SenesTech: A Little-Known Biotech Company Worthy Of Attention

Investing in biotech stocks can be a rewarding exercise. However, identifying biotech companies with great long-term prospects at a young stage is easier said than done. This is what keeps some investors from investing in this sector. As a growth-oriented investor with an extensive investment time horizon, I am generally more comfortable with investing in young biotech companies as long as such companies exhibit certain characteristics that point to long-lasting competitive advantages. SenesTech, Inc. (SNES), a small biotech company that specializes in fertility control for managing animal pest populations – primarily rats – caught my attention recently after the company delivered a record-breaking financial performance in the fourth quarter of 2024. After diving deep into company fundamentals, it seems reasonable to conclude that SenesTech deserves the attention of growth investors looking for exposure to young biotech companies with the potential to deliver market-beating returns in the long term.

The Business

SenesTech’s mission is to improve the health of the world by humanely managing animal populations through fertility control instead of relying on traditional poison-based pest control methods that are lethal for animals. The company currently sells two main products.

- Evolve Rats and Mice - a soft bait fertility control solution for rats.

- ContraPest – a liquid contraceptive for rates.

Evolve products, since their introduction in 2024, have become increasingly popular among SenesTech’s customers, resulting in these products accounting for just over 75% of total revenue in the fourth quarter of 2024. This popularity of Evolve has opened doors for the company to expand its distribution partnerships to new markets and new retail customers, paving the way for stellar revenue growth in the next five years.

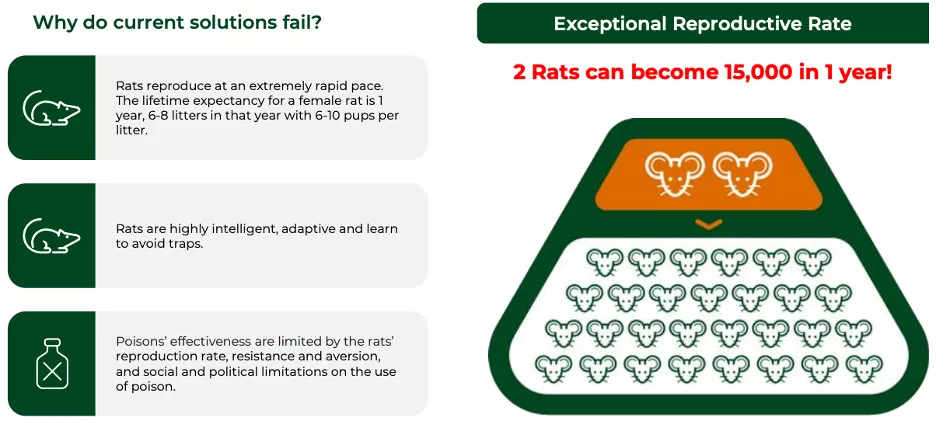

SenesTech’s business is centered on the understanding that rats reproduce at an extreme pace, making it difficult for traditional poison-based solutions to mitigate the threat posed by the growing rat population meaningfully. Based on the reproduction rates of rats, 2 rats can become 15,000 rats in just a year, which highlights the need for effective fertility control measures.

Exhibit 1: The challenges posed by the rapid pace of rodent reproduction

Source: Investor presentation

SenesTech is led by CEO Joel Fruendt, who brings over 15 years of experience in the vector and pest control industry.

Evolve is Emerging as a Game-Changer

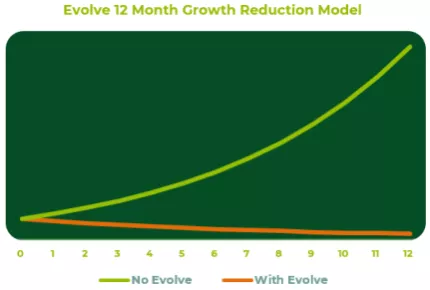

As discussed earlier, the rapid reproduction rate of rodents has made it difficult for traditional poison-based pest control solutions to mitigate the public health threats posed by rodents. A recent efficacy study found that Evolve can be used in an Integrated Pest Management (IPM) program to achieve superior results. The study found rats that consumed Evolve had up to a 61% reduction in fertility. After extrapolating this data to derive long-term trends, the laboratory study found that a continued Evolve treatment for 12 months would prevent pest population growth by more than 90%.

