Seek Strong ROICs In Turbulent Markets

In sinking markets, strong ROICs are the only life rafts. As we’ve shown, stocks for companies with higher ROICs performed the best during and after the financial crisis.

Nearly all stocks suffer in a bear market, but those with high ROICs tend to suffer less and rise faster in the recovery. If you want more confidence in your portfolio, then own companies with high ROICs.

Our Robo-Analyst[1] recently highlighted these companies with strong ROICs, growing profits, and undervalued stock prices: AutoZone (AZO: $914/share), SYSCO Corporation (SYY: $35/share), Best Buy (BBY: $60/share), NVR Inc. (NVR: $2,272/share), and Omnicom Group (OMC: $60/share). We featured AutoZone and Best Buy last week. We focus on NVR Inc. (NVR) and SYSCO Corporation (SYY) as this week’s Long Ideas.

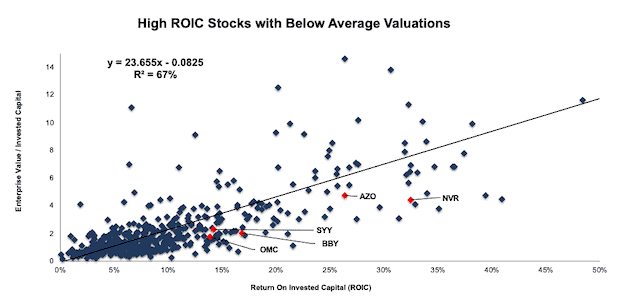

Using ROIC to Find Value

We’ve long argued (and proven empirically) that there is a strong correlation between improving ROIC and increasing shareholder value. We’ve also shown, the winners, both during and after a market crash, tend to be companies that earn a high ROIC. Figure 1 shows that changes in ROIC explain 67% of the changes in enterprise value divided by invested capital (a cleaner version of price-to-book) for the S&P 500. It also highlights five stocks trading well below their fair value based on ROIC.

Figure 1: Five Undervalued S&P 500 Stocks

Sources: New Constructs, LLC and company filings.

These five stocks are not only undervalued relative to the S&P 500, but the underlying businesses are also strong:

- All firms have positive and rising core earnings[2] and economic earnings

- All firms have increased their ROIC year-over-year (YoY) in the most recent period

- All firms have earned positive economic earnings in each of the past 10 years

- All stocks earn our Very Attractive rating

Investors looking for long-term-value-creating stocks in this volatile market should start here.

NVR Inc. (NVR) – Very Attractive rating

We first made NVR Inc. a Long Idea in April 2017 and reiterated the stock in February 2019. Since our original report, the stock is up 6% (S&P 500 +8%), and since our 2019 report, the stock is down 12% (S&P 500 -9%). This underperformance is unwarranted given the firm’s improving fundamentals and significantly discounted share price.

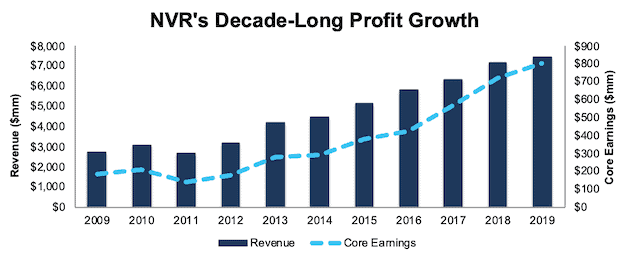

Over the past decade, NVR has grown revenue by 10% compounded annually and core earnings by 16% compounded annually, per Figure 2. The firm has increased its core earnings margin YoY in seven of the past 10 years and its TTM core earnings margin of 11% is up from 7% in 2009. NVR has improved its ROIC from 24% in 2009 to a top-quintile 32% TTM and has generated $2.2 billion (21% of market cap) in cumulative free cash flow (FCF) over the past five years.

Figure 2: NVR’s Revenue & Core Earnings Since 2009

Sources: New Constructs, LLC and company filings

Economic Earnings Are Also Improving

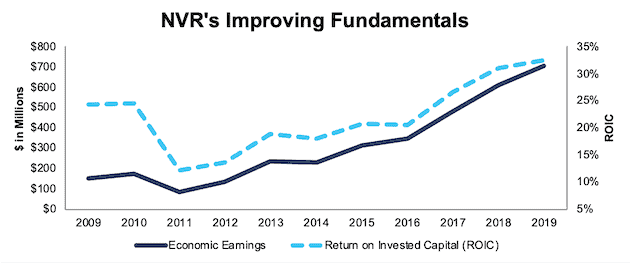

Core earnings account for unusual gains and expenses included in GAAP net income. To get the full picture of a company’s operations and hold management accountable for capital allocation, we also analyze balance sheets to calculate an accurate ROIC and economic earnings.

