S&P 500 Chases After Bad News Toward New High

For a week that had more negative than positive headlines, the S&P 500 (Index: SPX) perhaps surprisingly turned in a pretty good week. The index rose 1.8% to 4,783.83.

That puts the S&P 500 less than 13 points away from breaking its all-time high closing value of 4,796.56, which is set on 3 January 2022.

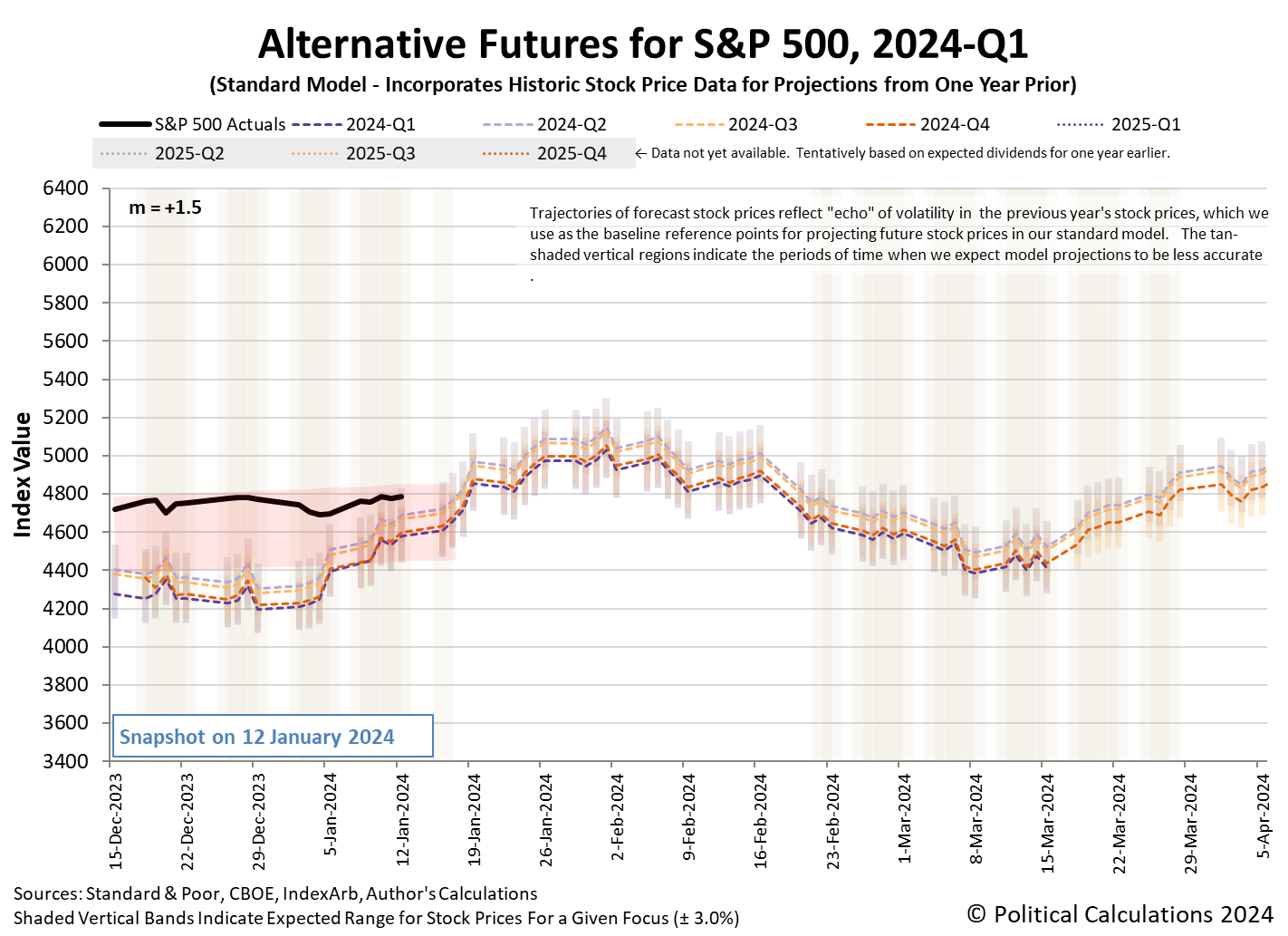

We say "perhaps surprisingly" because, in the current market environment, negative headlines focus investors on the very near term, in which the outlook for dividend growth is positive. The newest update to the dividend futures-based model's alternative futures chart indicates the trajectory of the S&P 500 is consistent with investors focusing their forward-looking attention on 2024-Q1 as we come to the end of the current redzone forecast range.

Why would negative headlines prompt investors to focus on the current quarter? It has everything to do with the expected timing of when the Federal Reserve will be forced to begin cutting interest rates to address a slowing U.S. economy. After the week's headlines, the CME Group's FedWatch Tool projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 20 March 2023 (2024-Q1), when investors anticipate it will launch a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024 are anticipated.

In the current market environment, that leads to rising stock prices. At least until fading economic conditions might reduce the expectations for dividend growth in future quarters and investors shift their attention accordingly. When that happens, bad news will become bad news for the trajectory of stock prices.

Speaking of which, here are the past week's market-moving headlines:

Monday, 8 January 2024

- Signs and portents for the U.S. economy:

- Fed minion says rate hikes are done:

- Nasdaq adds +2%, S&P, Dow also gain as tech stocks offset a slide in Boeing

Tuesday, 9 January 2024

- Signs and portents for the U.S. economy:

- BOJ minions get reason to keep never-endng stimulus alive as inflation continues biting:

- Bigger trouble developing in the Eurozone:

- ECB minions thinking about cutting rates sooner:

- Dow, S&P 500 retreat as yields edge up ahead of data, earnings

Wednesday, 10 January 2024

- Signs and portents for the U.S. economy:

- Fed minions say they're not sure they're not done fighting inflation:

- Questions raised and some positive signs developing in China:

- Bigger trouble developing in the Eurozone:

- Stocks climb as megacaps lead; inflation data, earnings on deck

Thursday, 11 January 2024

- Signs and portents for the U.S. economy:

- Fed minions say higher-than-expected inflation report no biggie for them:

- BOJ minions solve inflation:

- ECB minions dangle interest rate cuts if inflation falls lower:

- Nasdaq, S&P, Dow end little changed after inflation data sparks volatile trading session

Friday, 12 January 2024

- Signs and portents for the U.S. economy:

- Flagging loan margins, one-off charges drag down profit at major US banks

- Fed minions are losing money:

- Mixed economic signs developing in China:

- ECB minions claim they're not cutting interest rates anytime soon:

- Stocks end little changed as earnings offset inflation data

The Atlanta Fed's GDPNow tool's estimate of real GDP growth for the current quarter of 2023-Q4 declined to +2.2% from the +2.5% it projected last week. The Atlanta Fed's projections for GDP growth in 2023-Q4 will continue through 19 January 2024; it will be replaced by the BEA's initial estimate of that growth in the following week. The Atlanta Fed's nowcast of the GDP growth rate for now current 2024-Q1 will begin on 26 January 2024.

Image credit: Microsoft Bing Image Creator. Prompt: "editorial cartoon of a bull running away from a boy who is selling newspapers, with the boy running behind the bull, both running up a hill". The AI didn't quite get it, but we rather liked this image of the bull running after the boy shouting bad headlines.

More By This Author:

Snapshot Of The S&P 500's Market Cap

Rising CO₂ In Air Points To China Economic Recovery

U.S. Trade With China, World Continues Sinking

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more