S&P 500, Nasdaq 100 Soar Ahead Of Netflix Earnings. What Should Traders Expect?

After a brutal sell-off last Friday, U.S. stocks staged a remarkable rebound at the start of the new week, as solid earnings from several key financial institutions helped offset extreme pessimism about the challenging economic landscape. At the same time, news that the UK government will reverse deficit-financed fiscal stimulus that would have created a huge hole in the budget and sent markets into turmoil also appeared to reinforce risk appetite.

When it was all said and done, the S&P 500 surged 2.65% to 3,678, with consumer discretionary leading gains on Wall Street, followed by the real state and communications sectors. Meanwhile, the Nasdaq 100 soared 3.46% to 11,062, bolstered by a strong rally in shares of Microsoft, Alphabet, Amazon, Tesla, and Meta Platforms.

Looking ahead, stocks maintain a bearish bias amid growing recession headwinds and tightening financial conditions, despite Monday’s face-ripping advance, but thin liquidity and light positioning are likely to continue to amplify volatility in the equity space. In the current environment, any market-related headlines could spark outsize directional moves that would seem erratic in normal times.

Turning to near-term catalysts, the economic calendar lacks major data releases on Tuesday, but there is one event that the retail crowd should keep an eye on: Netflix’s earnings announcement after the closing bell.

Although Netflix (NFLX) is no longer among the 10 largest U.S. companies by market capitalization, it still has a large weighting in both the S&P 500 and the Nasdaq 100, suggesting that its trading performance may influence both indices, but perhaps more importantly set the tone for technology firms.

In terms of expectations, analysts forecast third-quarter EPS of $2.11 on revenue of $7.84 billion and a net addition of 1 million users, but more attention should be paid to guidance; after all investors are forward-looking. That said, traders should focus on the subscriber outlook, as well as commentary on the Paid sharing initiative and the launch of the lower-priced service tier with ads.

The embrace of advertisement could a boon for Netflix’s revenues, offsetting slower user growth in the increasingly competitive streaming business, so any bullish projections by management could boost sentiment, sparking a strong rally in NFLX’s shares.

Source: EarningsWhispter

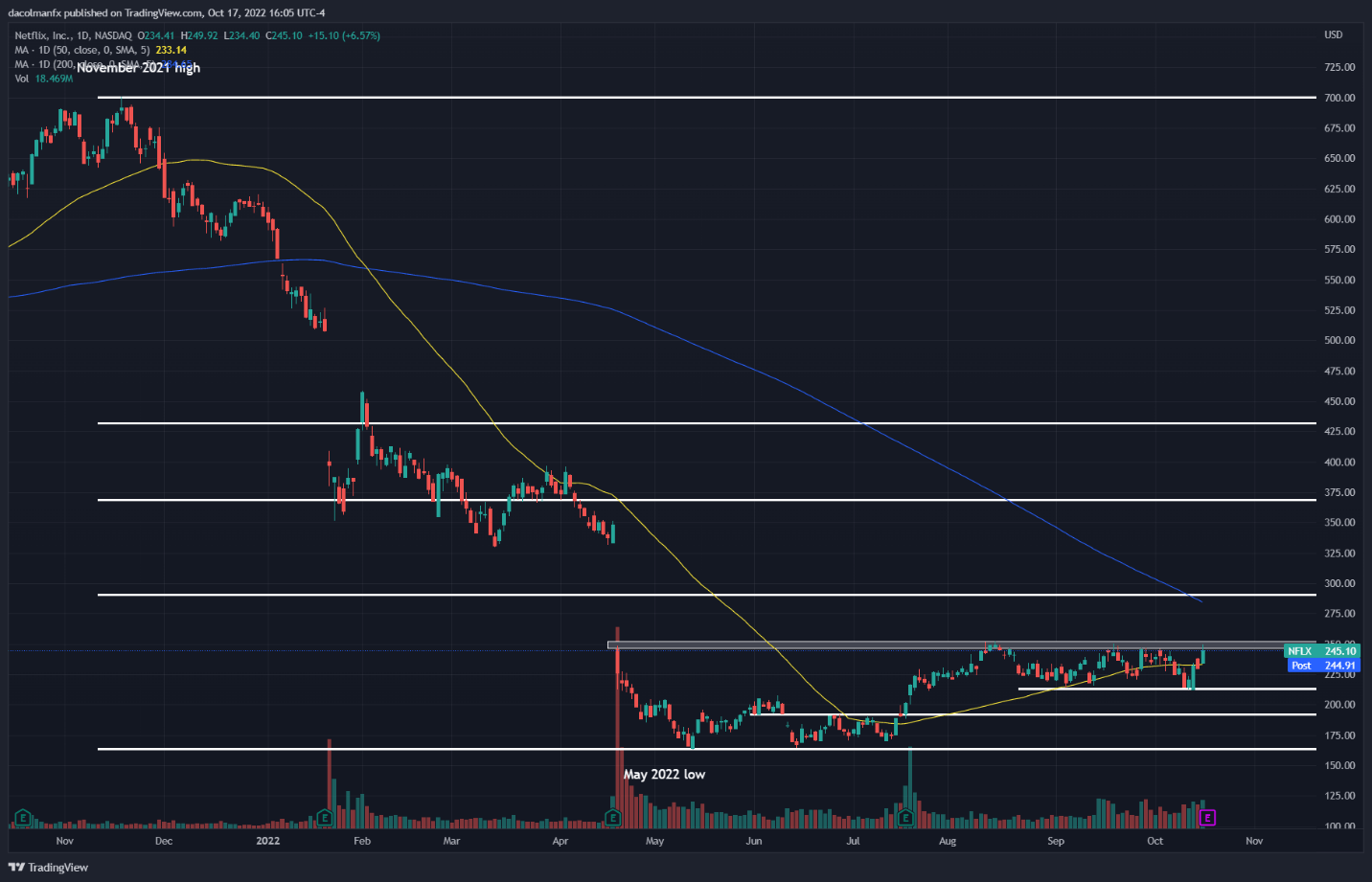

Focusing on Netflix’s key technical levels on the daily chart, initial resistance appears around the $250.00 psychological mark. If bulls manage to push prices above this barrier successfully, the focus shifts to $290, the 23.2% Fibonacci retracement of the November 2021/May 2022 sell-off. On the other hand, if earnings spark a bearish reaction, the first key support to consider rests near $215.00. If this floor is breached, we could see a move towards $190.00.

NETFLIX (NFLX) TECHNICAL CHART

(Click on image to enlarge)

Netflix Chart Prepared Using TradingView

More By This Author:

British Pound Outlook: GBP/USD Soars As Truss Hastens Efforts To Regain Credibility

Dax 40 Outlook: USD Weakness, Lower Yields Drive Stocks Higher

USD/JPY Soars After G7 Nations Sidestep Coordinated FX Intervention

Disclosure: See the full disclosure for DailyFX here.