S&P 500 Extends Losses As Yields Charge Higher Ahead Of Key Fed Decision. Now What?

U.S. stocks erased morning gains and closed moderately lower on Tuesday, extending losses from the previous session, weighed down by a rise in U.S. Treasury rates, with the 2-year yield charging towards its cycle highs following stronger-than-expected U.S. economic data.

First, the JOLTS survey showed that job openings surged in September, rising to 10.72 million, well ahead of estimates calling for a total of 9.85 million. This sturdy outturn indicates that there are 1.9 vacancies for every available worker, a sign that the labor market remains extremely tight despite the Federal Reserve’s best efforts to weaken hiring momentum. Second, manufacturing activity slowed less than expected in October, clocking in at 50.2 compared to a forecast of 50.00, pointing to resiliency in the goods-producing sector.

When it was all said and done, the S&P declined 0.41% to 3,856, with telecommunications and consumer discretionary leading the retrenchment. Meanwhile, the Nasdaq 100 plunged 1.02% to 11,289, undermined by a sell-off in Amazon (AMZN) and Alphabet shares (GOOG).

From a broader perspective, the constructive macro data released this morning suggest that demand has not yet cooled significantly to curb inflationary pressures, indicating that the Fed may have the margin to step on the brakes a little harder and for a little longer to restore price stability.

Traders will get a chance to assess the FOMC’s hiking outlook on Wednesday when the institution announces its November decision. Policymakers are seen raising borrowing costs by 75 basis points to 3.75-4.0%, the most restrictive range since early 2008. This move is fully discounted, so the focus will be on guidance, bearing in mind that this meeting does not include macroeconomic projections.

Judging by recent commentary, it is possible that the bank could fine-tune its message and prepare the market for a shift into a slower pace of tightening. However, this scenario should not be mistaken for a pivot, as a less front-loaded cycle now could just translate to more spread-out hikes in 2023.

In any case, a more cautious and data-dependent approach, which would allow assessing the effects of cumulative tightening on the economy, may be welcomed by Wall Street as an indication that we are past peak Fed hawkishness. This could propel risk assets a little higher. On the other hand, if the Fed maintains an aggressive tone and fails to soften its stance, all bets are off. This scenario could trigger the next leg lower for stocks.

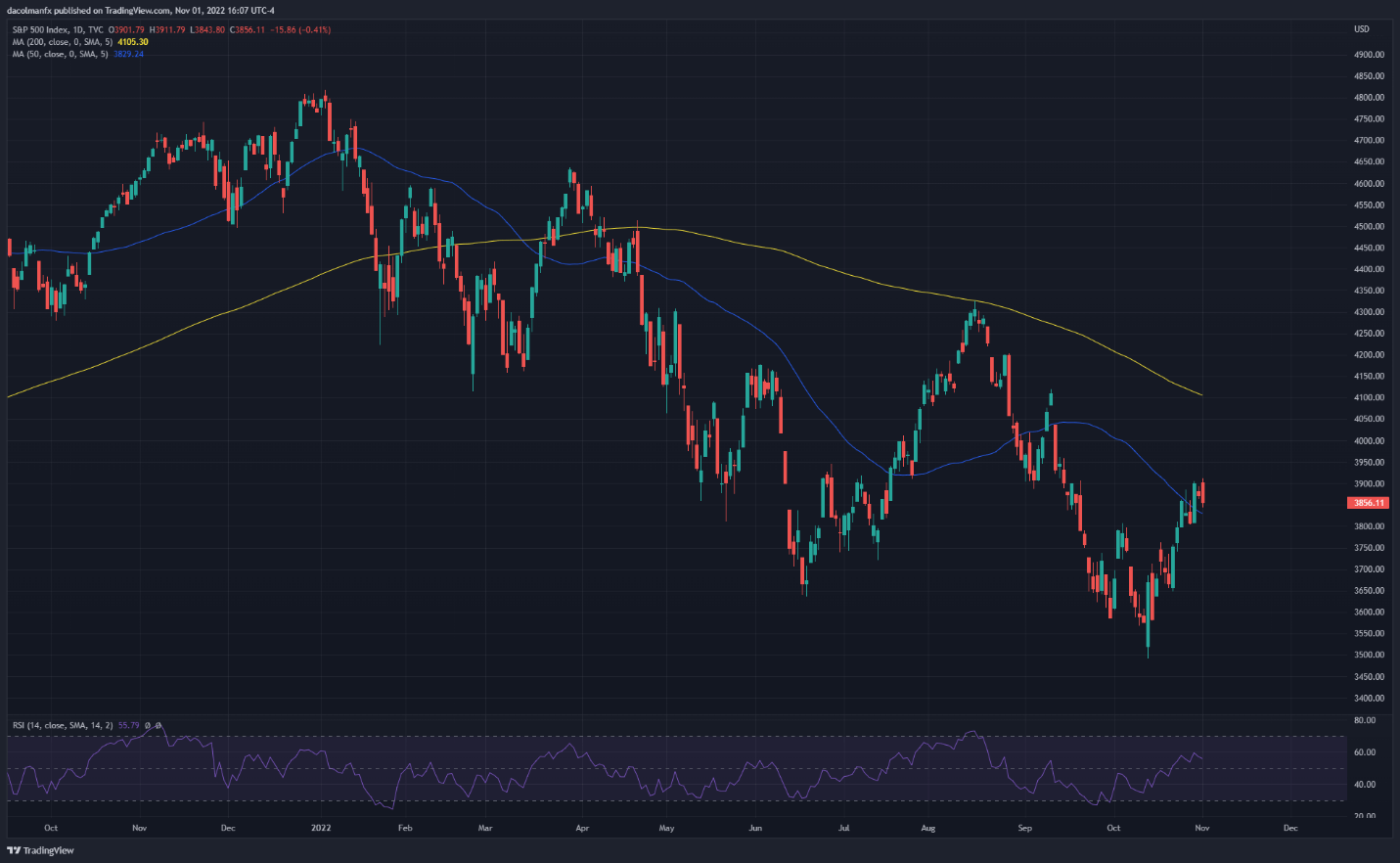

S&P 500 DAILY CHART

(Click on image to enlarge)

S&P 500 Chart Prepared Using TradingView

More By This Author:

US Economy Grows By 2.6% In Third Quarter, But GDP Data May Overstate Strength

S&P 500 Stages Big Turnaround Despite Microsoft & Alphabet Carnage, US GDP Eyed

S&P 500 Futures Turn Lower After Microsoft and Alphabet Post Mixed Earnings. Now What?

Disclosure: See the full disclosure for DailyFX here.