So, This Is The Breakout...

Hardly inspiring, but a price breakout it was. The Nasdaq edged itself above resistance, but it will need to do more to confirm. There was a MACD trigger 'buy' to go with generally improved technicals - although On-Balance-Volume remains bearish. Today's candlestick was not exactly blowing it out of the water, but it did qualify as a breakout

Where things get a little sketchy is when we dig into some of the other indices. The S&P didn't get to challenge resistance but did finish with a dragonfly doji, typically, this is important during a swing low, but it has less relevance when it appears as part of a trading range.

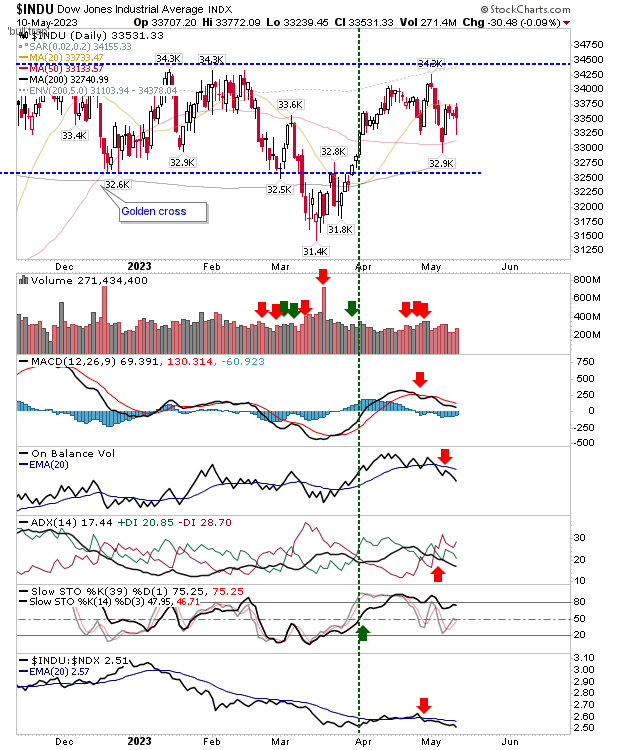

The Dow Jones wasn't so lucky, although it was looking a lot worse off earlier in the day. The 50-day MA looks key for support.

The Russell 2000 (IWM) finished with a bearish 'black' candlestick just below the 50-day MA resistance. However, because this index is stuck in a trading range the significance of this potentially bearish candlestick is reduced. On the plus side, there was a MACD trigger 'buy'.

We need to be careful here. There was a breakout, but it remains vulnerable to a 'bull trap'.It will only take a close below resistance to confirm (for the Nasdaq). But, a decent gain tomorrow (in the Nasdaq) would firm up the move and help drive demand for the S&P and Russell 2000.

More By This Author:

Nasdaq Breakout Tomorrow?

Losses With Distribution As Resistance Holds For The S&P And Nasdaq

Narrow Action For Markets Does Everthing But Breakout

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more