Sentiment And Data Not Matching

Image Source: Pexels

“Davidson” submits:

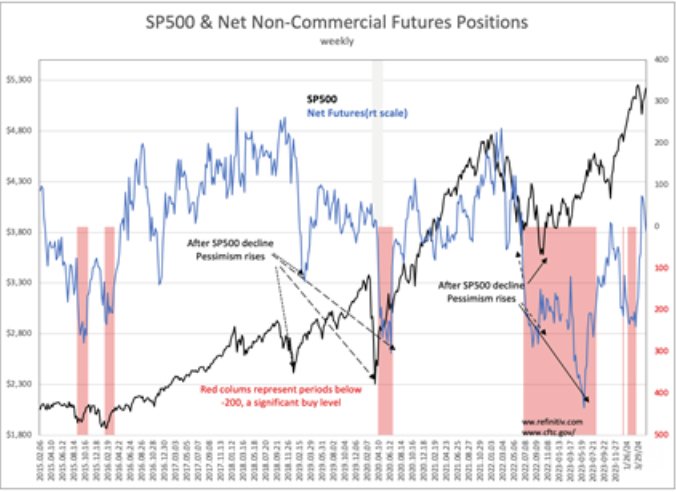

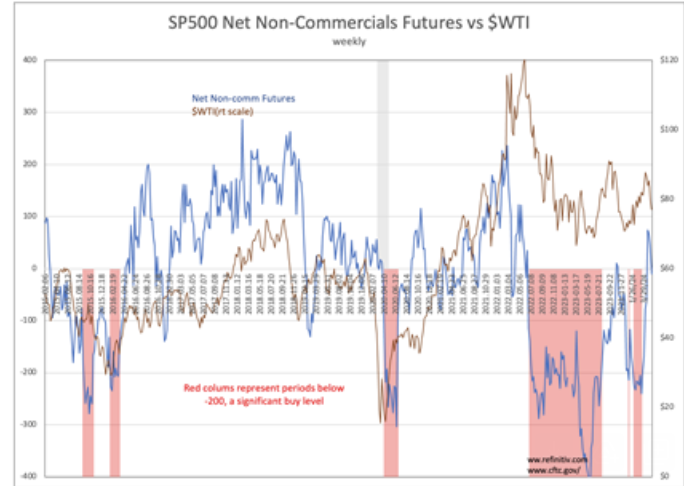

Three sentiment indicators reflected additional pessimism from the week prior after the PMI came in at 49.1, a PMI recession signal below 50. I suspect this caused portfolio managers to add downside hedges as seen in the SP500 Net Non-Commercial Futures, the WTI and a more pessimistic position on the Yield Curve. None of this has been supported by the hard data indicators i.e., employment, Real Personal Income, Real Retail Sales, New Orders for Durable Goods or Construction Spending.

Investors should use any short-term dips in sentiment as an opportunity to add capital to accounts. Over the longer-term, equity markets are driven by economics not sentiment.

More By This Author:

Flush Money Market Funds Typically Mean Rally

Real Personal Income Rises

10yr/Mortgage Ratio Implies Market Rise Coming

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more