Shell’s Executive Shake-Up And Seasonal Strength – A Buying Opportunity?

Image Source: Unsplash

Video Length 00:01:52

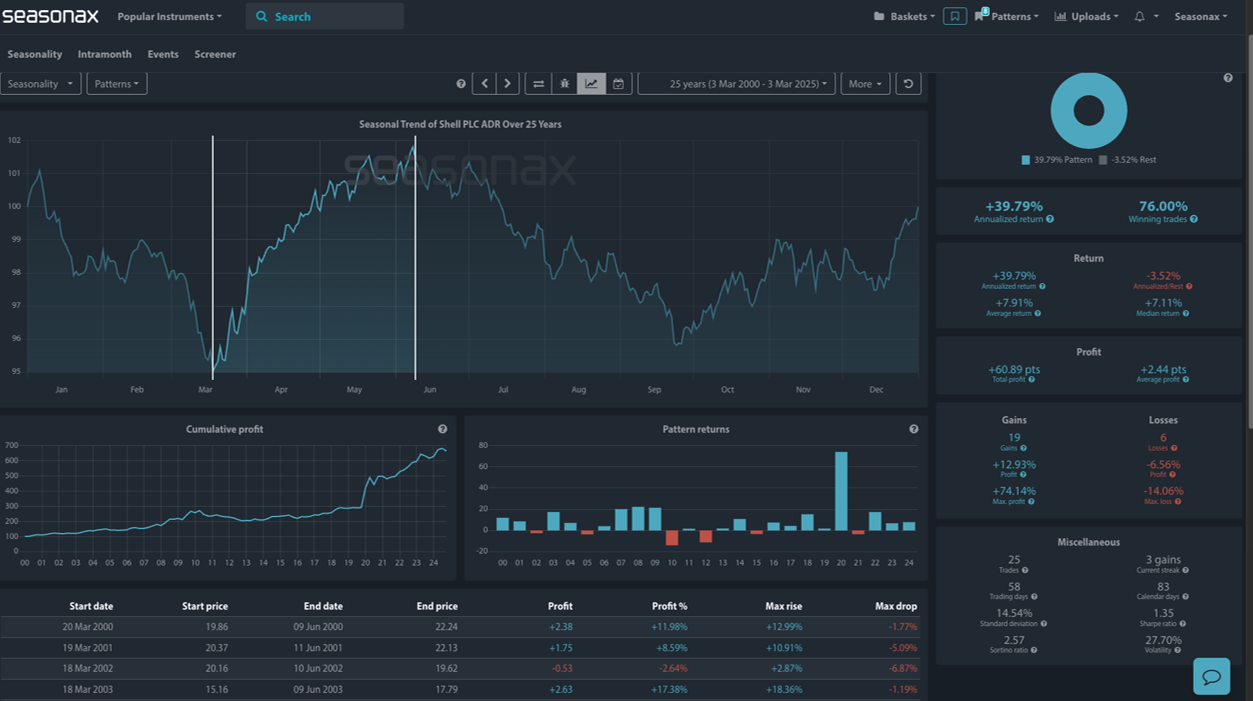

- Instrument: Shell PLC (SHEL)

- Average Pattern Move: +7.91%

- Timeframe: March 18 – June 9

- Winning Percentage: 76%

You may have heard that Shell Plc is undergoing a major executive reshuffle ahead of its highly anticipated March 25 strategy update. With Integrated Gas and Upstream Director Zoë Yujnovich stepping down, Shell is splitting its gas and upstream divisions into separate entities, appointing Cederic Cremers as President of Integrated Gas and Peter Costello as president of upstream. This restructuring signals a shift in focus for the company as it prepares to outline its next phase of strategic development. Given these changes, we want to analyze the data in more detail.

Seasonal Trends Suggest Strength Ahead

The chart shows you the typical development of Shell’s share price from early March to June over the past 25 years. This period has historically been a strong season for Shell, with an annualized return of +39.79% and a 76% probability of positive returns. Over this window, Shell has averaged a +7.91% gain, supported by seasonal oil demand and strategic corporate announcements.

(Click on image to enlarge)

Key Catalysts: Executive Restructuring and Strategic Update

Investors will be watching closely for the March 25 strategy presentation in New York, which is expected to provide a clearer roadmap for Shell’s energy transition, capital allocation, and growth outlook. If the strategy is well-received, it could serve as a catalyst for the stock to follow its seasonal upside pattern.

Technical Perspective

From a technical standpoint there is a major weekly support level which has held all through 2024 and early 2025 – will that level hold?

(Click on image to enlarge)

Trade risks

While Shell’s seasonal pattern points to potential gains, the upcoming strategy update introduces event risk, as investors react to new policies and restructuring implications. Additionally, oil price volatility, regulatory pressures, and global demand fluctuations remain key factors influencing Shell’s trajectory. volatility a key concern. Investors should monitor earnings updates and macroeconomic conditions closely.

More By This Author:

Room For More EURUSD Upside

Will The S&P 500 Rally Post-NFP In Line With History?

BASF SE: Can Cost-Cutting And Strategic Restructuring Fuel Seasonal Upside?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more