USD/JPY Price Forecast: Potential USD/JPY Range, Nikkei Halts Impressive Run

USD/JPY Recovers Lost Ground To Reveal Range Trading Possibility

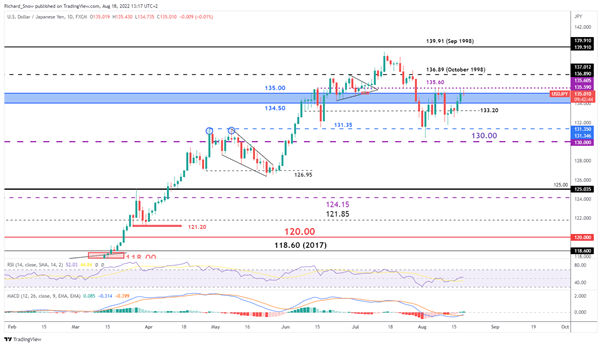

USD/JPY, like most dollar crosses, has witnessed a recovery as markets digest the short-lived notion of a Fed pivot following slightly cooler US CPI data last Wednesday. The softer dollar provided an opportunity for USD/JPY bulls to re-enter the trend at more attractive levels, just above the 131.35 mark.

Price action seems to have already reached a level of reflection (135.60) where yesterday and today’s price action reveals upper wicks on the daily candles – at the time of writing. The upper wicks can be an indication of a rejection of higher prices at 135.60, opening the door to a potential range set up.

USD/JPY appears to be trading largely within the 131.35 – 135.60 range. It may be more constructive to look for retests of support than looking to fade dollar strength due to the longer-term bull trend.

USD/JPY Daily Chart

(Click on image to enlarge)

Source: TradingView, prepared by Richard Snow

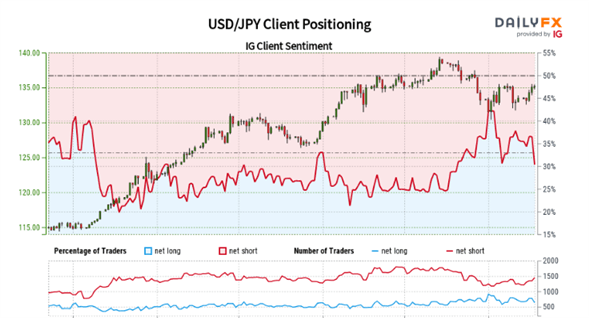

IG Client Sentiment Reveals A Bullish (Contrarian) Outlook

(Click on image to enlarge)

USD/JPY: Retail trader data shows 33.08% of traders are net-long with the ratio of traders short to long at 2.02 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

The number of traders net-long is 11.60% lower than yesterday and 9.68% lower from last week, while the number of traders net-short is 5.83% higher than yesterday and 13.99% higher from last week.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bullish contrarian trading bias.

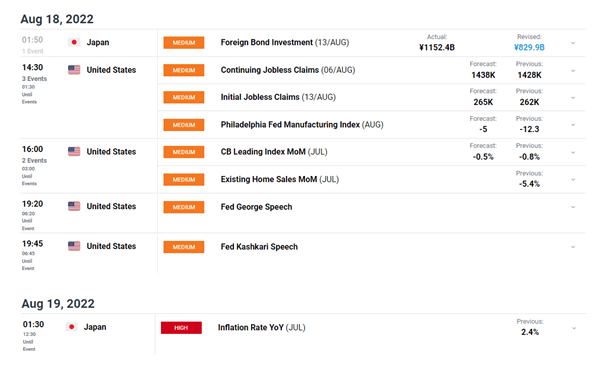

Risk Events Ahead

Today we see US continuing jobless claims data and the Philadelphia Fed manufacturing index figure following the dismal NY Empire State Manufacturing Index print earlier this week (-31.3). Then later, we have Fed speakers George and Kashkari. On Friday we have Japanese inflation data with the previous figure measuring 2.4%.

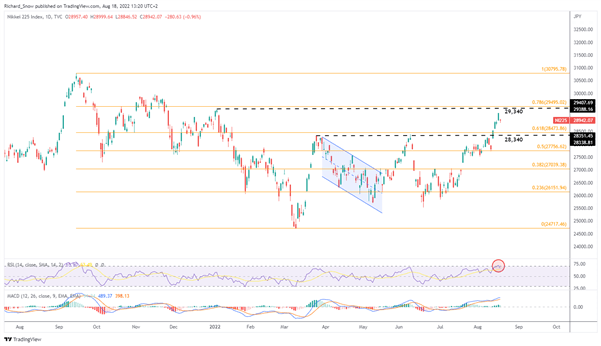

Nikkei Takes A Breather After 4-day Breakout Run

The Nikkei has been on an upward trajectory ever since trading above the 38.2% Fib retracement of the major 2021-2022 move. The bullish momentum was handed a further boost when prices broke above the 28.340 level of resistance - a level that failed to hold in the early days of June but a retest on Friday resulted in a conclusive break above.

Price action appears to have pulled back ahead of a potential test of the 29,340 level and 29,595 (78.6% Fib) and could put an end to the consecutive up days for the index. Support appears at 61.8% Fib followed by 28,340. Resistance remains at 29,340. The RSI briefly entered overbought territory before heading back down, suggesting we may see a period of lower prices or consolidation before another possible advance.

Nikkei Daily Chart

(Click on image to enlarge)

Source: TradingView, prepared by Richard Snow

More By This Author:

GBP/USD Forecast: Pound Extends Fall As Markets Digest FOMC MinutesS&P 500, Dow Jones And Nasdaq 100 Finished Lower Following FOMC Minutes

British Pound Under Pressure Following Hot Inflation Data – GBPUSD, EURGBP Setups

Disclosure: See the full disclosure for DailyFX here.