Nasdaq And S&P Launch Another Attack At Resistance As Russell 2000 Struggles.

Bears were unable to press their advantage when the first challenge of resistance failed. Instead, buyers mounted a fresh charge with the Nasdaq and S&P recording accumulation days. For the last couple of months, when buyers have had control of the Nasdaq, they have done so on bullish accumulation, but when bears have had the edge they haven't been able to control the story.

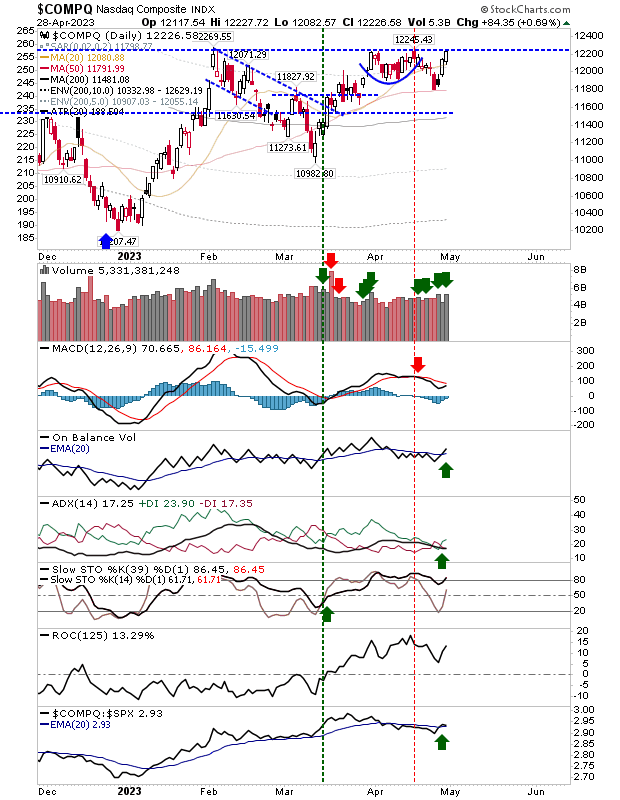

The Nasdaq returned a fresh 'buy' signal in On-Balance-Volume and ADX, and a return in bullish relative performance over the S&P. With the index back at 12,225, we have yet another knock on the door of a breakout. Remember, triple tops are rare, and for bears to have the edge they will need a small miracle to drive this lower. I would be looking for a breakout at minimum, bears may yet win out with a 'bull trap', but we cross that bridge when we come to it.

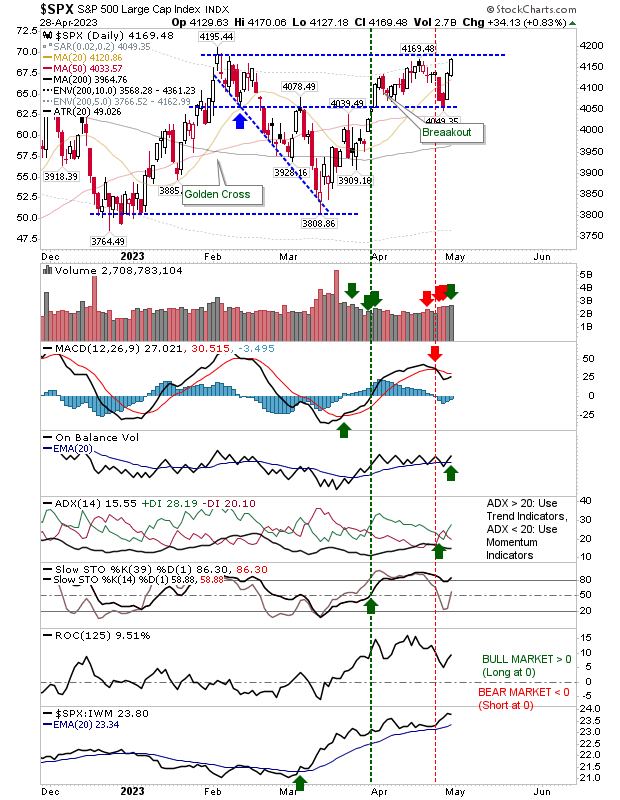

The S&P is also working on a resistant break. The MACD is the only bearish technical metric, and even that is well above its MACD bullish zero line. While the index lost ground against the Nasdaq, it maintains a strong relative performance advantage over the Russell 2000. It hasn't enjoyed the same degree of accumulation as the Nasdaq in recent weeks, but it's still very positive.

The worry is the Russell 2000. Strong bull markets need small cap leadership, and we are not seeing that here. Yes, buyers came in to rescue declines, but this is an index which is trying to build a right-hand-base, yet is stuck in a year long base. Only when the ETF get past $195 can we even consider that a right-hand-base is in the making. Its struggles below the 200-day MA don't help, and then only On-Balance-Volume is bullish, but really, it's in whipsaw.

This week, we will be looking (for a second time) for resistance breakouts in the Nasdaq and S&P. Whether markets will be able to build on such breakouts is a separate question, so let's get there first.

More By This Author:

"Death Cross" In Russell 2000 As Sellers Strike Markets

For Today, Read Yesterday - No Change In State Of Play

Neutral Finish To Week - Indices Ready To Rally.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more