Shorts’ Relative Break Out

Alongside the broader equity market, the most heavily shorted names have likewise been rallying off their lows in the past several days (before today). As for how significant of a rally that has been, on a relative basis, the 100 most heavily shorted stocks versus the Russell 3,000 have broken out of the downtrend that has been in place since the height of the meme stock mania in January of last year.

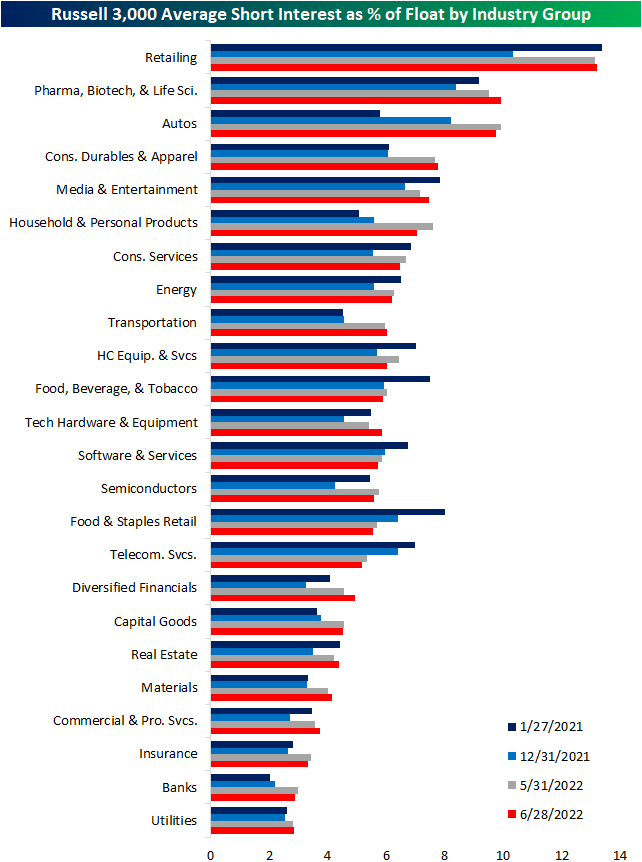

The latest short interest data as of June 15th was released yesterday, and the aggregate level of short interest for the whole of the Russell 3,000 rose from 5.1% of the float as of the end of May to 5.67% in mid-June which is the highest level since last October. Below we show the average reading for the stocks of each industry group at various points in time since the historic short squeezes of January of last year. As shown, last year saw a general unwinding of short interest across industry groups, but the bear market this year has resulted in those readings starting to rise once again.

Some industries like Retail—which is also the industry with the highest average short interest reading—have seen their readings essentially return to Meme Stock Mania peak readings. Others like the Autos or Household and Personal Products industries are much more heavily shorted than they were a year and a half ago. That is not to say all industries have seen short interest rise. Food and Staples Retail, Software and Services, and Telecom Services, to name a few, currently have lower average readings on short interest than last year, at the end of last year, and the last report. In other words, while the aggregate level of short interest has been headed higher, there is some nuance as to which areas of the market have seen build-ups in short interest over the past year and a half.

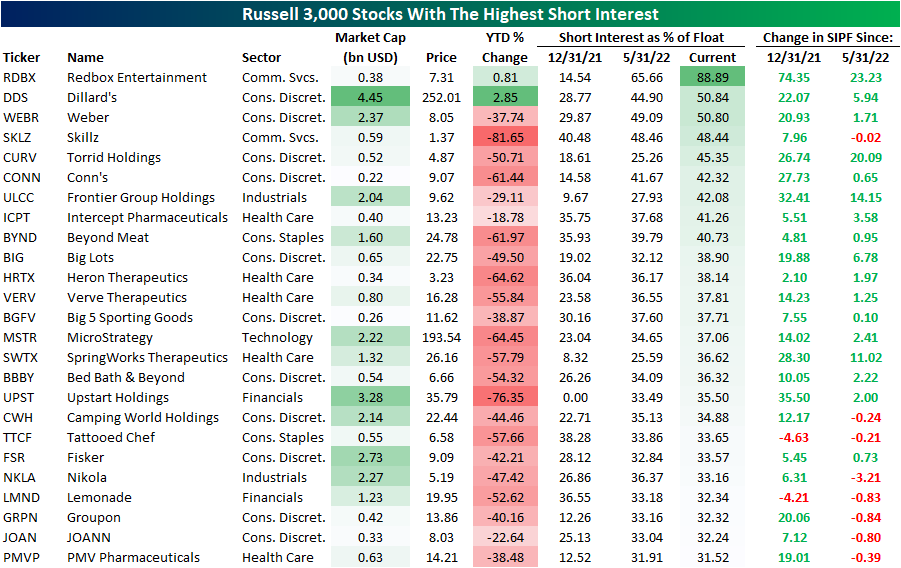

Taking a more granular look at which stocks in the index currently have the highest levels of short interest, recent SPAC, Redbox Entertainment (RDBX), tops the list with nearly 90% of its currently tradable shares sold short. Other than RDBX, there are only two other stocks with over half of float sold short: Dillard’s (DDS) and Weber (WEBR). While their short interest readings are similar, their performance year to date could not be more different. The former is one of the only names higher with a meager 2.85% gain whereas Weber (WEBR) has dropped 37.7%. Even though that is a huge decline, it is actually better than average for the whole of the 25 most heavily shorted names. The average decline year to date for this group is 45.8%. Although some names on this list have seen big increases in short interest between the latest updates, there is also a handful that has seen modest declines likely as existing shorts take profit following further declines.

(Click on image to enlarge)

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more