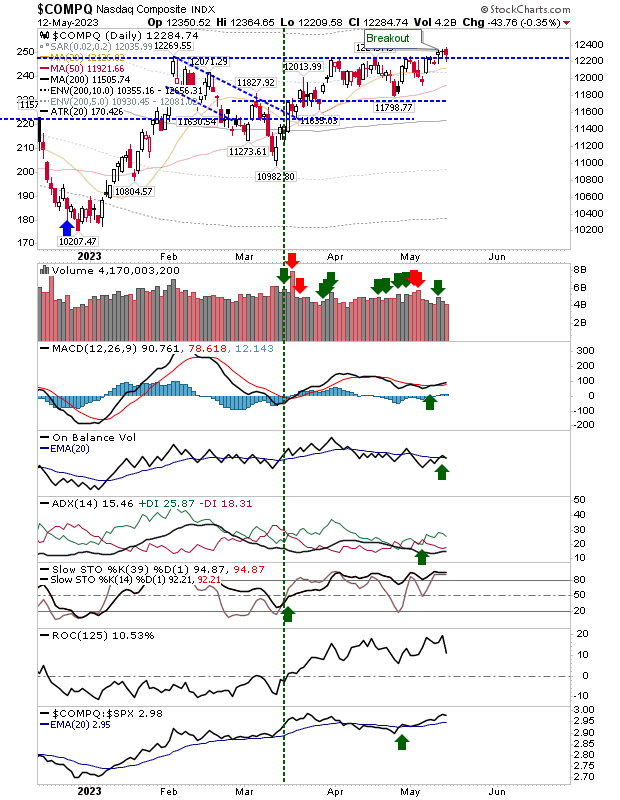

Nasdaq Breakout Holds Into The Weekend, But Follow Through Needed.

The Nasdaq went into the weekend with a breakout, and despite Friday losses it managed to cling on to breakout support. There was good buying volume on the breakout, and Friday's selling volume was well down on previous buying - confirming the move. The let down was the lack of price follow through. Technicals are in good shape, particularly stochastics amd relative index performance. The only disappointment was the relatively lacklustre MACD, which has flatlined a little.

(Click on image to enlarge)

The S&P remains range bound and below breakout resistance. It's enjoying a period of anonymous action that likely wouldn't peak the interest of traders, nor AI trading systems. In the long run, this should be viewed as bullish as there is no double top and only a lack of interest from buyers has prevented this from pushing higher.

(Click on image to enlarge)

On the flip side, the Russell 2000 ($IWM) is on the other side of the trading range interest, unlike the S&P, this is knocking on the door of a breakdown than a breakout. Since the "Death Cross" in late April, the 50-day MA has become resistance and has so far contained any attempt to rally. Friday's selling doesn't help bulls cause.

(Click on image to enlarge)

The Semiconductor Index is also struggling to recover from its breakdown, in addition to a secondary resistance defined by the three week trading range. Technicals are still mixed with a weak MACD trigger 'buy' and bearish ADX and Stochastics. The sharp underpeformance against the Nasdaq 100 is the biggest concern, and it's no closer to reversing this trend.

(Click on image to enlarge)

For next week, we are again looking for something more from bulls; to build on last week's breakout in the Nasdaq and to help drive a similar breakout in the S&P.

More By This Author:

So, This Is The Breakout...Nasdaq Breakout Tomorrow?

Losses With Distribution As Resistance Holds For The S&P And Nasdaq

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more