Software Bear Market

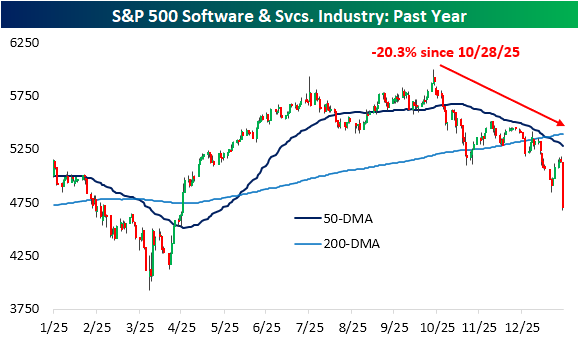

One week ago, we discussed the grim run for software stocks, and flash forward seven days, the picture has only gotten worse. Thursday has been a historically brutal session for the S&P 500's Software & Services industry as it is currently down 8.5% due in no small part to a 12% decline in the industry's (and one of the market's) largest stock: Microsoft (MSFT). Given the steep decline today, the software group is now trading at fresh local lows and has officially surpassed the 20% threshold from the October high to mark a new bear market.

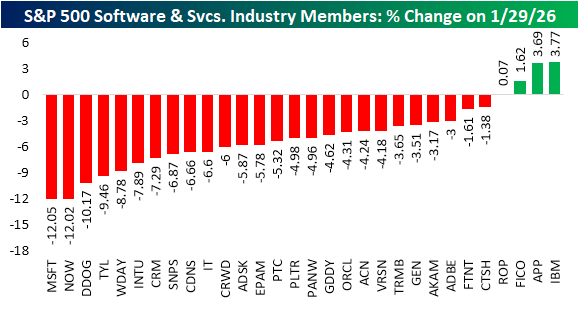

Again, the weakness in MSFT is a key reason for the huge decline given the S&P 500 is a market-cap weighted index. With that said, though, it is far from the only decliner nor should it receive all of the blame. As shown below, breadth is brutal with just four stocks higher on the day. As for the rest, most declines range in the mid to high single digits with Microsoft (MSFT), ServiceNow (NOW), and DataDog (DDOG) all down double-digit percentage points on the day.

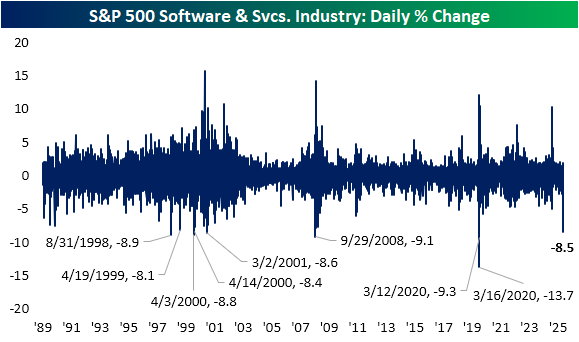

To put today's drop into historical perspective, below we show the daily change in the industry group for each day going back to the start of our data in September 1989. Today is the single worst decline since the midst of the COVID crash when it fell 9.3% on March 12th and 13.7% on March 16th, 2020. The next big declines as large as today date back to the Financial Crisis and the Dot Com years before that.

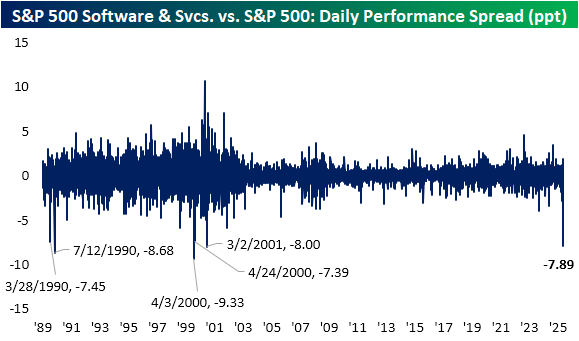

Even more notable is today's decline for software in the context of the broader market. Given Microsoft's (MSFT) huge weight in addition to other heavy hitters such as Oracle (ORCL), Palantir (PLTR), and Salesforce (CRM) to name a few, this industry alone accounts for about a tenth of total S&P 500 weighting. As a result, this group usually moves in the same direction as the rest of the market, especially in the past couple of decades. Today marks a historic disconnect though. The Software & Services industry is underperforming the broader S&P 500 by almost 8 percentage points. There have only been five other days on record with that degree of underperformance. The most recent of those: March 2001.

More By This Author:

3rd To Last Powell Fed DayHome Prices Vs. Stocks Long Term

Country ETFs Hot Hot Hot

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more