Dividend Reinvesting & Top-Rated Dividend Aristocrats To Buy Now

Image: Bigstock

Dividend reinvesting is a useful strategy for investors to compound their returns. As it is the process of using cash dividends to buy more shares of the same company over time, this strategy may be best suited for longer-term investors.

This is mostly because the accumulated shares from dividend proceeds replace the alternative of added liquidity in the portfolio. With that being said, it’s important for most investors to identify stocks that offer reliable dividends and provide strong performances.

Many dividend aristocrats fit the bill and provide steady income to the portfolio. To that note, here is a look at the top-rated Zacks dividend aristocrats at the moment who have raised their dividend for at least 25 consecutive years.

McDonald’s (MCD - Free Report)

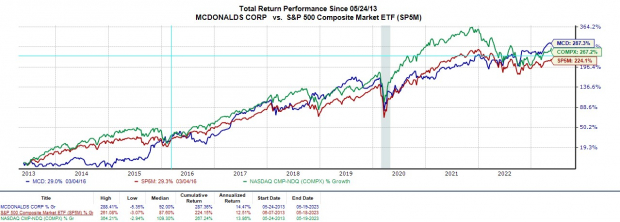

We’ll start with McDonald’s, which has had the strongest performance over the last decade relative to the other dividend aristocrats on the list. The fast food leader currently sports a Zacks Rank #2 (Buy) and its Retail-Restaurants Industry is in the top 16% of over 250 Zacks industries.

McDonald’s solid dividend and total return performance make it a prime candidate to use for a dividend reinvestment strategy.

Image Source: Zacks Investment Research

As shown above, McDonald’s total return in the last 10 years, including dividends, is +287%, which has topped the broader indexes. This has also topped the Retail-Food & Restaurants Markets +194%.

Dividend History

MCD has a 2.07% annual dividend yield at $6.08 a share. The annualized dividend growth over the last five years is 7.34%. McDonald’s currently has a 58% payout ratio, and it has now raised its dividend for 47 consecutive years.

With McDonald’s growth and outlook looking steady, now may be a good time to add positions. Plus, affordable fast food prices and the company's global reach make McDonald’s a viable investment even during tougher market environments or amid economic uncertainty.

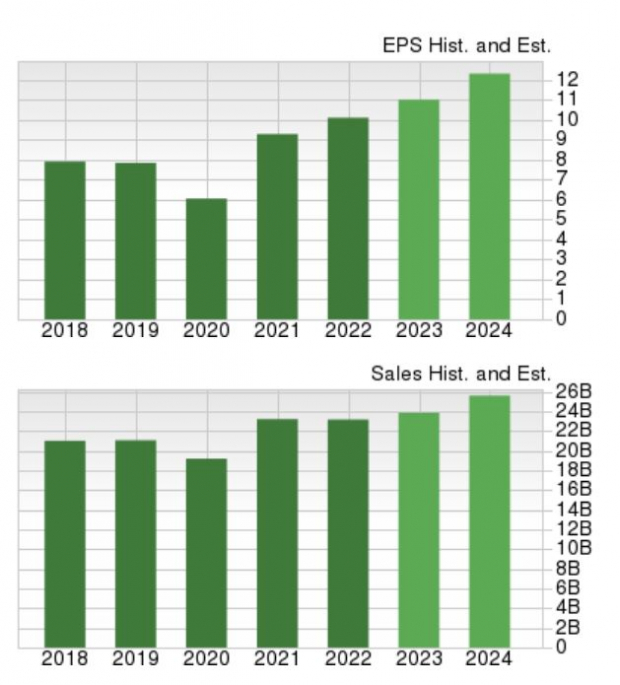

Shares of MCD were most recently seen trading at $295.55, with earnings forecasted to rise 9% this year and jump another 9% in FY24 at $12.08 per share. On the top line, sales are projected to be up 7% in FY23, and rise another 7% in FY24 to $26.71 billion.

