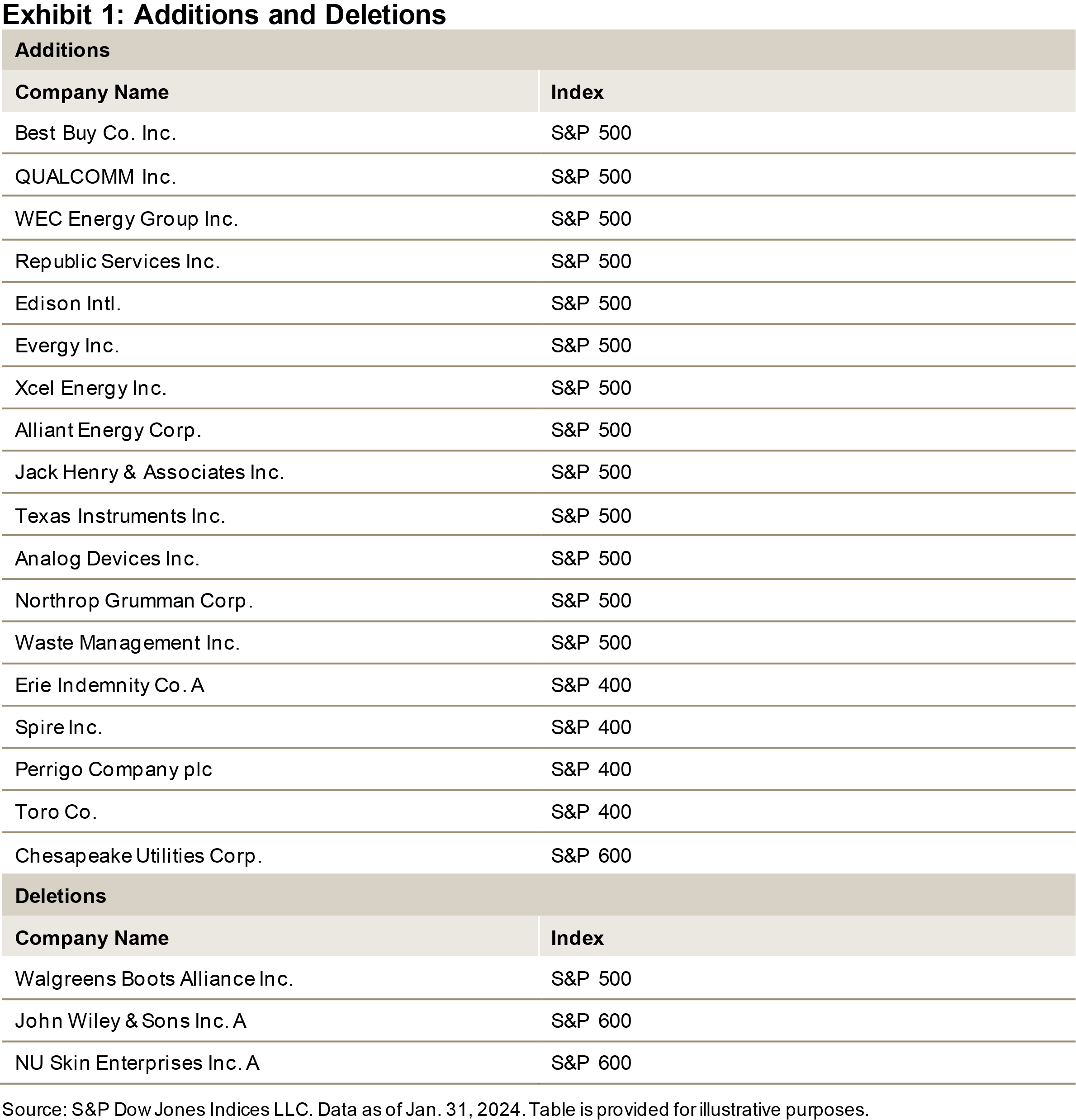

S&P High Yield Dividend Aristocrats Rebalance: Let’s Welcome The 18 Newest Members

