S&P 500, Nasdaq 100 Subdued On Sizzling Inflation Data, JPMorgan's Earnings Eyed

After a wild session and a sharp drop at the cash open following disappointing economic data, U.S. stocks managed to claw back most losses but were unable to finish the day in positive territory amid reduced appetite for taking on more risk in the face of elevated uncertainty. In this context, the S&P 500 declined 0.45% to 3,801, sliding for the fourth straight day. The Nasdaq 100, for its part, fell 0.14% to 11,728, erasing a drop of as much as 1.8%.

Today's worse-than-expected consumer price data spooked investors, triggering strong volatility on Wall Street. The deteriorating inflation profile may prompt policymakers to maintain a hawkish stance over the medium term or at least until there is strong evidence that the situation is starting to improve meaningfully. For context, June CPI clocked in at 9.1% y-o-y versus 8.8% y-o-y expected, hitting the highest level since November 1981. The core gauge, for its part, came in at 5.9% in annual terms, two tenths of a percent above consensus estimates, a sign that price pressures are broadening beyond volatile categories.

With the inflation trajectory not moving in the right direction, the U.S. central bank may deliver a larger-than-anticipated interest rate increase this month. This means that a 75 basis points hike is likely be the floor rather than the ceiling at the next FOMC meeting. In fact, investors are starting to discount a more front-loaded response, with swaps assigning a 79% probability to a 100 bp move. Aggressive monetary policy should create a hostile environment for stocks.

Looking ahead, the official start of the second quarter earnings season on Thursday should command heightened attention. On that note, JPMorgan Chase & Co, the largest U.S. financial firm, and Morgan Stanley are slated to unveil financial results tomorrow. For JPM, Wall Street analysts project earnings per share of $2.85 on revenue of $31.98 billion. Meanwhile, MS is seen reporting $279.73 billion in revenue, with a $1.55 EPS.

Commercial and investment banks, as lenders and deal-making institutions in the capital markets, have a front-row view of the economy, so traders should closely follow their results and pay particular notice to their guidance, along with their assessment of the outlook.

With the economy rapidly downshifting and skyrocketing inflation compressing margins, quarterly performance and forward-looking commentary may underwhelm expectations, paving the way for Wall Street to begin cutting forward estimates across the board. Negative earnings revisions, coupled with tightening financial conditions, may spark the next leg down in equities.

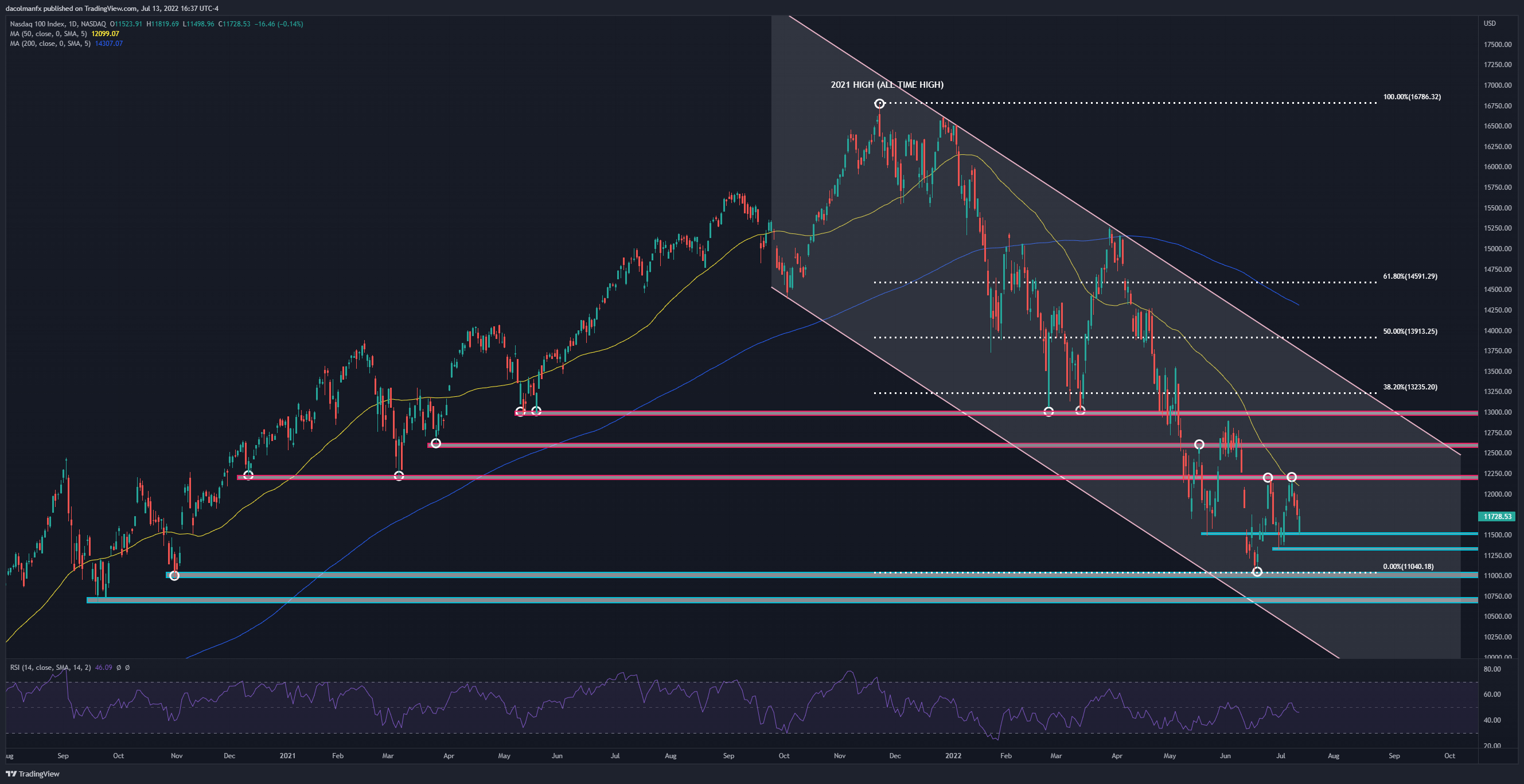

NASDAQ 100 TECHNICAL ANALYSIS

The Nasdaq 100 sold off at the cash open following the release of the June U.S. inflation report, which sparked a brief jump in Treasury yields. However, the tech index rebounded off technical support near 11,500 and finished the day largely flat. Looking ahead, if buyers manage to push prices higher, initial resistance comes in at 12,175/12,225, followed by 12,600. On further strength, the focus shifts to the psychological 13,000 level. On the flip side, if sellers return and drive the index lower, the first floor in play appears at 11,500. If this area is breached to the downside, bears could launch an attack on 11,325, followed by a possible retest of the 2022 lows.

NASDAQ 100 CHART

(Click on image to enlarge)

Nasdaq 100 Chart Prepared Using TradingView

More By This Author:

US Inflation Hits 9.1% On Soaring Gas Prices, Sky-High CPI To Embolden Fed Hawks

US Dollar Price Action: How Will Markets React To US CPI?

Swiss Franc Faces Contrasting Fates Against US Dollar And Euro. Where To For CHF?

Disclosure: See the full disclosure for DailyFX here.