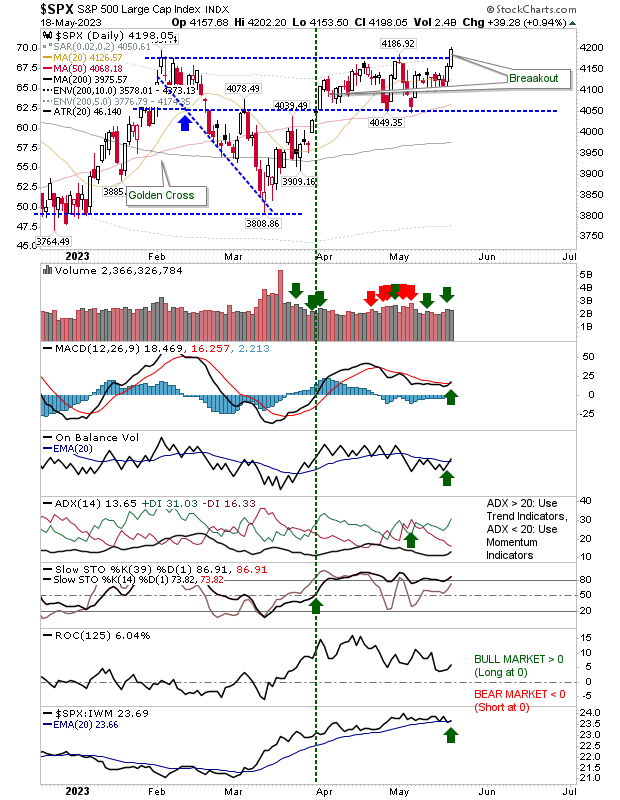

S&P 500 Breakout

If you missed the morning opportunity or were waiting for confirmation, well the S&P delivered with a solid breakout, albeit on modest volume.Today's breakout came with a MACD trigger 'buy' and On-Balance-Volume 'buy' signal, leaving technicals net bullish.

The Nasdaq added to its breakout with another decent white candlestick on a 1.5% gain.This added to the technical strength of the index.The only disappointment was the generally light volume with today's buying.

The Russell 2000 (IWM) built on yesterday's breach of its 50-day MA.There is still lots of work to do before the index clears $180 and begins a right-hand base.Technicals are net bullish although the index is still underpeforming relative to the Nasdaq and S&P.

The coming days will be about consolidation when sellers return.We have a solid breakout in the S&P, a consolidated breakout in the Nasdaq, and a bullish cross of the 50-day MA for the Russell 2000.All of these point to a positive few weeks (and months) ahead.Getting back to 2021 highs seems reasonable from here.

More By This Author:

Starting To See Separation And Some Follow Through For Nasdaq And Russell 2000

Another Small Step For Man...

Nasdaq Breakout Holds Into The Weekend, But Follow Through Needed.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more