S&P 500 Sets New Record High As Investors Potentially Shift Focus To 2024-Q2

After weeks of hovering within easy striking distance of its old record high close, the S&P 500 (Index: SPX) finally broke through and set a new record! The index reached its new record on Friday, 21 January 2024, closing out the trading week at 4,839.81. The new record is almost 1.2% higher than where it closed the previous week and is 0.9% higher than the old record of 4,796.56 that had been set over two years earlier on 3 January 2022.

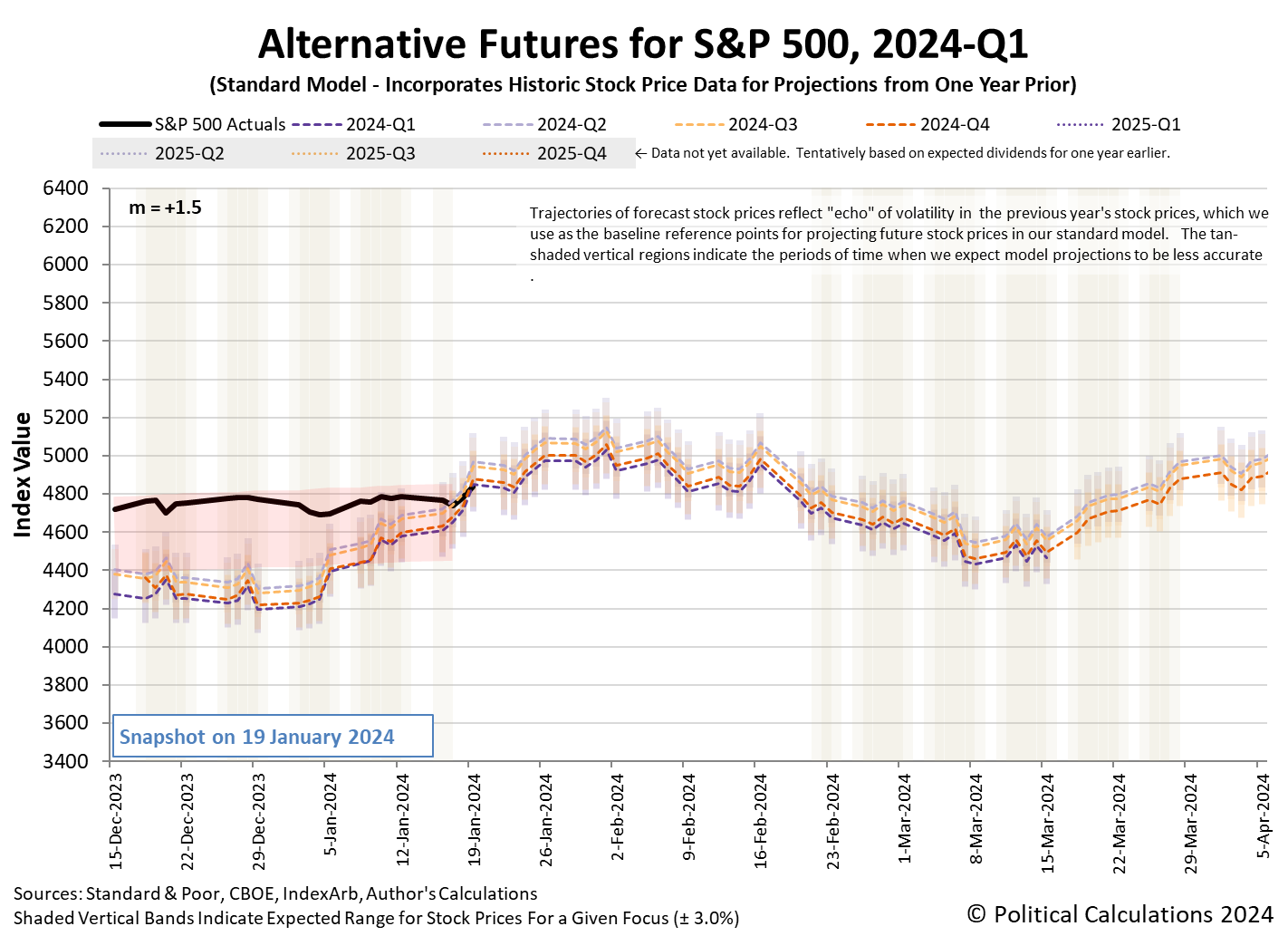

The record was broken as investors may have shifted their forward-looking focus from 2024-Q1 to the more distant future quarter of 2024-Q2. This change would coincide with changes in the expected timing for when the U.S. Federal Reserve will begin cutting interest rates. If so, the jump in stock prices accompanying the change in expectations would qualify as a Lévy flight event for the dividend futures-based model, but we'll need another week to verify if that is indeed what happened.

Speaking of changes in expectations, the CME Group's FedWatch Tool’s updated projections indicate investors now anticipate the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 1 May 2024 (2024-Q2), six weeks later than projected last week. This date marks the expected beginning of a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

These changes occurred as the last redzone forecast period of the dividend futures-based model's alternative futures chart came to an end. Based on what the latest update to the chart suggests, there would seem to be upside potential for the S&P 500 to continue setting new record highs in the short term. That's because the chart indicates investors were focusing on 2024-Q1 through the end of the trading week, where the alternative trajectory the S&P 500 would follow as investors focus on 2024-Q2 is higher.

(Click on image to enlarge)

The downside to focusing on 2024-Q2 is that investors will only hold their attention on this quarter until they have reason to shift their attention to another point of time in the future, which can happen with little warning. How stock prices might change also depends upon how investors expect the growth rate of trailing year dividends per share will change for the future quarters on which they might focus their attention.

