Upward Momentum Continues For New Home Sales

June 2023 saw continued upward momentum for new home sales in the United States. The initial estimate of the market cap of the U.S. new home market during the month is $29.43 billion, which at first glance, would appear to have dipped by a near-trivial amount from May 2023's initial estimate of $29.44 billion.

But that would not take the downward revisions to the three previous months estimated number of new home sales into account. After those adjustments, June 2023's initial market cap estimate represents a 3.4% increase from April 2023's revised market cap estimate of $28.46 billion.

Meanwhile, the average new home sale price increased by a small margin. June 2023's initial new home sale price estimate of $494,700 is up by 1.5% from the previous month's initial estimate of $487,300 and by 1.2% from May 2023's revised average new home sale price of $487,300.

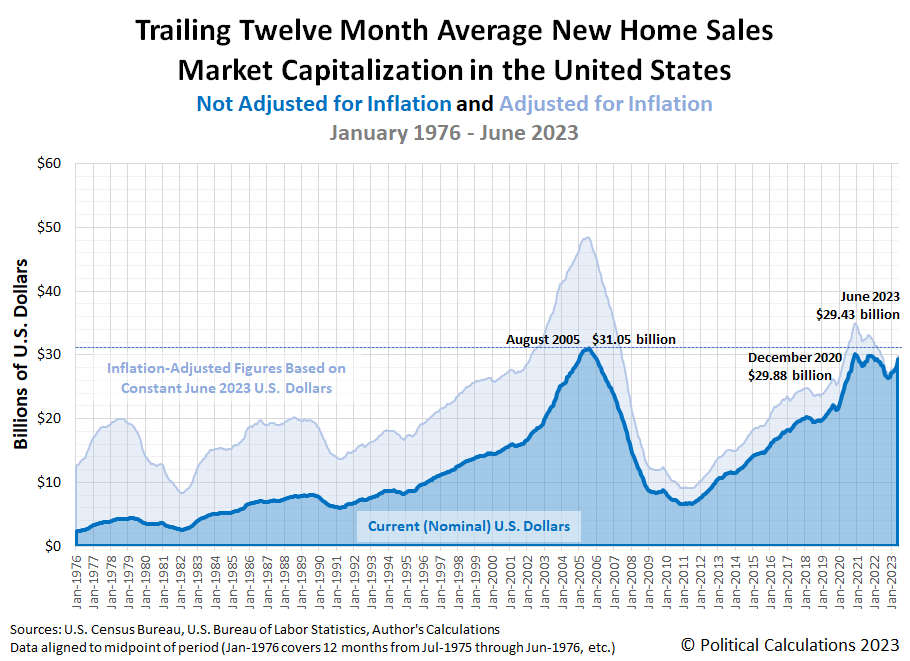

Altogether, we find the rising trend for the market capitalization of the U.S. new home market is continuing. Here is the latest update to our chart illustrating the market capitalization of the U.S. new home market:

The next two charts show the latest changes in the trends for new home sales and prices:

New home sales are rising:

New home prices are trending downward:

Reuters finds the gloom in June 2023's data, but cannot deny what's still an unbroken rising trend for new home sales since November 2022:

Sales of new U.S. single-family homes fell in June after three straight monthly increases, but the trend remained strong as an acute shortage of previously owned homes underpins demand.

Reuters later goes on to echo our analysis from last month:

With the inventory of existing homes near historically low levels and multiple offers on some properties, potential buyers are seeking out new houses, driving up homebuilding. Many homeowners have mortgage loans with rates below 5%, reducing the incentive to put their houses on the market.

The rate on the popular 30-year fixed mortgage is just under 7%, according to data from the Mortgage Bankers Association.

The shortage is also boosting house prices, which had been in retreat or declining earlier this year as higher mortgage rates pushed buyers to the sidelines. According to the National Association of Home Builders, fewer builders were offering incentives, including cutting prices to increase sales.

Rising mortgage rates plus rising new home sale prices is a recipe for rising unaffordability for American consumers. We'll take a closer look at that aspect of the new home market in the near future.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 26 July 2023.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 26 July 2023.

More By This Author:

Inflation Slows For Campbell's Tomato SoupProbability of Recession Starting In Next 12 Months Breaches 80%

The S&P 500 Continues Upward Trajectory As Expected

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more