BASF SE: Can Cost-Cutting And Strategic Restructuring Fuel Seasonal Upside?

Image Source: Unsplash

Video Length 00:02:10

- Instrument: BAS

- Average Pattern Move: +6.73%

- Timeframe: March 3 – June

- Winning Percentage: 80%

You may not realize it, but BASF SE, one of the world’s largest chemical companies, is undergoing a major transformation. The German industrial giant has embarked on an aggressive cost-cutting plan, a potential IPO for its Agricultural Solutions unit, and a restructuring of its coatings business. Despite these initiatives, the company recently cut its dividend from €3.40 to €2.25 per share, signalling caution amid economic headwinds. With BASF navigating these shifts, we want to analyze the data in more detail.

Seasonal Strength Supports a Potential Upside

The chart shows you the typical development of BASF’s share price between early March and June over the past 20 years. Historically, this has been a strong seasonal period for the stock, boasting an annualized return of +30.27% and an 80% winning trade probability. Over this timeframe, BASF has averaged a +6.73% gain, supported by favorable demand cycles in the chemicals sector.

(Click on image to enlarge)

Key Catalysts: Cost Reductions and Restructuring Moves

BASF aims to save €2.1 billion annually by 2026, with €1 billion in savings already realized. These efforts are critical as the company invests heavily in a large-scale petrochemical project in China while managing weaker industrial demand in Europe. Analysts expect adjusted EBITDA of €8.0 billion to €8.4 billion, contingent on moderate demand recovery.

A major restructuring effort is also underway, with BASF considering an IPO of its Agricultural Solutions unit by 2027 and strategic alternatives for its coatings business, including joint ventures or divestitures. These shifts could unlock shareholder value, particularly if economic conditions stabilize.

Technical Perspective

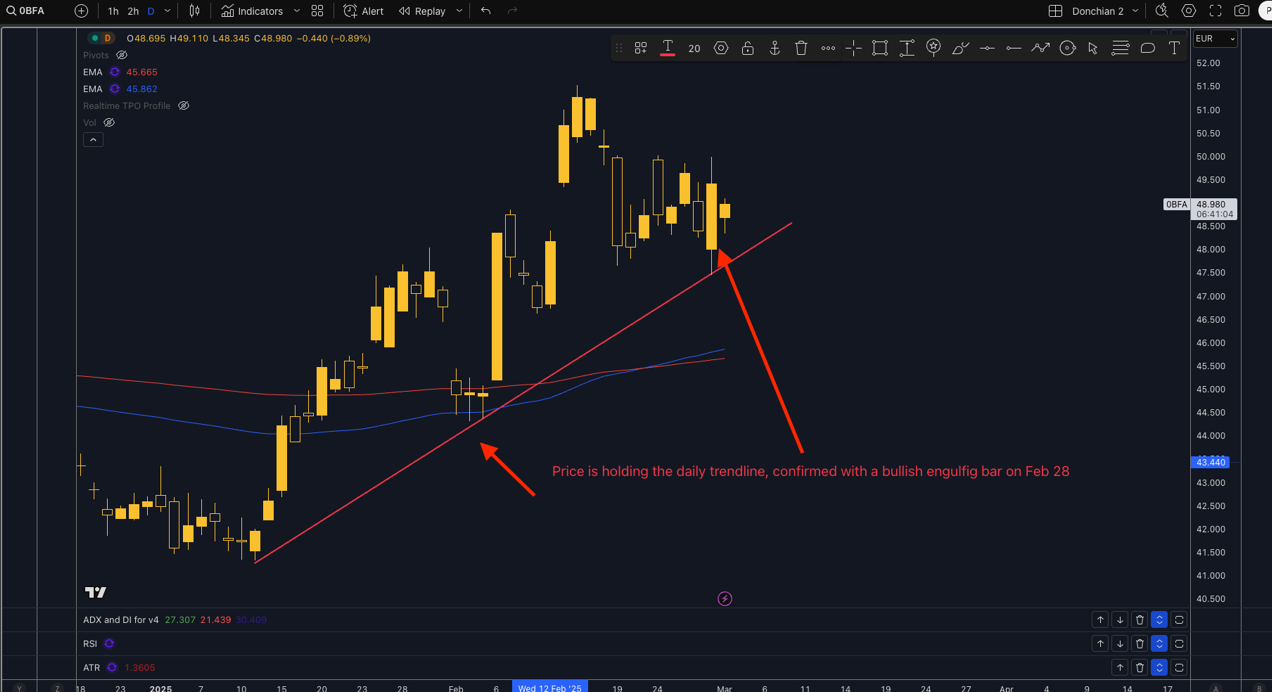

From a technical standpoint there is a potential daily trend line being held around the 48,000 level marked below.

(Click on image to enlarge)

Trade risks

While seasonal patterns suggest strength, BASF remains exposed to macroeconomic risks, energy costs, and global trade tensions. Additionally, the impact of cost-cutting and strategic shifts may take time to materialize, leaving near-term volatility a key concern. Investors should monitor earnings updates and macroeconomic conditions closely.

More By This Author:

Aston Martin’s Struggles to Continue? A Seasonal Perspective

Will Walmart’s Seasonal Strength Offset Profit Worries?

Will The NZDUSD Plunge On RBNZ Rate Cuts And Planned US Reciprocal Tariffs?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more