RegeneRx Versus Restasis: Who Hits The $2 Billion Dry-Eye Jackpot?

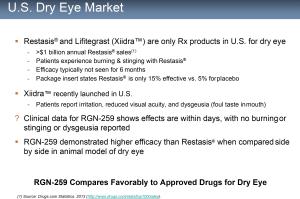

Allergan's (AGN) recent ploy to sell Restasis patents to the St. Regis Mohawk Tribe was perplexing to many. It also brought attention to Allergan's near term drug pipeline and the dynamics of the $1.8 billion U.S. dry-eye market. Allergan's Restasis controls 70% market share, while Shire's (SHPG) Xiidra controls over 20%. Xiidra is the only prescription eye drop indicated to treat both the signs and symptoms of dry-eye; Restasis is indicated to help increase tear production.

Xiidra has taken rapid share since entering the market in the second half of 2016. Now a manhunt is on for the next company to potentially disrupt the dry-eye market. RegeneRX (RGRX) and Aldeyra (ALDX) are two candidates. The question remains, "Who hits the dry-eye jackpot first?" I explain below.

About RegeneRx

RegeneRx is a clinical-stage biopharmaceutical company focused on the development of a novel therapeutic peptide, Thymosin beta 4, or TB4, for tissue and organ protection, repair and regeneration. The company has three product candidates in clinical development: [i] RGN-259, a preservative-free topical eye drop for regeneration of corneal tissues damaged by injury, disease or other pathology; [ii] RGN-352, an injectable formulation to treat cardiovascular diseases, central and peripheral nervous system diseases; and [iii] RGN-137, a topical gel for dermal wounds and reduction of scar tissue.

RGN-259 could eventually capture investors' attention. In July it completed Phase 3 clinical trial testing for dry-eye syndrome:

RegeneRx Biopharmaceuticals, Inc. ... a clinical-stage drug development company focused on tissue protection, repair and regeneration, today announced that its U.S. joint venture, ReGenTree LLC, has completed treatment of the last patient enrolled in its Phase 3 "ARISE-2" clinical trial testing RGN-259 preservative-free eye drops for dry eye syndrome ("DES").

ARISE-2 is a double-masked, placebo-controlled clinical trial that enrolled approximately 600 patients in the U.S. and was initiated less than 12 months ago. The trial is designed to replicate the clinical results achieved in ARISE-1, a Phase 2b/3 clinical trial in patients with DES. Patient data will be scrubbed and validated prior to data lock and subsequent statistical analysis. ReGenTree will report the results as soon as practicable thereafter.

RegeneRx believes RGN-259 compares favorably to the company. At a September 11, 2017 Rodman & Renshaw conference, the company implied RGN-259 [i] showed better efficacy than Restasis and [ii] reported no burning or stinging or diysgeusia (foul taste in mouth), unlike Xiidra:

On the surface RGN-259 could be another candidate to disrupt dry-eye alongside Xiidra.

About Aldeyra

Aldeyra is a biotechnology company focused on the development of products for inflammation, inborn errors of metabolism, and other diseases related to generated toxic and pro-inflammatory chemical species called aldehydes. The company's flagship product, ADX-102, is still under development for the potential treatments of noninfectious anterior uveitis, allergic conjunctivitis, dry-eye disease and Sjogren-Larsson Syndrome ("SLS"), a rare inborn error of metabolism resulting in severe skin and neurological disorders.

Aldeyra captured investors' attention last month when it showed significant improvements in a midstage trial for dry-eye. ALDX spiked 50% after the results were released, and after I began writing about the stock and the potential upside in dry-eye.

Who Hits The Dry-Eye Jackpot?

Who enters the dry-eye market first is a complicated question. Aldeyra is likely more well-known, but RegeneRx has a bigger head start. RegeneRx has completed Phase 3 testing and the results could be out within weeks. As RGRX becomes more well-known and the results of Phase 3 testing approach, I believe the stock could trade much higher. Meanwhile, Aldeyra will not begin its Phase 2b clinical trial for dry-eye until the first half of 2018. This could involve studying a larger patient group and seeking the optimal dose that ADX-102 could be effective with minimal side effects.

According to RegeneRx's management presentation, its dry-eye treatment has shown higher efficacy than Restasis and in certain instances, fewer side effects than Xiidra. Aldeyra's ADX-102 merely showed improvements in its ability to treat dry-eye, yet no mention of how it would fare head-to-head with competitors. On the other hand, RegeneRx's liquidity is waning.

In Q2 2017 it generated revenue of $12.7 million, but suffered operating losses of $303 million. For the first six months of 2017 its cash from operations was -$541 million. At the end of Q2 cash on hand was $243 million, down from $1.6 billion in the year earlier period. At its current cash burn rate RegeneRx could likely go a few more quarters before needing to raise more cash. That said, Aldeyra recently raised nearly $27 million in a secondary offering. Prior to that, it had nearly $15 million in cash on hand.

I Am Betting On Both

I am currently long both stocks. If RegeneRx's Phase 3 clinical trials are successful then raising new money will likely not be a problem. Just 20% of the U.S. dry-eye market could equate to about $360 million in revenue. I believe the upside for a new entrant with a product that can perform is difficult to even quantify. I am betting on RGRX and am also long ALDX, just in case.