Icelandair´s Share Price Down 98%

Image Source: Unsplash

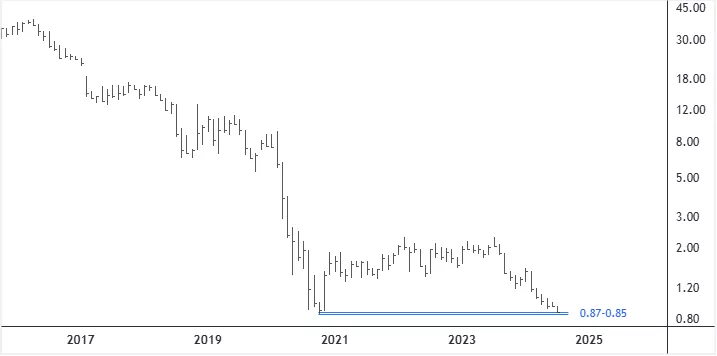

The share price of Icelandair in the Icelandic stock market has tanked 98% in the most recent 8+ years, after topping out at an all-time high in late April of 2016. Over the period, its market capitalization has plummeted from almost ISK 194 billion to about ISK 36 billion.

In September 2020, the airline increased its share capital by 23 billion new shares issued – up to a total of 28.4 billion shares - in a public share offering. The offering price was ISK 1.0 per share. Seven thousand new investors were added to the shareholder base, with general investors accounting for around 50% of the total shareholding in the company at the time.

From its July 18 2023 swing high, Icelandair´s stock price has fallen 62%. At the end of May this year, it declined below 1 ISK and has stayed under the offering price since or for 29 trading days. That means the investors who participated in the secondary offering almost four years ago are now suffering from capital/market loss. The 30-day average trading/ISK volume today stood at 48.5M/46.1M, on the same date last year it was 177M/358M. Today the closing price was just under 0.87 per share and thus at a new all-time low.

Stock Price of Icelandair - Monthly Chart

Penny stocks

In the U.S., some define penny stocks as stocks trading for less than $5 per share. But the more common definition is stocks priced under a dollar; hence the name “penny stocks.” These stocks usually do not trade as many shares or as often compared to the higher-priced stocks. In other words, they have much less volume and are, therefore, very illiquid. Usually, institutional investors stay away from such stocks due to their inherent riskiness.

The major stock exchanges in the United States normally set limits on how low the price of a stock can go before they remove it from their trading platform. Typically, if a stock´s price stays under one dollar for a certain number of days and/or the stock falls below minimum trading thresholds, the market makers stop making a market in the name and the exchange deems the shares disqualified from being listed and takes them off its listings. If I recall, the New York Stock Exchange (NYSE) will remove stocks if their share prices remain below one dollar for 30 consecutive trading days.

Once delisted, the company shares are moved to the alternative over-the-counter (OTC) or pink sheets markets. There it is likely that the trading volume of the stock will dry up and that the price of the stock will drop further.

To prevent a declining share price go to zero and the shareholders´ holdings in the stock becoming worthless, companies can take steps to avoid being relegated to the OTC market. Two common corporate actions are reverse stock splits, where the price of the stock is increased while the number of outstanding shares is decreased, and share buybacks, where company officials consider the stock to be undervalued, repurchase shares at a low price and reissue (sell) them if and when the price has recovered.

More By This Author:

Indicator Signaling A U.S. Recession

Icelandic Stock Indexes Under Pressure

Stocks Underperforming Bonds In Iceland

Disclosure:

The author of the analysis presented does not own shares or have a position or other direct or indirect monetary interests in the financial instrument or product discussed in his ...

more