S&P 500 Regains Poise, But Headline Risk Remains

Image source: Pixabay

Global equities kicked off Thursday on a brighter note, buoyed by optimism that Washington and Beijing may yet avert a renewed trade war. Chinese, Australian and French markets all logged decent gains, setting a constructive tone for the day. For the S&P 500, the combination of diplomatic progress, solid earnings, and a resilient technical backdrop has helped restore confidence, though few traders are willing to let their guard down just yet.

Trade war risks ease

The market’s cheer was sparked by fresh signs that US-China negotiations could yield something other than confrontation. Treasury Secretary Scott Bessent’s openness to extending the tariff truce if Beijing halts its rare-earth export curbs provided a glimmer of hope. Meanwhile, China’s Commerce Ministry offered a carefully worded clarification that its rare-earth measures are “not an export ban”, signalling that cooler heads might prevail ahead of an expected Trump–Xi meeting. The upshot has been a modest risk-on rotation that lifted the S&P 500 futures roughly 2% this week, clawing back most of last Friday’s bruising losses.

Company earnings have been good so far

Adding fuel to the recovery has been a stream of encouraging corporate updates. Taiwan Semiconductor Manufacturing Co. (TSMC) kicked things off with stronger-than-expected guidance, making semiconductors among the biggest stock gainers today ahead of the big US names reporting later this month. Tesla opens the batting on 22 October, followed by the mega-caps in the final week, with Nvidia — typically fashionably late — to come after that.

So far, the results have largely justified the market’s lofty valuations. Bloomberg data show that around 78% of S&P 500 firms reporting through Wednesday have beaten estimates — a rate that even hardened sceptics would concede is impressive. Earnings resilience, combined with hopes of a thaw in trade tensions, has allowed investors to look past a cocktail of political risk in France and trade tensions between US and China.

S&P 500 reclaims broken levels

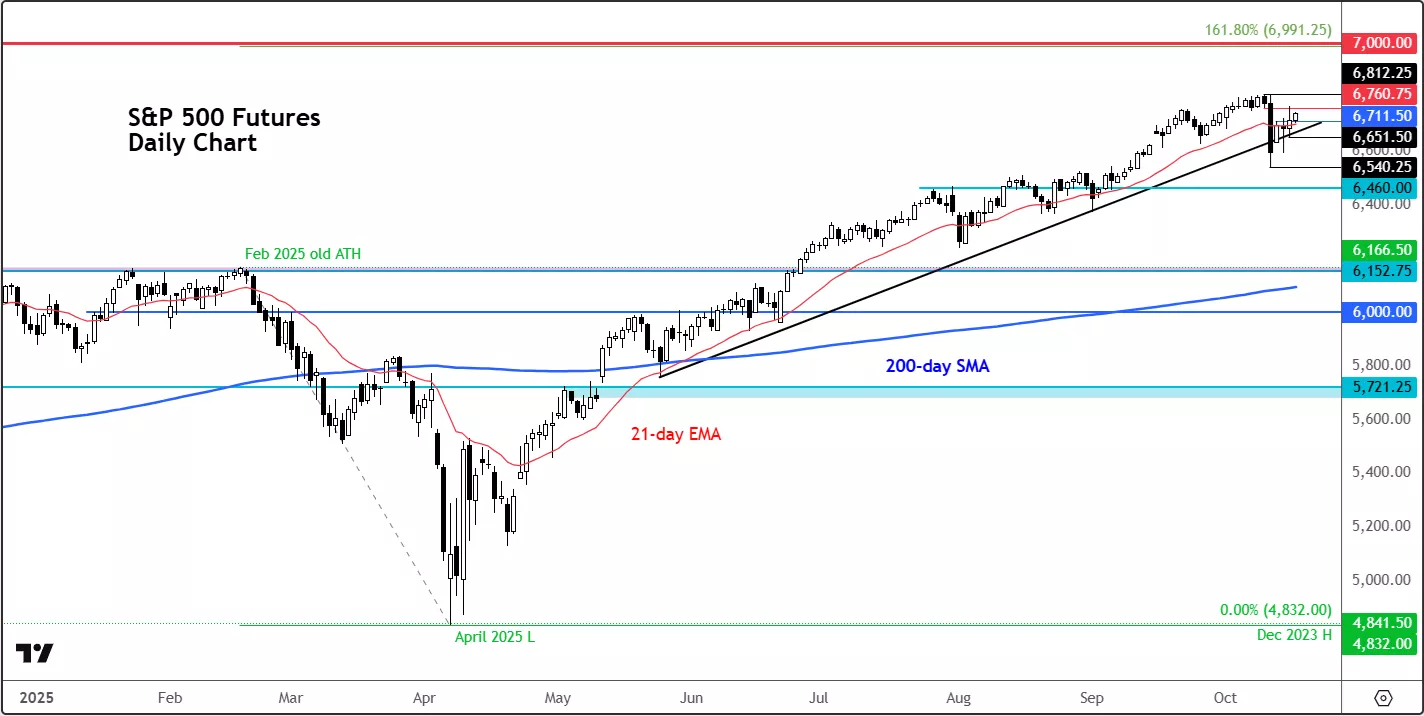

From a technical standpoint, last week’s swift 2.5% sell-off did briefly rattle nerves. The S&P 500 broke below a handful of moving averages and trend lines, tempting short sellers into action. Yet the ensuing rebound has served as a timely reminder of a timeless adage: the trend remains your friend.

Despite bouts of volatility this week, the index continues to carve out higher highs and higher lows — the hallmark of an intact uptrend. A genuine reversal would require a decisive break of key support levels and the formation of a clear topping pattern, neither of which has materialised so far. Those who faded the rally too aggressively have learnt that lesson the hard way; short trades that looked smart on Friday quickly turned stale by mid-week.

That said, trading against the prevailing trend can still yield short-term rewards, provided one is nimble. Unrealised profits evaporate quickly when momentum turns back in the direction of the primary trend. Discipline remains the winning trait in such an environment.

Key levels to watch

Immediate support sits around 6710–6711 on the S&P 500 futures chart, aligning with recent highs and daily closes this week. A break below 6651 would open the door towards 6600, then the 6540 area —Friday’s low, where stop orders are likely congregating. Below that, the 6500 psychological mark looms large before the round numbers at 6400 and 6300 come into play.

On the topside, resistance converges near 6760 — the underside of a broken trend line and last Thursday’s low. A clean break above there would bring the all-time high at 6812 back into focus, followed by the symbolic 6900 and the big 7000 figure beyond.

At the time of writing, futures are holding above the 21-day exponential moving average, suggesting the path of least resistance is still higher. But complacency would be a mistake. As recent price action has shown, a single post or off-hand remark can undo days of orderly market behaviour.

More By This Author:

S&P 500 Remains On The Front Foot

GBP/USD Hit By Soft UK Data Ahead Of US CPI And FOMC Next Week

USD/JPY In Focus As Powell’s Dovish Tone Adds To US-China Tensions