US Economy Grows By 2.6% In Third Quarter, But GDP Data May Overstate Strength

Third-quarter GDP Key Points:

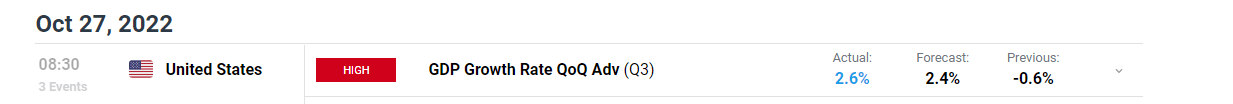

- The U.S. economy returned to growth in the third quarter, expanding at an annualized rate of 2.6% versus the 2.4% expected

- The GDP report points to economic resilience despite rapidly tightening financial conditions, but accounting may be overstating underlying strength

- Today’s data is backward looking so it is not likely to have a major effect on the Fed’s tightening roadmap

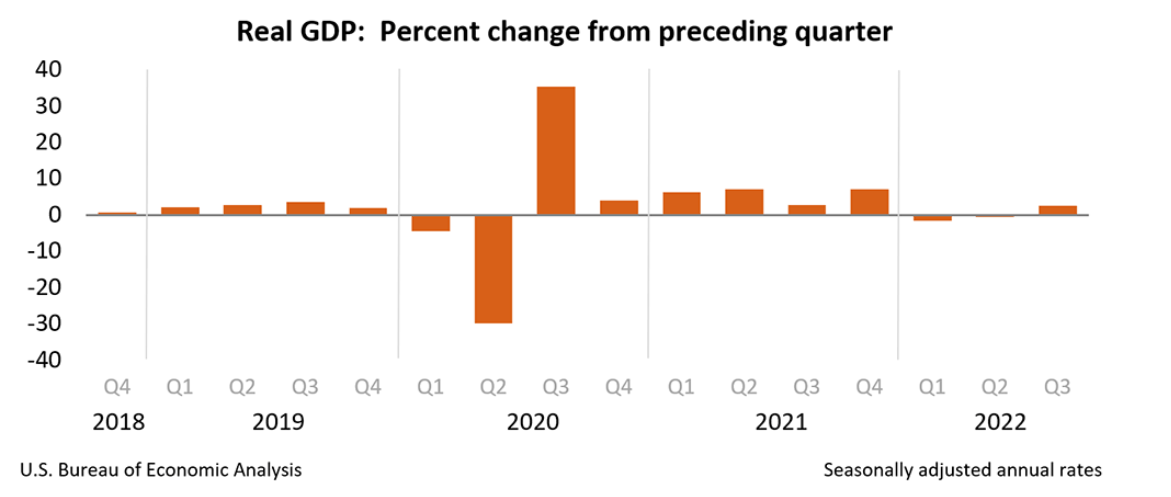

After two consecutive quarters of back-to-back contraction, the U.S. economy rebounded vigorously in the July-September period, driven primarily by the external sector, a sign that activity remains resilient despite rapidly tightening financial conditions.

According to the U.S. Department of Commerce, third-quarter gross domestic product, the broadest measure of goods and services produced by the country, grew at an annualized rate of 2.6%, above expectations for a 2.4% increase, an outturn that is likely to ease recession anxiety, at least for now.

Delving into the report’s details, personal consumption expenditures advanced 1.4% following a 2% gain previously, suggesting that the consumer staying power is waning but not yet breaking, even as high inflation continues to squeeze wallets by eroding purchasing power.

US Data At A Glance

Source: U.S. Bureau of Economic Analysis

For its part, gross private domestic investment fell by 8.5%, with most of the weakness concentrated in the residential subcomponent, which plummeted by 26.4%, yielding to the weight of rising mortgage rates and cooling housing demand in a context of increasingly restrictive monetary policy.

Meanwhile, trade had a positive contribution to growth, adding 2.7 percentage points to the top-line GDP figure, as exports of goods and services outpaced the increase in imports for the period in question.

Source: DailyFX Economic Calendar

All things considered; the strong GDP result may be overstating the momentum. Final sales to domestic purchases, a key measure of internal demand, appear to corroborate this assessment. This metric, which excludes volatile government spending and inventories, only edged up 0.5% after a 0.2% advance in the previous quarter, pointing to underlying weakness in the economy.

Today's data does little to change the FOMC's near-term plans, suggesting that policymakers are likely to deliver another 75 basis-point hikes at their November conclave, in line with current market pricing.

However, the outlook for monetary policy after next month's meeting is less certain, as several Fed officials have begun calling for a slowdown in the pace of interest rate increases for fear that the hawkish tightening cycle could trigger a severe downturn at some point in the future.

More By This Author:

S&P 500 Stages Big Turnaround Despite Microsoft & Alphabet Carnage, US GDP EyedS&P 500 Futures Turn Lower After Microsoft and Alphabet Post Mixed Earnings. Now What?

Disclosure: See the full disclosure for DailyFX here.