Some notable adjustments to NVR’s balance sheet include:

- Removed $740 million in excess cash

- Added $396 million in accumulated asset write-downs

- Added $87 million in operating leases

After all adjustments, we find that NVR’s economic earnings grew 16% compounded annually over the past decade, per Figure 3. NVR’s economic earnings have grown 12% compounded annually over the past two decades.

Figure 3: NVR’s Economic Earnings & ROIC Since 2009

Sources: New Constructs, LLC and company filings

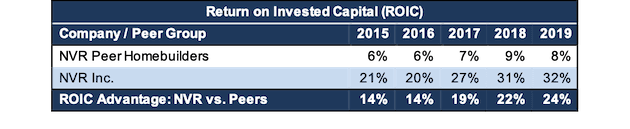

Building on an ROIC Advantage

As noted in our original report, NVR’s success has not been solely the result of a rising tide (housing market) lifting all boats (homebuilders). Instead, our research indicates NVR has improved its ROIC at a faster pace than the 15 homebuilders under coverage, per Figure 4. Peers include Beazer Homes (BZH), KB Home (KBH), Lennar Corporation (LEN), PulteGroup (PHM), Taylor Morrison Home Corp (TMHC), and more. None of the peers under coverage earn a higher ROIC than NVR.

Figure 4: NVR’s Growing ROIC and Profitability Advantage Over Peers

Sources: New Constructs, LLC and company filings

NVR Has Upside Potential

At its current price of $2,272/share, NVR has a price-to-economic book value (PEBV) ratio of 0.5. This means the market expects NVR’s after-tax profit (NOPAT) to permanently decline by 50%. This expectation seems extremely pessimistic and shortsighted. Even at the depths of the 2008/2009 recession, NVR’s NOPAT declined YoY in three consecutive years before rebounding and growing 16% compounded annually over the next decade. Longer-term, NVR has grown NOPAT by 11% compounded annually over the past two decades.

If NVR traded at the level implied by the trend line in Figure 1, it would be worth $5,135/share today, 126% above its current price. NVR’s current price implies its ROIC will permanently decline to ~19%, a level not seen since 2014.

NVR’s current economic book value, or no-growth value of the stock, is $4,690/share – a 106% upside to the current price. When we analyze the cash flow expectations baked into the stock price using our reverse DCF model, we find that NVR has significantly more upside potential.

Even if NVR’s NOPAT margin falls to 9% (three-year average, compared to 11% in 2019) and it grows NOPAT by just 4% compounded annually for the next decade, the stock is worth $6,272/share today – a 176% upside. See the math behind this reverse DCF scenario.

Compensation Plan Properly Incentivizes Executives

In our original report in 2017, we pointed out NVR’s superior executive compensation plan. NVR added return on capital to its executive compensation plan in 2014 and quality corporate governance remains in place today.

In its latest proxy statement, NVR disclosed that 50% of the vesting of executives’ stock options are subject to return on capital performance over a three-year period. NVR’s compensation committee believes return on capital is an important metric for the firm due to the “capital intensive nature of the homebuilding industry.” NVR’s executive compensation plan lowers the risk of investing in this company because we know executives are incentivized to create true shareholder value.

This compensation plan, along with strong fundamentals, earned NVR a spot in March’s Exec Comp Aligned with ROIC Model Portfolio.

SYSCO Corporation (SYY) – Very Attractive Rating

We first made SYSCO a Long Idea in December 2017. Since then, the stock is down 43% while the S&P 500 is down 7%. However, the firm’s fundamentals have grown stronger over this time. After falling nearly 60% YTD, its stock price presents a great buying opportunity.

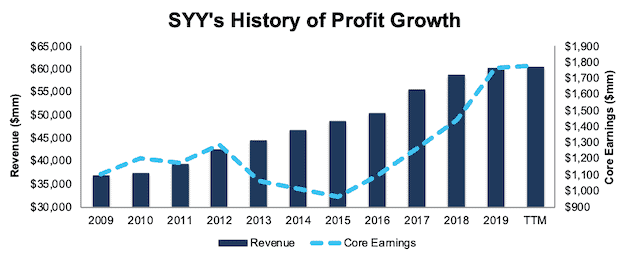

Over the past decade, SYY has grown revenue and core earnings by 5% compounded annually per Figure 5. The firm has increased its core earnings margin YoY in each of the last four years and its 2019 core earnings margin of 3% is up from 2% in 2015. SYY earned a 14% ROIC in 2019, which is above its 10-year average (13%) and much improved from 10% in 2015. SYY has also generated $3.5 billion (20% of market cap) in cumulative free cash flow over the past five years.

