Losses With Distribution As Resistance Holds For The S&P And Nasdaq

It wasn't a great day for indices, particularly as volume ranked as confirmed distribution for the S&P and Nasdaq, with daily volume traded higher than any prior buying day. Neither market is down at key support, and as long as this remains the case this still looks like a prelude to a breakout; it would take a loss of 50-day MAs in both indices to reverse my optimism.

The Nasdaq is dealing with 'sell' triggers in the MACD and OBV, but the index continues to outperform the S&P.

The S&P triggered 'sells' in the MACD, On-Balance-Volume and ADX to go with the increased selling volume.While we await to see if a fresh support test is in the making, it's likely we will see such a test first in the S&P before the Nasdaq.

The Russell 2000 (IWM) remains more problematic. We have a second day where we have had 'gravestone' doji with a large upper spikes - such spikes representing excessive supply that will be hard to shift.My optimism for the S&P and Nasdaq does not extend to the Russell 2000.Momentum (stochastics) is firmly bearish, along with significant underperformance to the Nasdaq and S&P.

If you look at the weekly chart of the Russell 2000 (IWM), you can see how the index is struggling below the 200-week MA, with the 50-week MA about to bearish cross the slower moving average.

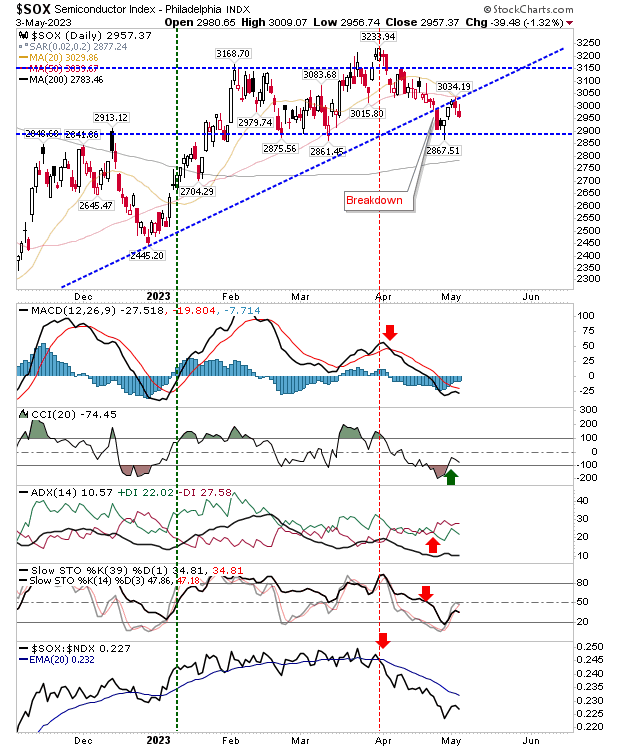

The other struggle is in the Semiconductor Index. It has lost rising trend support on bearish technicals (bar the CCI). This is not good news for the Nasdaq, although it hasn't yet influenced this index.The sharp relative underpeformance against the Nasdaq 100 isn't helping.

While today's (and yesterday's) action favors bears, one days worth of buying may be enough to reverse it.I'm still looking for breakouts in the Nasdaq and S&P ahead of further losses, but will the market deliver?

More By This Author:

Narrow Action For Markets Does Everthing But Breakout

Nasdaq And S&P Launch Another Attack At Resistance As Russell 2000 Struggles.

"Death Cross" In Russell 2000 As Sellers Strike Markets

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more