The S&P High Yield Dividend Aristocrats® includes large-, mid-, and small-cap companies in the U.S. that have raised their dividends for at least 20 consecutive years. The index recently concluded its annual reconstitution on Jan. 31, 2024, which brought 18 new members into this accomplished group. Accounting for the three deletions, the index’s total count increased from 121 to 136, which enhances its overall diversification and liquidity. This blog will examine the additions and deletions through a size and sector lens and provide a look at the laudable track record of constituents’ dividend increases.

(Click on image to enlarge)

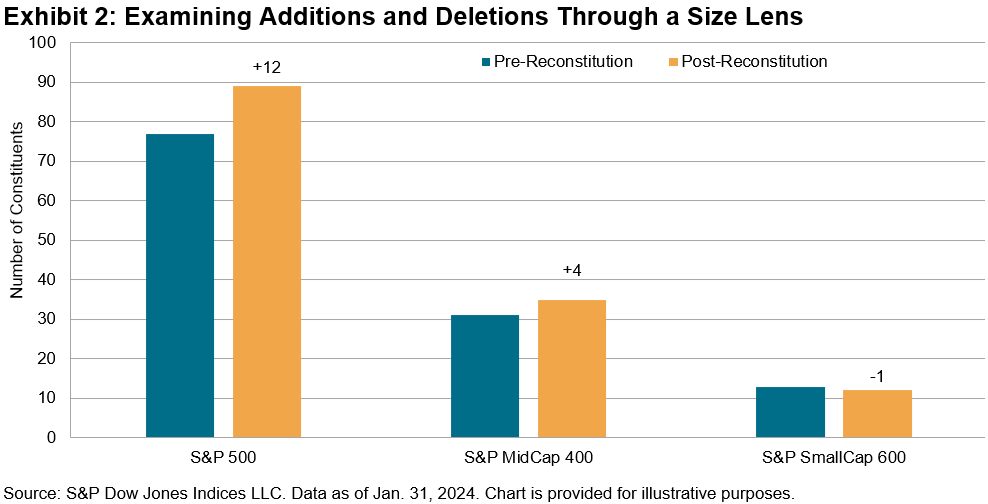

Exhibit 2 details how the reconstitution affected the S&P High Yield Dividend Aristocrats from a size perspective. Pre-reconstitution, the index had 77, 31 and 13 constituents in the S&P 500®, S&P MidCap 400® and S&P SmallCap 600®, respectively. The 15 net additions included 12 net additions from the S&P 500, 4 additions from the S&P MidCap 400, and 1 net deduction from the S&P SmallCap 600. Post-reconstitution, there are 89, 35 and 12 constituents from the S&P 500, S&P MidCap400 and S&P SmallCap 600, respectively.

(Click on image to enlarge)

