S&P 500 Continues To Stall Around 4300 As Jackson Hole Looms

Stocks continue to struggle for direction in Thursday’s session as traders eagerly away next week’s Jackson Hole economic symposium. Economic data continues to remain at the forefront, as this morning’s initial jobless claims came in lower than expected (250k act. vs. 262k exp.). US Treasury yields were lower across the curve, as global growth concerns continue to linger. The recent summer rally appears to be taking a breather as market participants eagerly await the commentary from Fed Chair Jerome Powell and other prominent economists next week. Following the release of FOMC minutes on Wednesday, traders continue to hunt for clues as to the future path of Fed policy following the recent CPI print for July.

This afternoon Jim Bullard of the St. Louis Fed indicated that he would like to see the Fed raise its target range to 3.75%-4% by year-end, while also saying that it remains "too early" for the market to be thinking about Fed rate cuts.

The market of late has been eager to price in the so-called “Fed policy pivot”, with many thinking it will come in 1Q or 2Q 2023. Rate policy remains under scrutiny, with markets gyrating between bets of 50 bps and 75 bps for the September FOMC meeting. In-between now and then, we will get the July PCE and August CPI prints which may offer further clarity as to whether “peak inflation” is truly here.

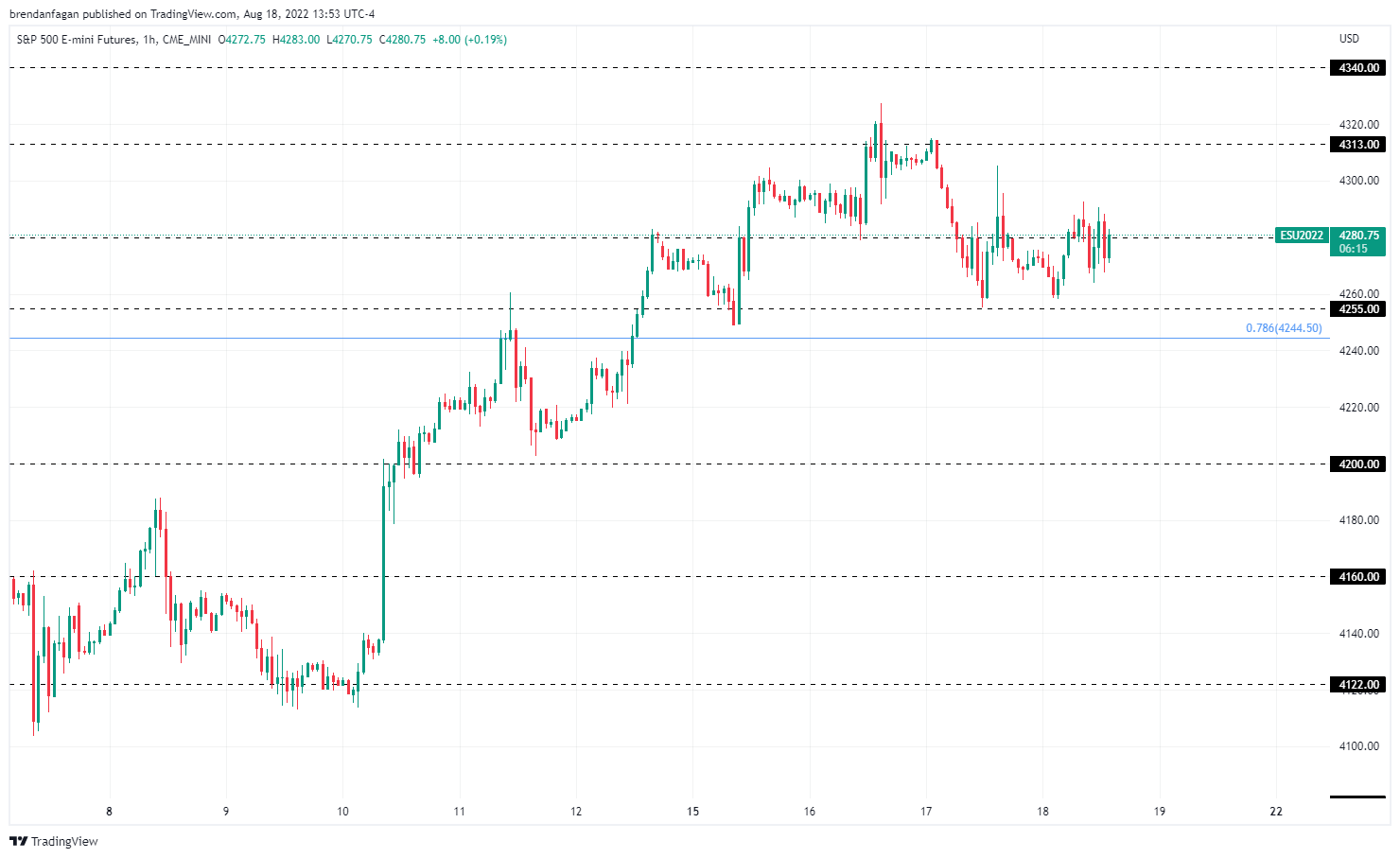

S&P 500 FUTURES (ES) 1 HOUR CHART

(Click on image to enlarge)

Chart created with TradingView

S&P 500 futures (ES) continue to chop around as the market looks for a catalyst. The market has shrugged off economic data and Fedspeak to continue to linger just below 4300. While bulls have not been able to sustain any breaks above 4300, bears have also not been able to chip away below 4260. This ping-pong match may look to break next week as event risk comes to the forefront. If Chair Powell and his contemporaries look to talk down the recent rally in risk assets, ES may look to break Fib support at 4244 and explore price(s) closer to support at 4200. The Fed may get aggressive when it comes to the recent rise in equities as it equates to an easing of financial conditions, which sits contrary to their stated policy goals. Whether or not this holding pattern below 4300 is pure exhaustion remains to be seen. For now, price may continue to coil around 4280 as the market hunts for its next catalyst.

More By This Author:

FTSE 100 Analysis: UK Stocks Remain Rangebound - Key Levels To Watch

USD/JPY Price Forecast: Potential USD/JPY Range, Nikkei Halts Impressive Run

GBP/USD Forecast: Pound Extends Fall As Markets Digest FOMC Minutes

Disclosure: See the full disclosure for DailyFX here.