Return Of OMXIPI On A Cyclical Upturn

Image Source: Pexels

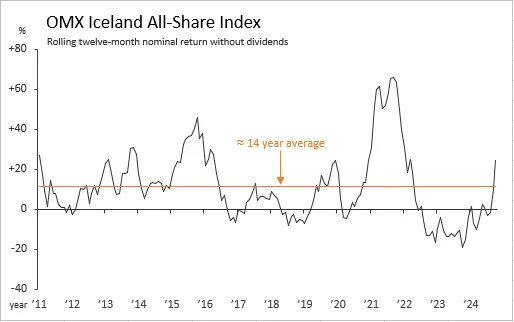

The first chart displays the rolling one-year return of the OMX Iceland All-Share Index without dividends reinvested and inflation adjustment. The return in October was +25% vis-à-vis the same month a year ago and up from the +10% return in September. Its current standing is about 14 percentage points above the 14-year average return (+11.3%).

OMXIPI

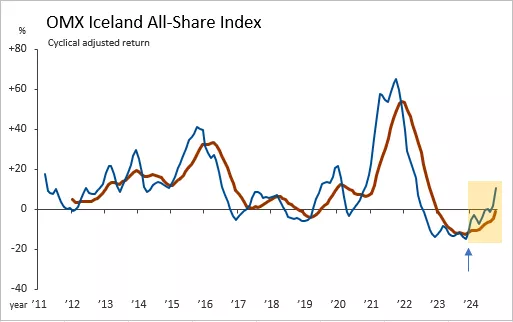

The second chart shows what I prefer to call the ‘cyclical adjusted return’ of the Index. This measure gave an early cyclical upturn signal in January of this year when the shorter-term blue line crossed up through the longer-term brown line, which was later confirmed. Now waiting to see if the brown line manages to rise above the zero line.

OMXIPI

My third chart depicts the Index with my very long-term Sentiment Swing Indicator (SSI) in the lower window. A buy signal was triggered in the SSI in January, as mentioned in prior posts, and since then the SSI has been steadily rising – confirming the earlier signal. Need to see if the Index can take out its January high or if it will begin forming some type of a cup-and-handle pattern in the coming months.

OMXIPI - Monthly Chart

More By This Author:

OMXIPI Expected To Drop

Increased US Recession Risk

Icelandair´s Share Price Down 98%

Disclosure: The author of the analysis presented does not own shares or have a position or other direct or indirect monetary interests in the financial instrument or product discussed in his articles ...

more