Exhibit 2: Evolve 12-month growth reduction model

Source: Evolve efficacy study by SenesTech

This result does not come as a surprise given that adding a fertility control component to an IPM program has already been proven effective both in an agricultural and urban setting.

During the fourth quarter of 2024, SenesTech expanded its distribution partnerships to make the most of Evolve’s high efficacy, including product launches on e-commerce giant Amazon (AMZN)) and retail giant Walmart (WMT) and also with Tractor Supply Co. (TSCO). In addition to this, the company secured distribution agreements in 10 countries globally to expand its footprint, which is a positive move that is likely to unlock new growth opportunities in the current fiscal year. These international locations include New Zealand, the United Arab Emirates, and Hong Kong. The company is also set to begin a pilot program in New York City on April 27, potentially paving the way to showcase the effectiveness of Evolve, resulting in new customer sign-ups.

Exhibit 3: The footprint of Evolve

Source: Investor presentation

Aided by the rapid growth in Evolve sales, SenesTech reported a 70% YoY increase in revenue in Q4 to $501,000 while the gross margin also improved meaningfully from 44% in Q4 2023 to 61% in Q4 2024. In an encouraging development, the company also reported a cash burn reduction from $1.5 million per quarter to approximately $1 million, suggesting that SenesTech is headed in the right direction to achieve profitability as the business scales.

SenesTech is Well-Positioned to Enjoy Long-Lasting Competitive Advantages

SenesTech’s humane approach to finding solutions to pest population growth is likely to benefit from several tailwinds in the future, potentially leading to long-lasting competitive advantages. Evolve, the biggest contributor to SenesTech’s revenue today attempts to address the pest population growth problem by targeting reproduction, which is a long-term strategy aimed at providing a long-lasting solution to the problem. In contrast, traditional poison-based solutions have proven to be temporary solutions that do not address the root cause of the pest population growth problem.

In addition, SenesTech’s products are deemed environmentally neutral, and there have been no reported incidents of these products negatively affecting the global food chain. This characteristic makes the products suitable to be used in a variety of settings including zoos, animal sanctuaries, and even public parks. This versatility may prove to be a differentiator in the long run.

Some of the other characteristics that position Evolve to enjoy competitive advantages include:

- Easy integration of Evolve into existing IPM programs.

- The ability of these products to address the bait aversion problem associated with poisonous fertility control methods.

- Cost-effectiveness compared to many rodenticide products in the market.

Evolve seems well-positioned to enjoy long-lasting competitive advantages, which makes SenesTech an attractive biotech company to monitor closely as such competitive advantages often lead to stellar growth in economic profits.

Risks to Monitor

Investing in a young, fast-growing biotech company certainly carries inherent risks. For SenesTech, the biggest barrier to growth is challenges in securing local government approvals to distribute pest control products. Since this is a regulated market, it may take some time for SenesTech to fully deploy its products across all states in the United States.

Investors also need to monitor SenesTech’s new strategy of focusing on existing products as the company may find itself in a pitfall where failure to invest in innovative products may end up resulting in market share losses.

Takeaway

SenesTech, with the rapid growth of Evolve, seems well-positioned to capture a meaningful share of the pest control solutions market in the U.S., potentially creating a pathway to expand globally. Although there are a lot of uncertainties today, the company’s recent financial performance suggests it is moving in the right direction to scale profitably. SenesTech’s decision to prioritize the distribution of existing products and recently reported operating efficiencies are likely to keep cash burn at a manageable rate until the company inches toward profitability.

Related Articles:

SenesTech: The Smart Money’s Bet On Rodent Population Control

SenesTech Has Built A Better Mouse Trap

SenesTech Expands Rapidly With Evolve, Poised For Breakout Growth In 2025

More By This Author:

The Meme Stock Mania Is Back; Run

Streaming Cannot Save Disney, For Now

Booking Holdings: Worth Considering Amid Travel Resurgence

Disclosure: I do not own any positions in the stocks mentioned in this article.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring ...

more