S&P 500 Rises As Prospects For More Rate Hikes Recede

The S&P 500 rose 1% during the fourth and final week of July 2023. The index closed out the trading week at 4582.23.

The major market-moving news event of the week was the Federal Reserve's quarter point rate hike, which it announced on Wednesday, 26 July 2023. And though Fed Chair Jay Powell did his best to try to convince anyone listening the Fed was looking to increase the Federal Funds Rate higher at the following press conference, investors weren't buying it.

Instead, after watching the Fed hike the Federal Funds Rate to a target range of 5.25%-5.50%, the CME Group's FedWatch Tool now projects no future rate hikes through April 2024, six weeks longer than what they expected before the Fed's meeting. The FedWatch Tool then anticipates a series of quarter point rate cuts will begin as early as 1 May (2024-Q2) that are expected to continue at six-to-twelve-week intervals through the end of 2024.

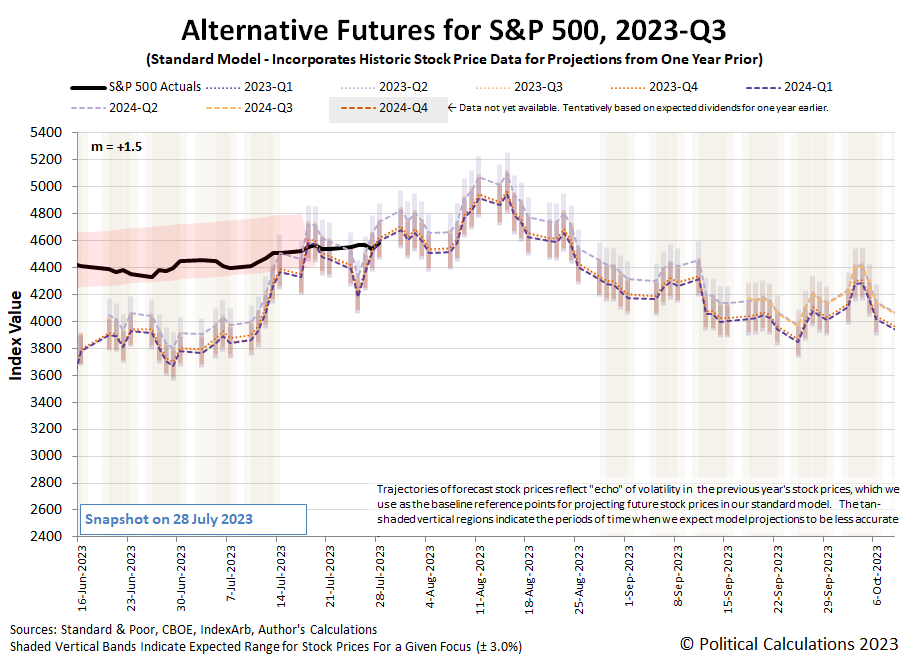

The latest update to the alternative futures chart shows the trajectory of the S&P 500 is consistent with what the dividend futures-based model predicts it would be if investors were focusing their forward looking attention on either 2023-Q4 or 2024-Q1. Although there's very little difference between the alternate future trajectories projected by the model, we'll assume investors are looking ahead to the fourth quarter of 2023 until we have more evidence to indicate otherwise.

(Click on image to enlarge)

We use the Federal Reserve's regularly-paced announcements of how it will set the Federal Funds Rate as calibration events to determine the value of the multiplier (m) for the dividend futures-based model. Since 9 March 2023, we've observed the value of multiplier is approximately 1.5, which continues to hold after the Fed's July 2023 announcement.

Other stuff happened during the week to affect the trajectory of stock prices in the U.S. Here's our summary of those market-moving headlines.

Monday, 24 July 2023

- Signs and portents for the U.S. economy:

- Bigger trouble, stimulus developing in China:

- JapanGov minions want BOJ minions on board for hitting inflation target:

- ECB minions excitement growing over next rate hike despite worsening Eurozone economy:

- Dow leads Wall Street higher as investors eye beyond tech

Tuesday, 25 July 2023

- Signs and portents for the U.S. economy:

- Fed minions hurt there won't be a happy dance:

- Bigger stimulus developing in China:

- ECB minions getting results they wanted:

- Dow notches longest win-streak since Feb. 2017, Nasdaq, S&P close with gains

Wednesday, 26 July 2023

- Signs and portents for the U.S. economy:

- Fed minions do the expected, threaten to hike rates again, claim there will be no recession:

- ECB minions getting new problems to think about:

- Nasdaq, S&P falter; Dow matches record longest win-streak with 13th straight day in green

Thursday, 27 July 2023

- Signs and portents for the U.S. economy:

- Bigger trouble developing in the Eurozone:

- Other central banks go into copycat mode:

- Gulf central banks raise key interest rates by 25 bps, mirroring Fed

- Hong Kong central bank raises interest rate after Fed hike

- Thai central bank to hike rates by 25 bps on Aug. 2, ending tightening cycle - Reuters poll

- ECB raises key rate to historic high, keeps options open

- ECB fans talk of September pause after raising rates to 23-year high

- But the BOJ minions have something different in mind:

- Bigger trouble, stimulus developing in China:

- Wall Street closes down, Dow snaps longest winning streak since 1987

Friday, 28 July 2023

- Signs and portents for the U.S. economy:

- Bigger trouble, stimulus developing in China:

- BOJ minions tweak never-ending stimulus:

- ECB minions starting to have second thoughts about more rate hikes:

- Intel results, soft inflation data boost S&P, Dow; Nasdaq posts best day since late May

The BEA's first estimate of real GDP growth in the second quarter of 2023 came in at 2.4%, in line with the final projection of the Atlanta Fed's GDPNow tool. That tool is now looking at the current quarter of 2023-Q3, where its first estimate of the real GDP growth rate 3.5%.

More By This Author:

Upward Momentum Continues For New Home Sales

Inflation Slows For Campbell's Tomato Soup

Probability of Recession Starting In Next 12 Months Breaches 80%

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more