Sentiment And Stock Prices Diverge

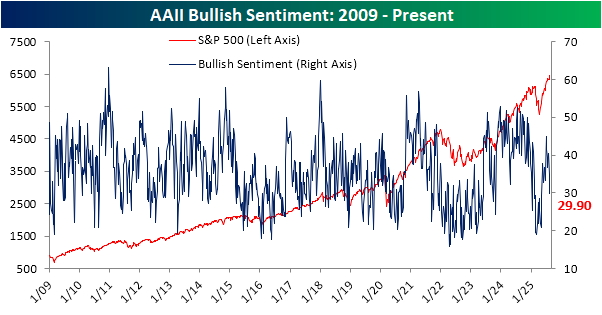

The S&P 500 has had a couple of closes at record highs since last week's update on sentiment from the American Association of Individual Investors (AAII). However, looking at the latest update, you wouldn't have guessed the market was doing well. Bullish sentiment shed five points week over week, down to 29.9%, a level not seen since early May.

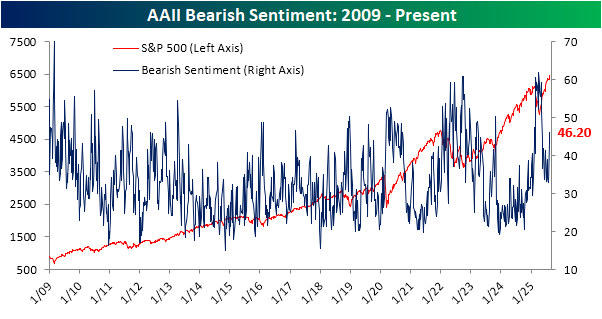

The lack of bulls coincides with a spike in bears up to 46.2%, which is the most elevated since May 8th.

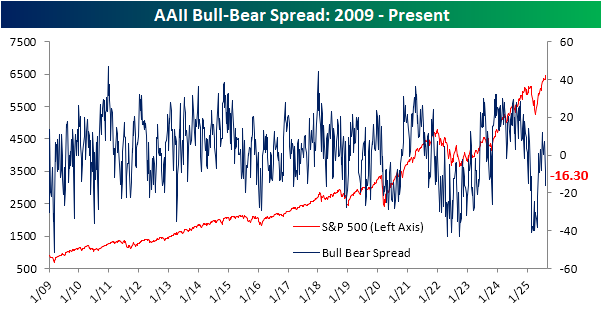

Put together, bears are now outnumbering bulls by 16.3 percentage points, which is the lowest spread since the spring. Additionally, holding aside the fact that the S&P 500 is near record highs, this week's reading is significantly lower than normal. Historically, the average bull-bear spread has been +6.4, putting the current spread 1.25 standard deviations below the historical average. In other words, sentiment has tipped into what can be considered elevated bearish levels.

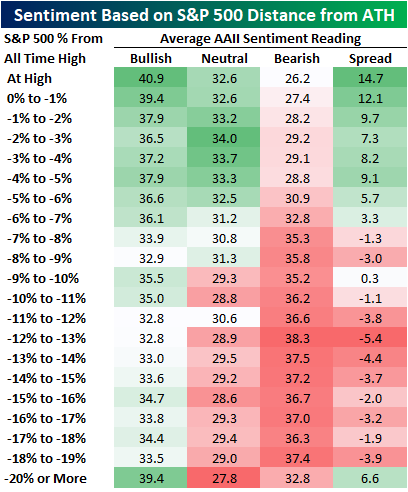

Again, it is one thing for bears to be out in full force to an extreme degree when stocks are weak. It is another entirely more surprising thing to see these levels when stocks are hitting record highs. In the table below, we show the average readings for bulls and bears in the AAII survey based on how far the S&P 500 is trading from all-time highs. As might be expected, sentiment has historically tended to be the most bullish/least bearish when the S&P 500 is closer to all-time highs. However, sentiment also tends to be more bullish when stocks are in pronounced pullbacks of at least least 20%. Comparing that to now, current levels of bullishness are about 11 points lower than what might be expected, and the level of bears is 20 points higher than what might be expected.

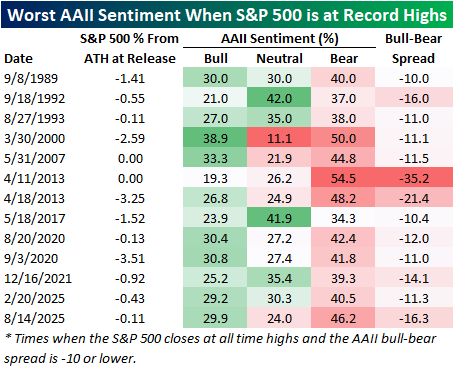

The degree to which investors reported as bearish was historic this week. In the history of the weekly AAII investor sentiment survey dating back to 1987, the bull-bear spread has only been lower in a week where the S&P 500 made an all-time high two other times. Both of those instances were in back-to-back weeks in 2013. Other than that, there have only been 13 weeks (including those two in 2013 and now) when the S&P 500 hit record highs and the bull-bear spread was -10 or lower. Before this week, there was also an occurrence earlier this year, almost exactly six months ago, right before the Q1 peak.

More By This Author:

Trump 2.0 Vs Trump 1.0 - The First 200 DaysLarge-Cap Left Behinds

Economic Optimism Returns Among Small Businesses

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more