opportunity for long term investors with a target of $71.37, a 31% upside from its current price.

Quad 7 Capital has been a leading contributor with various financial outlets since early 2012. If you like the material and want to see more, scroll to the top of the article and hit ...

more

I would have thought #Starbucks was saturated by now. Seems like there is one on every corner.