Revisiting The Biggest Winners And Losers Since The COVID Crash Low

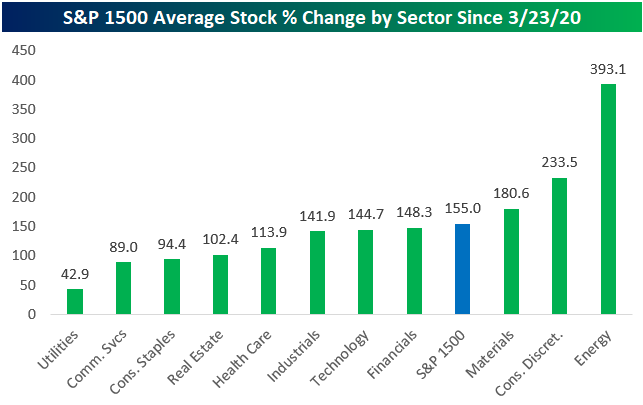

In a little over a month on 3/23/22, we’ll be exactly two years removed from the stock market’s COVID Crash closing low. Below we show how the average stock that’s currently in the S&P 1500 has done since the 3/23/20 low by sector. Stocks in the S&P 1500 are up an average of 155% since the COVID Crash low. By far the best performing sector has been Energy where the average stock is up 393%. Consumer Discretionary stocks are up the second most on average at +233.5%, while Materials stocks rank third with an average gain of 180.6%. Notably, stocks in the Financials and Technology sectors are both up roughly the same on average since 3/23/20 with gains of 148% and 145%, respectively. Three sectors have average gains of less than 100%: Consumer Staples (+94.4%), Communication Services (+89%), and Utilities (+42.9%). Note that these results are only based on price change, so higher dividend-paying sectors like Utilities are up more on a total return basis.

There are currently 59 stocks in the S&P 1500 up more than 500% from their closing level on 3/23/20, and there are 11 up more than 1,000%.GameStop (GME) remains at the top of the list with a gain of 3,042%, followed by SM Energy (SM) and Matador Resources (MTDR) with gains of more than 2,000%. Aluminum-maker Alcoa (AA) is the best performing Materials stock on the list with a gain of 1,160% since 3/23, rising from $5.67/share up to $71.45 as of this morning. The average share price of the 11 stocks that are up 1,000%+ was just $4.42 on 3/23/20. Their average share price now is $66.78!

Tesla (TSLA) is by far the largest company on the list of best performers with a market cap of more than $900 billion at the moment. Back on 3/23/20, Tesla (TSLA) shares closed at $86.86.Since then, the stock has gained 944%, putting shares above the $900 level.

There are 56 stocks currently in the S&P 1500 whose price today is lower than it was at the close on 3/23/20. Below are the 35 stocks that are down at least 10% in price since then.eHealth (EHTH) and Tabula Rasa (TRHC) have been the worst two with declines of more than 80%. Another three are down more than 50% (QURE, STRA, IVR), while 16 more are down 20%+. The two stocks on the list of worst performers with the largest markets caps at the moment are Gilead (GILD) and Biogen (BIIB). These two stocks performed well in the very early days of COVID, but they’ve been trending lower ever since and currently trade at the same levels they were at in mid to late 2019.

Clorox (CLX) is an interesting name to see on the list of worst performers. When COVID first hit, there was a run on disinfectant products like bleach that Clorox manufactures.(Remember trying to find Clorox wipes throughout the first half of 2020? They were nowhere to be found!)

The supply/demand imbalance pushed shares of Clorox (CLX) sharply higher from January to August 2020, but since then shares have steadily trended lower and lower, and they’re now right back to where they were trading in early January 2020. Normally, we see stocks “take the stairs up and the elevator down,” but the two-year chart for Clorox looks like the opposite: it took the elevator up when COVID first hit, and it has taken the stairs down ever since.