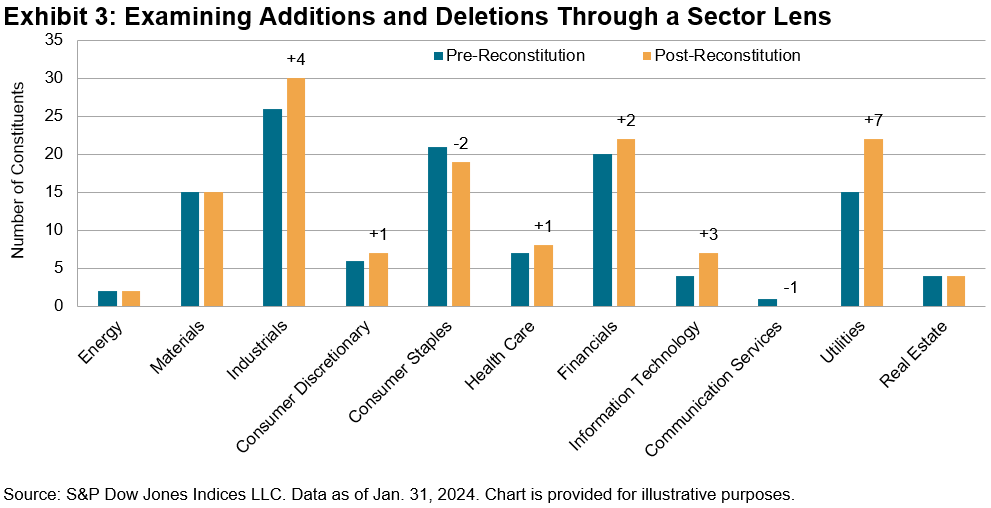

As Exhibit 3 displays, Utilities and Industrials were the biggest beneficiaries of the reconstitution, with their net counts increasing by 7 and 4, respectively. Industrials now comprises 30 constituents, 8 more than the next-highest sectors by count: Financials and Utilities, each with 22. After losing two constituents, Consumer Staples dropped to the third-highest sector by count, with 19. The lone constituent in the Communication Services sector, John Wiley & Sons, was removed from the index, resulting in Communication Services being the only GICS® sector without representation in the index.

(Click on image to enlarge)

A Long History of Dividend Growth

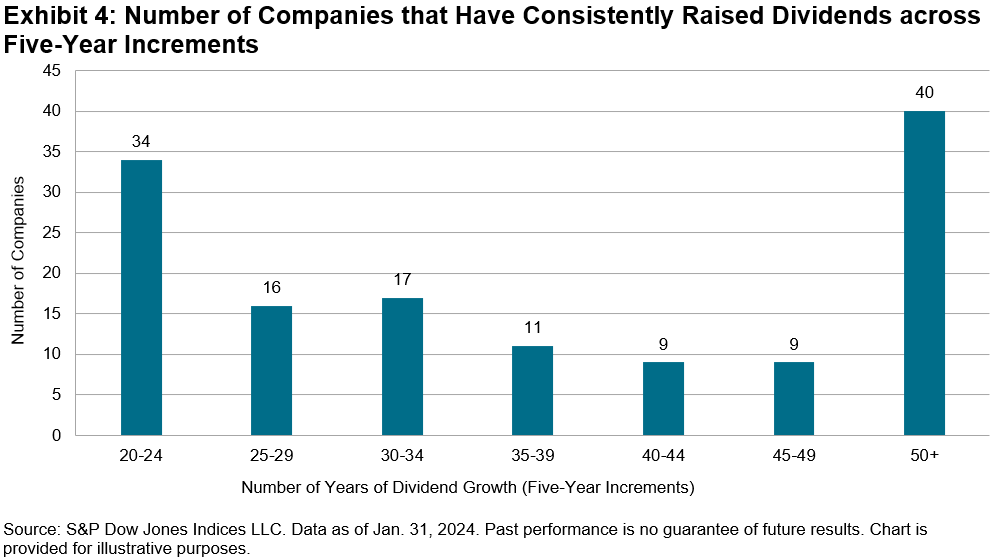

Exhibit 4 summarizes the number of constituents that have increased their dividends in five-year increments. Notably, over one-half of constituents have increased their dividends for 35 years or longer, and over 36% have achieved this feat for 45 years or longer. These track records are certainly commendable and demonstrate these companies’ historically consistent ability and willingness to return increasing amounts of shareholder capital across multiple decades.

(Click on image to enlarge)

More By This Author:

S&P 500 Dividend Aristocrats Rebalance: Fastenal in, Walgreens out

The S&P Dividend Aristocrats Remain Benchmark Beaters In Pan Asia

S&P DJI’s Global Islamic Equity Benchmarks Surged Nearly 12% In The Final Quarter, Outperforming Conventional Benchmarks in 2023

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.