Severe Sanctions Imposed On Russia

Image Source: Pixabay

Sanctions On Russia Go To Eleven

In our previous post (Russia's Invasion of Ukraine: Risks and Opportunities), we wrote that one reason U.S. markets bounced after Russia's invasion of Ukraine was that

Russia's invasion didn't lead to war with NATO, and the West hasn't so far resorted to nuclear-level sanctions against Russia, such as removing it from SWIFT or boycotting its energy exports.

But we cautioned that a couple of big outstanding risks remained. First, the possibility of the current war between Russia and Ukraine escalating to one between Russia and NATO, and second,

that sanctions imposed against Russia become more severe, leading to reciprocal sanctions and metastasizing economic disruptions.

Over the weekend, sanctions against Russia did become much more severe, including excluding some Russian banks from SWIFT and an attempt to "paralyze the assets" of Russia's central bank, in the words of EU President Ursula von der Leyen.

First, we commit to ensuring that a certain number of Russian banks are removed from SWIFT.⁰

— Ursula von der Leyen (@vonderleyen) February 26, 2022

It will stop them from operating worldwide and effectively block Russian exports and imports.

Ruble Drops, Russia Raises Key Rate

Russia's currency dropped by more than 40% at one point Sunday night, prompting Russia's central bank to raise its key interest rate to 20%. As of this writing, the ruble had recovered somewhat and was down about 23% versus the dollar.

The Risk Of Russian Retaliation

Anatoly Karlin, the Russian journalist who predicted the current war before it happened,

Why Russia 🇷🇺 may invade Ukraine 🇺🇦 after all. @akarlin0 estimates an 85% chance of invasion.

— Portfolio Armor (@PortfolioArmor) February 16, 2022

Might be worth adding downside protection here just in case. $SPY $QQQ https://t.co/LJyWqUHMyN

Warned on Sunday that Russia could respond to the current sanctions with an energy embargo.

Twitter TL in delusion, think Russia is stalled if not losing, seem to have lost the ability to read maps.

— Anatoly Karlin (🇷🇺,🇷🇺) (@akarlin0) February 27, 2022

The shock and disbelief will be biblical. pic.twitter.com/Xq3QAbviqY

A Glimmer Of Hope

The one bit of positive news in this is that Russians and Ukrainians are sitting down to negotiate.

Negotiations between Russian delegation and Ukrainian delegation, initiated at Ukraine’s request, are about to start. pic.twitter.com/2ptZ52KgHH

— ASB News / MILITARY〽️ (@ASBMilitary) February 28, 2022

Update On Our Beaten-Down Russian Stocks

In our last post, we mentioned that we had picked up a few shares of Gazprom and Yandex:

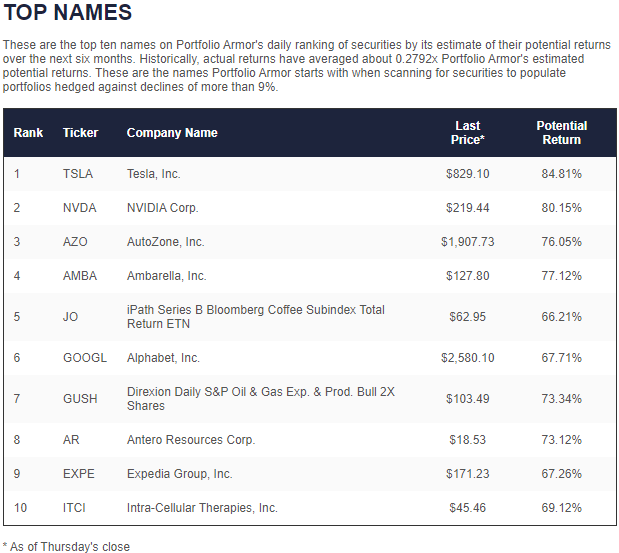

In our personal account, we bought shares of two of them on Thursday and Friday: Yandex (YNDX) and Gazprom (OGZPY). Just to clarify: neither of those stocks were Portfolio Armor picks. For an idea of the sort of names Portfolio Armor has picked recently, these were its top ten names last month:

Screen capture via Portfolio Armor on 1/27/2022.

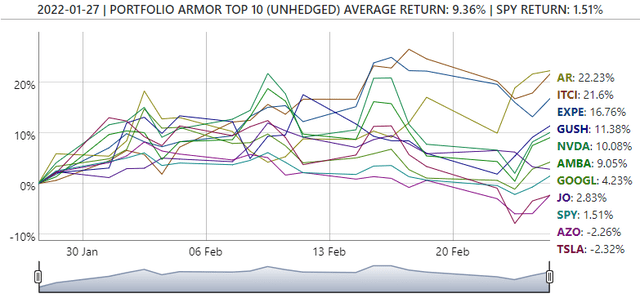

And here's how they've done since, versus the SPDR S&P 500 ETF (SPY):

Portfolio Armor tends to pick stocks that have been going up recently, such as the current winner from the January 27th cohort, the oil E&P Antero Resources Corp (AR); Yandex and Gazprom both dropped significantly (along with the rest of the Russian market) after the invasion started.

As we type this early Monday morning, Yandex is down about 18% in Frankfurt trading and Gazprom is down about 31%. We've entered a limit order to purchase more Gazprom Monday. A reminder of our rationale behind that:

As of Friday's close, contra data you'll find on some popular financial sites, Gazprom's forward dividend yield was about 22%.

Most dividends on Russian stocks paid in the subsequent year. JP Morgan estimates Gazprom will pay ~95 rubles per ADR, so that's about $1.16 per ADR, quite sizable. pic.twitter.com/2T3uK1n6Yv

— iamhammed (@iamhammed_) February 25, 2022

Currently, Gazprom is trading at about $3.71, raising that dividend yield to 31% (assuming Karlin's warning of an energy embargo doesn't come to pass, prompting a dividend isn't cut). Buying Russian stocks now isn't for the faint of heart, so don't risk more than you can afford to lose.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more