Figure 5: SYY’s Revenue & Core Earnings Since 2009

Sources: New Constructs, LLC and company filings

Economic Earnings Are Growing Even Faster

We made the following adjustments to SYY’s balance sheet to calculate an accurate ROIC and economic earnings:

- Added $1.6 billion in accumulated other comprehensive loss

- Added $505 million in operating leases

- Added $170 million in accumulated asset write-downs

- Added $140 million in accumulated goodwill amortization

- Removed $118 million in deferred tax assets

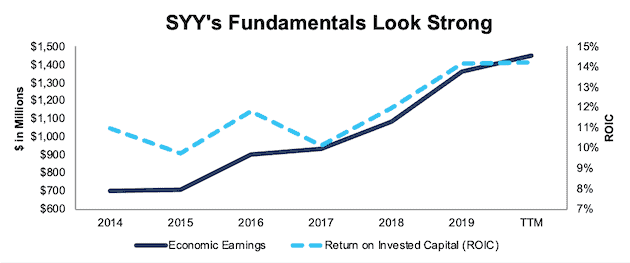

After all adjustments, we find that SYY’s economic earnings grew 14% compounded annually over the past five years, 5% compounded annually over the past decade, and 10% compounded annually over the past two decades.

Figure 6: SYY’s Economic Earnings & ROIC Since 2014

Sources: New Constructs, LLC and company filings

Higher ROIC Drives Competitive Advantages

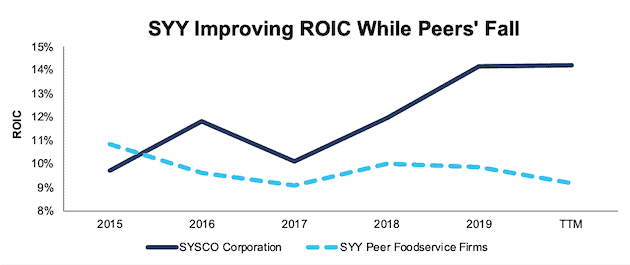

SYSCO has leveraged its global distribution network and customer relationships to maintain competitive advantages over peers. Per Figure 7, SYSCO has improved its ROIC from 10% in 2015 to 14% TTM. The market-cap-weighted average of the 14 Food Retail & Distribution firms under coverage has fallen from 11% to 9% over the same time. Peers include US Foods Holding Corp (USFD), United Natural Foods (UNFI), SpartanNash Co. (SPTN), and Core-Mark Holding Co. (CORE) and more.

Figure 7: SYY’s ROIC & Profitability Leads Competition

Sources: New Constructs, LLC and company filings

Shares Look Significantly Undervalued

At its current price of $35/share, SYY has a price-to-economic book value (PEBV) ratio of 0.4. This ratio means the market expects SYY’s NOPAT to permanently decline by 60%. This expectation seems overly pessimistic and an overreaction to the current economic uncertainty given that SYY actually grew NOPAT YoY in 2007, 2008, and 2009 (the last prolonged economic downturn). Furthermore, SYY has grown NOPAT by 6% compounded annually over the past decade and 9% compounded annually over the past two decades.

If SYY traded at the level implied by the trend line in Figure 1, it would be worth ~$76/share today, 117% above its current price. SYY’s current price implies that its ROIC will permanently decline to ~10%, which is well below its 14% TTM ROIC.

SYY’s current economic book value is $88/share – a 151% upside to the current price. Even in a conservative growth scenario, SYY has more upside potential.

If SYY can maintain its 2019 NOPAT margin (3%) and grow NOPAT by just 4% compounded annually for the next decade, the stock is worth $114/share today – more than three times higher than its current price. See the math behind this reverse DCF scenario.

Compensation Plan Rewards Executives for Creating Value

SYY’s executive compensation plan properly incentivizes executives to create shareholder value. In fiscal 2019, one-third of SYY’s performance shares were awarded based on the firm’s three-year average adjusted ROIC. SYY has included ROIC as a performance metric in its executive compensation plan since 2012.

This focus on ROIC holds executives accountable for prudent stewardship of capital and aligns executives’ interests with shareholders’ interests.

The Importance of Fundamentals & Quantifying Expectations

In volatile markets, it pays to incorporate accurate fundamentals into investment decision making. Fundamentals need not be 100% of your process, but they should not be 0%. And, if you’re relying on fundamentals at any level, it pays to make sure you have accurate fundamentals. Investors should not make decisions based on incomplete or less accurate data than what is available. Our Company Valuation Models incorporate all the data from financial filings to truly assess whether a firm is under or overvalued and get an accurate representation of the risk/reward of a stock. For NVR and SYY, the risk/reward looks good.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Our core earnings are a superior measure of profits, as demonstrated in In Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to IBES “Street Earnings”, owned by Blackstone (BX) and Thomson Reuters (TRI), and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Good article.