Short Interest Update - Monday, March 27

Although equities broadly are starting the new week higher, the most heavily shorted stocks are trading lower today. In the chart below, we show the relative strength of an index of the 100 most heavily shorted stocks versus the Russell 3,000 since January 2021 (the peak of the meme stock mania). Overall, the past couple of years since that period have consistently seen heavily shorted names underperform as seen through the downward trending line below. Although heavily shorted names saw some outperformance in January, they are making new lows.

On Friday, the latest short interest data as of mid-March was released by FINRA. Overall, there has not been too much of a change in short interest levels with the average reading on short interest as a percentage of the float of Russell 3,000 stocks rising by 5 bps since the start of the year to 5.8%.

Prior to the changes to industry classifications that went into effect one week ago, the formerly labeled “retailing” industry consistently held the highest levels of short interest. Now, it is the Consumer Discretionary Distribution and Retail industry in the top spot with an average short interest level of 12.7%. That is up from 12.5% coming into the year and is multiple percentage points higher than the two next highest industries: Pharmaceuticals, Biotechnology & Life Sciences (9.36%), and Autos (9.18%). In spite of the recent bank closures, the banking industry actually has the lowest average levels of short interest. That being said, the latest data as of March 15th would have only accounted for a few days following the collapse of SVB. As such, the next release scheduled for April 12th with end-of-month data will provide a better read on the recent banking trouble’s impact on short interest levels.

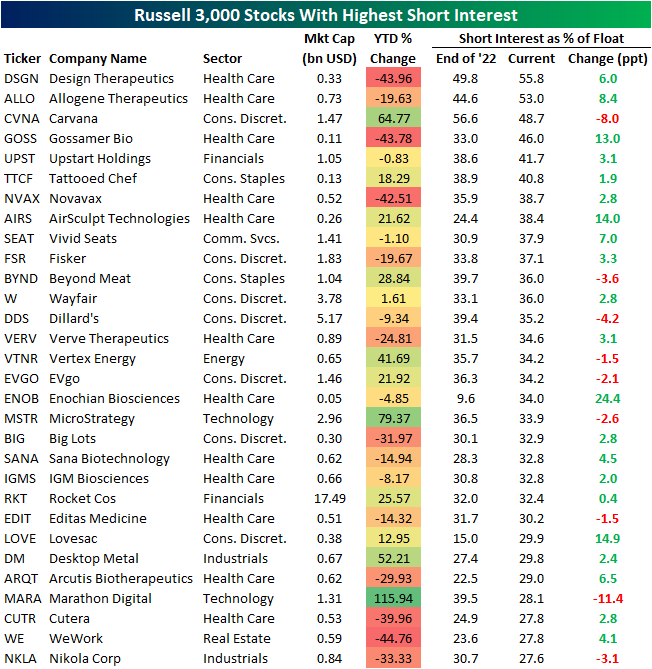

In the table below, we show the individual Russell 3,000 stocks with the highest levels of short interest as of the March 15th data. The sole two stocks with more than half of shares sold short are both Health Care names: Design Therapeutics (DSGN) and Allogene Therapeutics (ALLO). Both have seen short interest levels rise mid-single digits year to date. Other notables with high levels of short interest include some names that were briefly in vogue in recent years like Carvana (CVNA) and Beyond Meat (BYND). While short interest levels remain elevated, those are also two of the stocks listed below that have seen the largest declines in short interest this year which is likely due to solid appreciation in their stock prices. Only Marathon Digital (MARA) has seen a larger drop with its short interest level falling 11.4 percentage points since the end of last year after the stock more than doubled year to date. We would also note another crypto-related name, MicroStrategy (MSTR), is on the list and has been the second-best performer of the Russell 3,000 stocks with the highest short interest.

More By This Author:

Best And Worst Stocks Since The COVID Crash LowSector Performance Experiences A Historical Divergence

Seasonality Keeps Claims Below 200K?

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more