Sezzle Stock: Improved Valuation, New Catalysts Present A Buy The Dip Opportunity

Image Source: Pexels

Sezzle (Nasdaq: SEZL) (OTC: SEZNL) has the potential to be a high risk, high reward play on online and in-store payment solutions. The stock plunged 51% at the end of 2024. I see this large dip as a buying opportunity as a recovery is expected.

The selling began when the stock reached an unsustainable overbought level, where a correction was inevitable on profit taking. Another reason for the sharp drop was likely triggered due to fears from insiders selling shares after a significant run-up in the stock price in 2024. The selling was then accelerated by a short report from Hindenburg Research. This short report may have an incorrect thesis.

Sezzle's Business Background

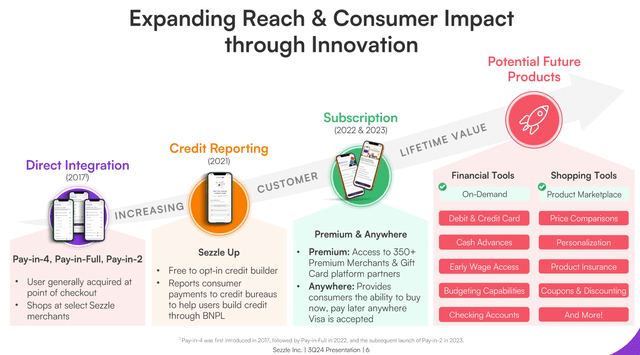

Sezzle is a $1.3 billion market-cap company that provides payment solutions online and in-stores. The Sezzle Platform offers a 'buy now, pay later' service where customers can pay installments over time. This allows its customers to build credit if they choose. The company also has a service called Pay-in-Four, which allows customers to pay one-fourth of the total purchase price and then pay another fourth every two weeks over a six-week period. Sezzle also has another option called Pay-in-Two, where customers pay half up front and then pay the second half in two weeks.

SEZL also offers Sezzle Virtual Card which allows consumers to shop with merchants that are not integrated with Sezzle. This acts as a closed-end installment loan. Sezzle Anywhere enables consumers to use their Sezzle Virtual Card at any online or in-store merchant via subscription.

The company also offers a premium subscription service that allows consumers to access large non-integrated premium merchants known as Sezzle Premium. SEZL's new On-Demand product enables consumers to shop anywhere Visa is accepted to use the Pay-in-4 service. The company also offers long-term lending through partnerships with 3rd party lenders.

Sezzle Q3 2024 Presentatio

Continue reading on Seeking Alpha

More By This Author:

Ardagh Metal Packaging: Get To Know This Little Known 11% Dividend Stock

Fluor: Stock Has A Positive Outlook With Steady Flow Of Contracts

Photronics: A Hidden Gem Likely To Benefit From AI Growth

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Disclaimer: The ...

more