For example, if investors were to suddenly shift their attention to the even more distant future quarter of 2024-Q3, this hypothetical Lévy flight event would be accompanied by a downward shift in the S&P 500's trajectory.

What would cause such a change? It will happen in response to the random onset of new information, much like what can be seen to have happened with the market-moving headlines during the holiday-shortened trading week that was:

Tuesday, 16 January 2024

- Signs and portents for the U.S. economy:

- Fed minion opens mouth, creates doubt about when Fed will start cutting rates this year:

- Bigger trouble developing in China:

- BOJ minions get data to justify keeping never-ending stimulus alive for longer:

- Wall Street ends down as Apple weighs

Wednesday, 17 January 2024

- Signs and portents for the U.S. economy:

- Fed minions not gaining converts in their claim they won't cut rates soon:

- Bigger trouble, stimulus developing in China:

- BOJ minions say they'll gently ease out of never-ending stimulus:

- ECB minions claim they're not done fighting inflation:

- Wall Street ends down as US retail sales data crimps rate cut bets

Thursday, 18 January 2024

- Signs and portents for the U.S. economy:

- Fed minions put prospect of faster rate cuts back on the table:

- Bigger trouble developing in China:

- ECB minions not happy to see Eurozone wages rising:

- Nasdaq, S&P, Dow notch second best day of 2024, boosted by chip stocks and Apple

Friday, 19 January 2024

- Signs and portents for the U.S. economy:

- Fed minions expected to hold off rate cuts until May:

- Bigger trouble developing in China:

- S&P 500 closes at record high, Nasdaq and Dow also surge as Wall Street finds footing

The Atlanta Fed's GDPNow tool's final nowcast estimate of real GDP growth for 2023-Q4 was +2.4%, up slightly from last week's +2.2% growth estimate. The BEA's initial estimate of that growth during 2023-Q4 will be released on Thursday, 25 January 2024. The Atlanta Fed's nowcast of the GDP growth rate of the current quarter of 2024-Q1 will begin on Friday, 26 January 2024.

More By This Author:

Teen Employment Enters 2024 On Slow Downtrend

The Price History: Campbell's Tomato Soup

S&P 500 Chases After Bad News Toward New High

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more