Should Investors Buy Lowe's Or Home Depot Stock This Earnings Season - Both? Neither?

Image: Bigstock

Investors may be wondering if it’s time to buy the recent dip in Home Depot (HD - Free Report) or Lowe’s (LOW - Free Report) stock as we progress through this earnings season. Let’s see if Home Depot’s recent skid after first-quarter results was a buying opportunity, as well as what might be in store for Lowe’s as its Q1 report approaches next week.

Home Depot Q1 Review

Investors are on edge for Lowe’s Q1 results after Home Depot posted its first quarterly sales decline in 14 years on Tuesday.

Home Depot was still able to slightly top earnings expectations with Q1 EPS at $3.82 compared to estimates of $3.80 per share. This was despite sales missing first-quarter expectations by -3% at $37.25 billion. Year-over-year earnings declined -6%, with sales down -4% from the prior year quarter.

Image Source: Zacks Investment Research

The sales decline came as a surprise to most, as high mortgage rates were thought to increase spending on home improvement projects in correlation with many consumers holding off on new home purchases. However, Home Depot indicated that its customers seemed to put off big-ticketed items associated with home improvement projects during the quarter.

Lowe’s Q1 Preview

Looking toward Lowe’s first-quarter results next Tuesday on May 23, earnings are expected at $3.49 per share. This would be a small dip, but mostly on par with EPS of $3.51 in the prior-year quarter. Sales are forecasted to be down -8% to $21.65 billion.

Lowe’s has a nice track record of beating earnings expectations, and it has surpassed quarterly EPS estimates for 15 consecutive quarters. Wall Street will be monitoring Lowe’s Pro segment, which is geared toward professional remodeling and repair customers and has expanded the company’s growth in recent years.

Image Source: Zacks Investment Research

Performance & Valuation

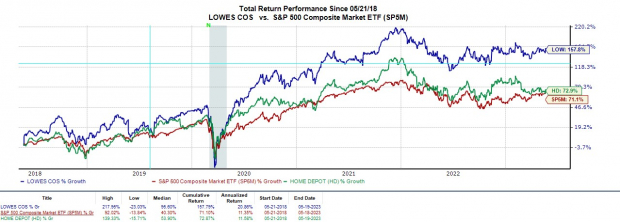

Home Depot stock is now down -8% year-to-date, which is largely attributed to concerns over its first quarterly sales decline in more than a decade. This has trailed Lowe’s +3% year-to-date performance and the S&P 500's +10%.

Still, Home Depot's total return, including dividends, is +73% over the last five years to slightly top the benchmark, with Lowe’s +158% total return performance standing out during this period.

Image Source: Zacks Investment Research

Home Depot may certainly be a buy-the-dip candidate for many investors, and it trades attractively relative to its past from a price-to-earnings perspective. Lowe’s P/E valuation stands out, as well.

In this regard, Home Depot’s 18.7X forward earnings and Lowe’s 15.2X are nicely beneath the S&P 500’s 19.4X. Even better, Home Depot stock trades 32% below its decade high of 27.7X and at a 12% discount to the median of 21.2X. Lowe’s stock is just as intriguing, trading 33% below its own decade-long high of 22.9X and offering a 16% discount to the median of 18.1X.

Image Source: Zacks Investment Research

Growth & Outlook

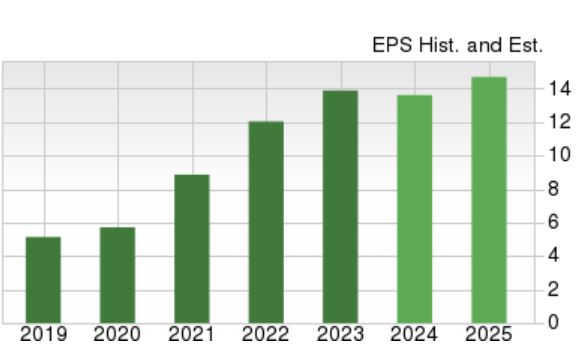

Based on Zacks Estimates, Home Depot’s earnings are expected to decline -9% in its current fiscal 2024 at $15.23 per share, following a stronger year that saw EPS at $16.69 in FY23. With that being said, FY25 earnings are expected to rebound and rise 6% at $16.24 per share. Sales are forecasted to be down roughly -3% in FY24, but rebound and rise 3% in FY25 to $156.75 billion.

Image Source: Zacks Investment Research

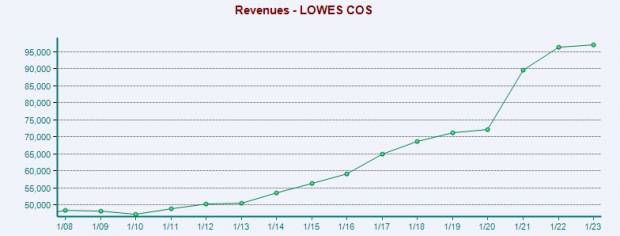

Pivoting to Lowe’s, earnings are expected to slightly dip -1% in its current fiscal 2024, but rebound and jump 9% in FY25 at $14.91 per share. On the top line, sales are projected to drop -9% in FY24 and then stabilize and rise 2% in FY25 to $90.58 billion.

Image Source: Zacks Investment Research

Bottom Line

Lowe’s and Home Depot stock both land a Zacks Rank #3 (Hold) at the moment. These home improvement retail leaders still look like solid investment options despite the post-pandemic boost they received beginning to slow.

Longer-term investors may be rewarded for holding on to Lowe’s and Home Depot stock at their current levels, as they are starting to offer attractive discounts to their past in terms of P/E valuation.

More By This Author:

Dividend Reinvesting & Top-Rated Dividend Aristocrats To Buy Now

Dividend Stocks: The Surprising Truth

This Large-Cap Bank Is Separating Itself From The Herd

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more