Image Source: Zacks Investment Research

Caterpillar (CAT - Free Report)

One of the more intriguing dividend aristocrats at the moment is Caterpillar, which has a Zacks Rank #1 (Strong Buy). Additionally, its Manufacturing-Construction and Mining Industry is in the top 2% of all Zacks industries.

Caterpillar's stock is appealing as a leader in its space and the largest global construction and mining equipment manufacturer. Caterpillar has historically provided investors with lofty returns, with shares of CAT up +228% over the last decade including dividends.

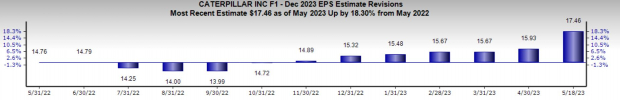

This has outpaced the benchmark’s +224% and topped the Machinery-Construction/Mining Markets’ +216%. What is most intriguing about Caterpillar stock at the moment is its rising earnings estimate revisions.

Image Source: Zacks Investment Research

Fiscal 2023 earnings estimates are sharply up over the last six months, as shown in the chart above. Furthermore, over the last 90 days, FY23 earnings estimates have risen 12%, with FY24 EPS estimates up 8%.

With shares of CAT recently seen trading at $214.78, Caterpillar’s earnings are now expected to soar 26% this year at $17.46 per share compared to EPS of $13.84 in 2022. Fiscal 2024 earnings are projected to rise another 2%.

Dividend History

CAT has a 2.24% annual dividend yield at $4.80 a share. Caterpillar’s dividend growth over the last five years is 8.19% with a payout ratio of 30%. Caterpillar has raised its dividend for 29 consecutive years. Notably, Caterpillar’s dividend yield is well above the industry average of 1.59%, in addition to topping the S&P 500’s 1.51% average.

Image Source: Zacks Investment Research

W.W. Grainger (GWW - Free Report)

Lastly, W.W. Grainger also stands out among dividend aristocrats with a Zacks Rank #2 (Buy). The broad-line business-to-business distributor of maintenance, repair, and operating (MRO) products and services is also benefiting from a strong business environment, with the Industrial Services Industry in Zacks top 37%.

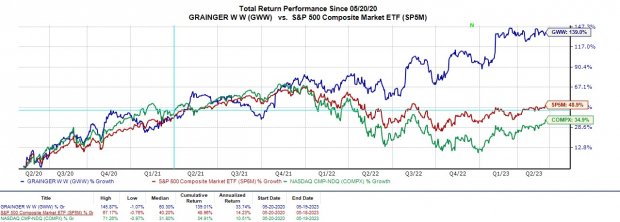

Grainger’s strong performance in recent years makes the stock worthy of consideration for accumulating shares in regard to dividend reinvesting.

Image Source: Zacks Investment Research

In the last three years, shares of GWW are up +139%, including dividends, to largely outperform the S&P 500 and the Nasdaq while crushing the Industrial Services Markets -30%. Over the last decade, Grainger’s total return of +266% has also outperformed the benchmark’s +224% and its Zacks Subindustry’s -36%.

Dividend History

GWW has a 1.10% annualized dividend yield at $7.44 a share. Grainger’s annualized dividend growth over the last five years is 5.87% with a payout ratio of 21%. Grainger has raised its dividend for 51 consecutive years, classifying the company as a dividend king, as well.

As a dominant industry leader, Grainger’s stock has most recently been seen trading at $681.78, with earnings now forecasted to jump 20% this year at $35.53 per share compared to EPS of $29.66 in 2022. Fiscal 2024 earnings are expected to rise another 5%. Plus, earnings estimate revisions are noticeably up over the last 30 days.

Image Source: Zacks Investment Research

Takeaway

The steady and expansive growth of these companies makes a dividend reinvestment strategy very intriguing to investors who buy their stocks. Buying McDonald’s, Caterpillar, and Grainger stock, or accumulating more shares through dividend reinvesting, makes a lot of sense when considering the reliable income they provide as aristocrats as well as their strong total return performances.

More By This Author:

Dividend Stocks: The Surprising TruthThis Large-Cap Bank Is Separating Itself From The Herd

3 Attractive Large-Caps Worth Investors' Attention

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more